Region:North America

Author(s):Shubham

Product Code:KRAD0704

Pages:85

Published On:August 2025

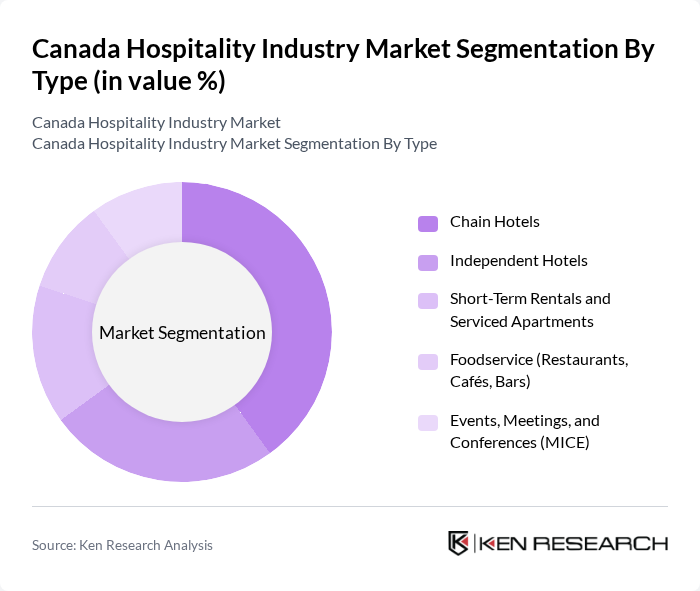

By Type:The hospitality market in Canada can be segmented into various types, including Chain Hotels, Independent Hotels, Short-Term Rentals and Serviced Apartments, Foodservice (Restaurants, Cafés, Bars), and Events, Meetings, and Conferences (MICE). Each of these segments caters to different consumer needs and preferences, contributing to the overall market dynamics.

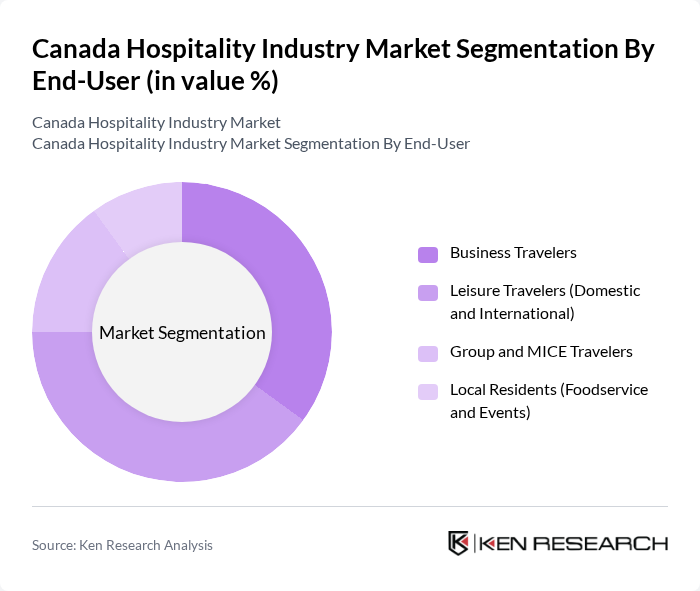

By End-User:The end-user segmentation of the hospitality market includes Business Travelers, Leisure Travelers (Domestic and International), Group and MICE Travelers, and Local Residents (Foodservice and Events). Each segment reflects distinct travel motivations and spending behaviors, influencing the services and offerings within the industry.

The Canada Hospitality Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Marriott International, Inc. (Canada), Hilton Hotels & Resorts (Canada), Accor S.A. (Fairmont, Novotel, Sofitel, etc.), Four Seasons Hotels Limited, IHG Hotels & Resorts (InterContinental, Holiday Inn, etc.), Hyatt Hotels Corporation, Wyndham Hotels & Resorts, Best Western Hotels & Resorts, Choice Hotels International, Coast Hotels Limited, Silver Hotel Group, Sandman Hotel Group (Northland Properties), Delta Hotels & Resorts (by Marriott), Atlific Hotels, Radisson Hotel Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Canadian hospitality industry appears promising, driven by evolving consumer preferences and technological advancements. As travelers increasingly seek personalized experiences, businesses that leverage data analytics to tailor services will likely thrive. Additionally, the integration of sustainable practices and smart technologies will enhance operational efficiency and guest satisfaction. With a focus on health and safety, the industry is poised to adapt to changing market dynamics, ensuring resilience and growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Chain Hotels Independent Hotels Short-Term Rentals and Serviced Apartments Foodservice (Restaurants, Cafés, Bars) Events, Meetings, and Conferences (MICE) |

| By End-User | Business Travelers Leisure Travelers (Domestic and International) Group and MICE Travelers Local Residents (Foodservice and Events) |

| By Service Type | Accommodation Services Food and Beverage Services Meetings and Events Services Travel Intermediation (OTAs and Travel Agencies) |

| By Distribution Channel | Direct Booking Online Travel Agencies (OTAs) Corporate and TMC Contracts Traditional Travel Agencies |

| By Price/Category (Accommodation) | Luxury Mid and Upper Midscale Budget and Economy |

| By Location | Urban and Gateway Cities (e.g., Toronto, Vancouver, Montreal) Secondary and Suburban Markets Rural and Resort Destinations |

| By Stay Pattern (Accommodation) | Short Stay (1–3 nights) Medium Stay (4–7 nights) Extended Stay (8+ nights) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hotel Industry Insights | 150 | Hotel Managers, General Managers |

| Restaurant Sector Analysis | 100 | Restaurant Owners, Head Chefs |

| Travel and Tourism Trends | 80 | Travel Agents, Tour Operators |

| Event and Conference Management | 70 | Event Planners, Venue Managers |

| Food and Beverage Services | 90 | Food Service Managers, Catering Directors |

The Canada Hospitality Industry Market is valued at approximately USD 23 billion, reflecting a significant recovery driven by increased travel demand, consumer spending on leisure activities, and a robust business travel sector post-pandemic.