Region:Europe

Author(s):Shubham

Product Code:KRAC0697

Pages:92

Published On:August 2025

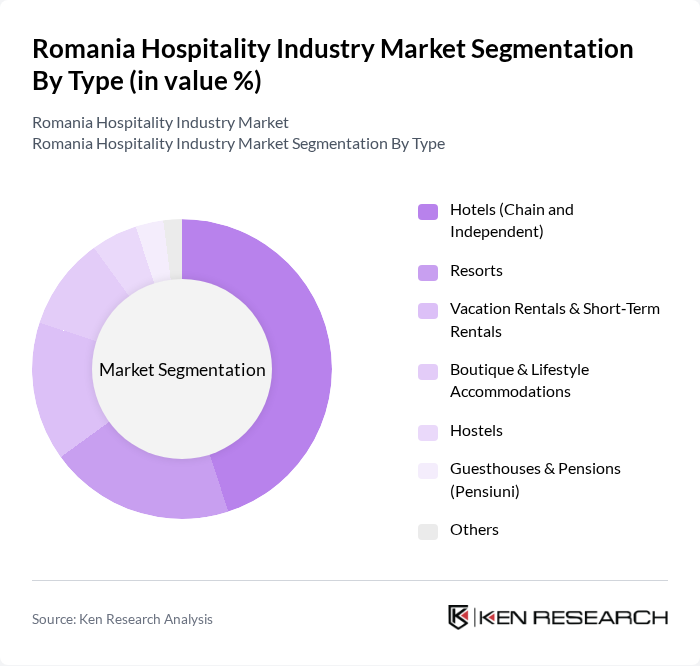

By Type:The hospitality market in Romania is segmented into various types, including hotels (both chain and independent), resorts, vacation rentals, boutique accommodations, hostels, guesthouses, and others. Each sub-segment caters to different traveler preferences and budgets, with hotels being the most prominent due to their established presence and brand recognition. The rise of vacation rentals and boutique accommodations reflects changing consumer preferences towards unique and personalized experiences, as online platforms scale and international brands expand lifestyle concepts in key cities .

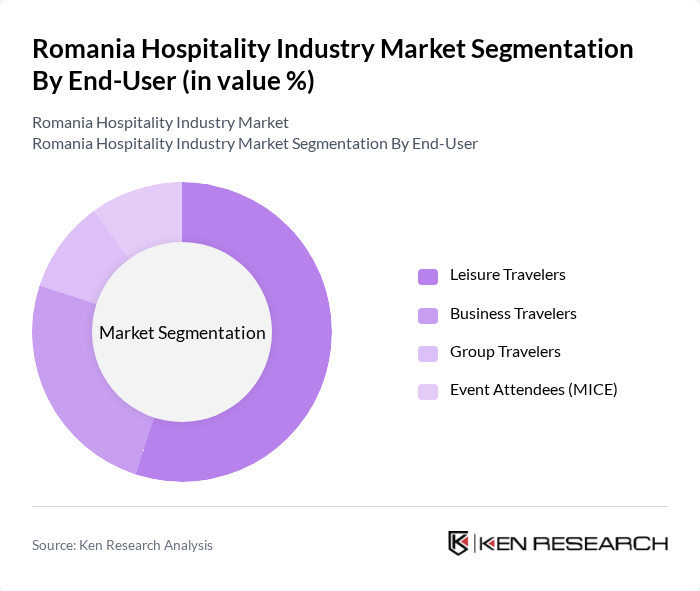

By End-User:The end-user segmentation of the hospitality market includes leisure travelers, business travelers, group travelers, and event attendees (MICE). Leisure travelers dominate the market, supported by record hotel overnight stays and domestic demand strength, while business travel and events activity remain significant in large urban centers as international accessibility improves .

