Region:Central and South America

Author(s):Dev

Product Code:KRAD0336

Pages:99

Published On:August 2025

By Type:The hospitality industry in Brazil can be segmented into various types, including Chain Hotels, Independent Hotels, Service Apartments, Resorts, Hostels, Vacation Rentals, Bed and Breakfasts, Boutique Hotels, Guest Houses, and Others. Each of these subsegments caters to different consumer preferences and market demands. Chain hotels and independent hotels dominate the market, while there is a growing trend towards eco-friendly and boutique properties, reflecting changing traveler preferences for sustainability and unique experiences .

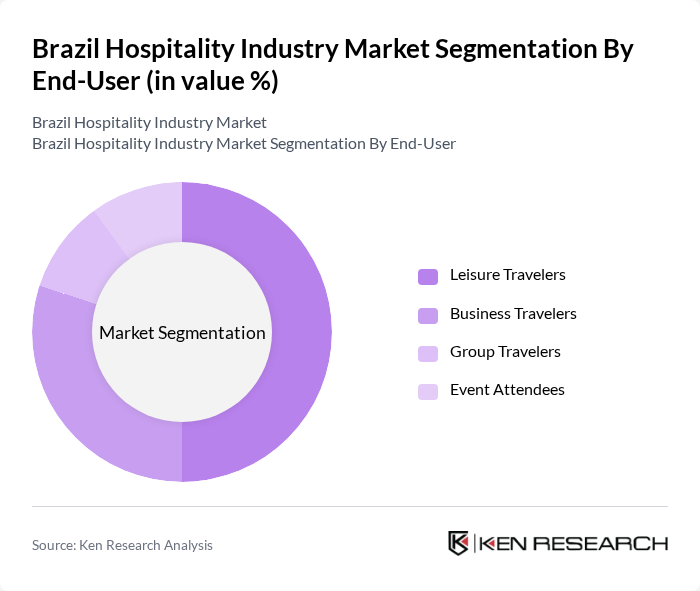

By End-User:The end-user segmentation of the hospitality industry includes Leisure Travelers, Business Travelers, Group Travelers, and Event Attendees. Each segment has unique needs and preferences that influence their choice of accommodation and services. Leisure travelers represent the largest segment, driven by Brazil’s appeal as a tourist destination, while business travelers are a significant contributor in major urban centers .

The Brazil Hospitality Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Accor SA, Marriott International Inc., Hilton Worldwide Holdings Inc., InterContinental Hotels Group PLC (IHG), Wyndham Hotels & Resorts Inc., BHG (Brazil Hospitality Group), Atlantica Hotels International, Louvre Hotels Group, Blue Tree Hotels, Meliá Hotels International, Nacional Inn Hotéis e Centros de Convenções, GJP Hotels & Resorts, Grupo Pestana, Transamerica Hospitality Group, Ibis Hotels (Accor) contribute to innovation, geographic expansion, and service delivery in this space.

The Brazil hospitality industry is poised for a dynamic future, driven by increasing domestic and international tourism. With the government's commitment to infrastructure development and the rise of online booking platforms, the sector is expected to adapt to changing consumer preferences. Additionally, sustainability practices and technological innovations will play a crucial role in enhancing guest experiences. As the economy stabilizes, the hospitality market is likely to witness a resurgence in demand, fostering growth and investment opportunities.

| Segment | Sub-Segments |

|---|---|

| By Type | Chain Hotels Independent Hotels Service Apartments Resorts Hostels Vacation Rentals Bed and Breakfasts Boutique Hotels Guest Houses Others |

| By End-User | Leisure Travelers Business Travelers Group Travelers Event Attendees |

| By Service Level | Luxury Hotels Mid-Range Hotels Budget Hotels |

| By Service Type | Room Service Food and Beverage Services Concierge Services Spa and Wellness Services |

| By Booking Channel | Online Travel Agencies (OTAs) Direct Bookings Travel Agents Corporate Bookings |

| By Location | Urban Areas Rural Areas Coastal Regions Tourist Attractions |

| By Price Range | Budget Mid-Range Luxury |

| By Customer Segment | Families Couples Solo Travelers Business Groups |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Hotel Sector | 60 | General Managers, Marketing Directors |

| Mid-Range Accommodation | 50 | Operations Managers, Front Desk Supervisors |

| Vacation Rentals | 40 | Property Managers, Owners |

| Tourism Agencies | 55 | Agency Owners, Travel Consultants |

| Food & Beverage Services in Hospitality | 45 | Restaurant Managers, Catering Directors |

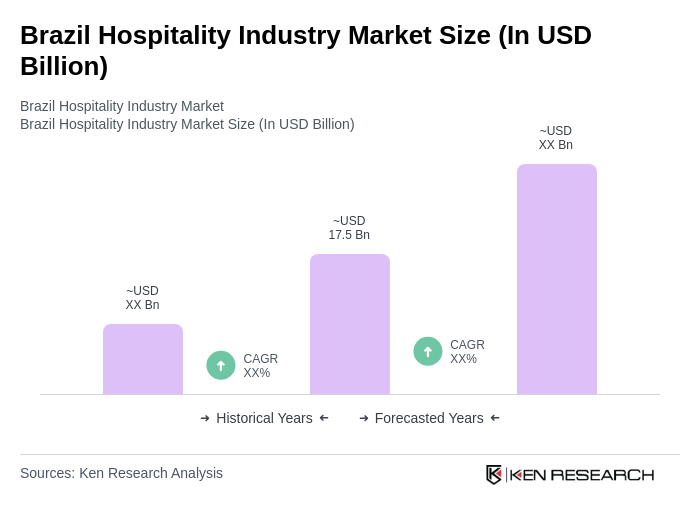

The Brazil Hospitality Industry Market is valued at approximately USD 17.5 billion, reflecting a robust growth driven by increased domestic and international tourism, as well as the expansion of the middle class seeking diverse accommodation options.