The Romania Hospitality Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Marriott International (including JW Marriott Bucharest Grand Hotel; Courtyard), Hilton Worldwide (Athénée Palace Bucharest, Hilton Garden Inn), Accor (Pullman, Novotel, Mercure, Ibis, Ibis Styles), InterContinental Hotels Group (IHG Hotels & Resorts: InterContinental Athénée Palace, Crowne Plaza, Holiday Inn), Radisson Hotel Group (Radisson Blu, Park Inn by Radisson), Continental Hotels (Romania), Orbis/Ennismore & Local Partners (Moxy, Tribe, The Hoxton – where applicable), NH Hotel Group (NH Hotels, NH Collection), Meliá Hotels International (Meliá, INNSiDE), TUI Group (tour operations, resort partnerships on the Black Sea coast), B&B Hotels, Vienna House by Wyndham, Ramada by Wyndham (Ramada, Ramada Plaza), ARO Palace Bra?ov S.A. (Hotel Aro Palace), Ana Hotels (Ana Hotels Poiana Bra?ov, Crowne Plaza Bucharest management) contribute to innovation, geographic expansion, and service delivery in this space .

The Romania hospitality industry is poised for significant growth, driven by increasing tourism and rising disposable incomes. As infrastructure improvements continue, the sector will likely see enhanced visitor experiences, further boosting demand. Additionally, the integration of technology in hospitality services will streamline operations and improve customer satisfaction. However, businesses must remain vigilant against economic fluctuations and competition from alternative accommodations to sustain growth and profitability in this dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Hotels (Chain and Independent) Resorts Vacation Rentals & Short?Term Rentals Boutique & Lifestyle Accommodations Hostels Guesthouses & Pensions (Pensiuni) Others |

| By End-User | Leisure Travelers Business Travelers Group Travelers Event Attendees (MICE) |

| By Service Type | Rooms & Accommodation Services Food & Beverage (On?site Restaurants, Bars, Catering) Meetings & Events (Conference, Banquet, MICE) Wellness, Spa & Leisure Amenities |

| By Price Range (Service Level) | Luxury & Upscale Mid?Scale Budget & Economy |

| By Location | Bucharest Metropolitan Area Secondary Cities (Cluj?Napoca, Timi?oara, Ia?i, Bra?ov, Constan?a) Coastal & Danube Delta Mountain & Rural Tourism Regions (Carpathians, Transylvania) |

| By Customer Demographics | Families Couples Solo Travelers Millennials & Gen Z |

| By Booking Channel | Online Travel Agencies (OTAs) Direct (Brand.com, Call, Walk?in) Global Distribution Systems (GDS) & Corporate Traditional Travel Agencies & Tour Operators |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hotel Industry Insights | 140 | Hotel Managers, Front Office Supervisors |

| Restaurant Sector Feedback | 110 | Restaurant Owners, Head Chefs |

| Tourist Experience Evaluation | 120 | Domestic and International Tourists |

| Event and Conference Venues | 80 | Event Coordinators, Venue Managers |

| Travel Agency Perspectives | 90 | Travel Agents, Tour Operators |

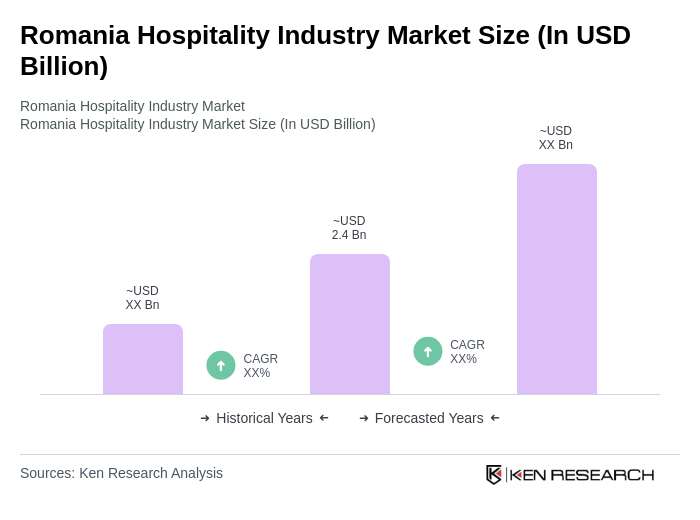

The Romania hospitality industry market is valued at approximately USD 2.4 billion, reflecting a full post-pandemic recovery supported by record overnight stays and strengthening demand fundamentals.