Region:Middle East

Author(s):Dev

Product Code:KRAD0423

Pages:91

Published On:August 2025

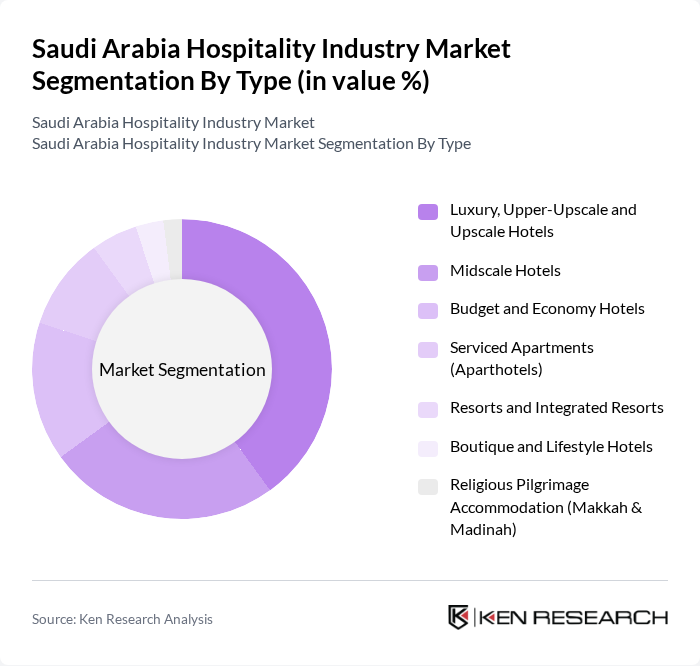

By Type:The hospitality industry in Saudi Arabia is segmented into various types, including luxury, midscale, and budget accommodations. Luxury, Upper-Upscale, and Upscale Hotels dominate the market due to the influx of high-spending tourists and business travelers seeking premium experiences, and because the majority of both existing inventory and pipeline keys are positioned in these segments. Midscale Hotels serve a growing domestic and regional middle class, while Budget and Economy Hotels support cost-conscious travelers, especially for intra-KSA trips. Serviced Apartments and Resorts are gaining traction alongside leisure-led giga-projects and longer-stay corporate demand in primary and secondary cities .

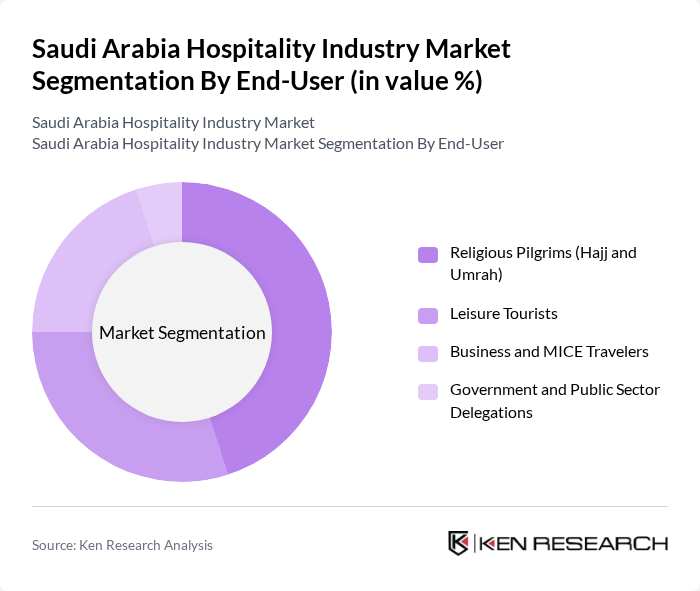

By End-User:The end-user segmentation of the hospitality industry includes various categories such as religious pilgrims, leisure tourists, business travelers, and government delegations. Religious Pilgrims, particularly for Hajj and Umrah, represent a significant portion of the market, consistent with data showing pilgrimage as the leading purpose for international visits and tens of millions of Umrah pilgrims annually. Leisure tourists are increasingly drawn by culture, events, and Red Sea experiences, while Business and MICE Travelers contribute materially in Riyadh and Jeddah, influenced by expanding corporate activity and event-led visitation .

The Saudi Arabia Hospitality Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Accor, Hilton, Marriott International, IHG Hotels & Resorts (InterContinental Hotels Group), Radisson Hotel Group, Hyatt Hotels Corporation, Four Seasons Hotels and Resorts, Mövenpick Hotels & Resorts, Jumeirah Group, Rosewood Hotels & Resorts, Shangri-La Group, Wyndham Hotels & Resorts, Best Western Hotels & Resorts, Dur Hospitality, Taiba Investments contribute to innovation, geographic expansion, and service delivery in this space. A substantial share of both active inventory and committed pipeline keys is concentrated in the upscale-and-above tiers, underscoring the strategic focus of these operators on premium positioning aligned with national tourism objectives .

Additional validation notes and recent trend evidence: - Visitor volumes: International arrivals exceeded twenty-one million in the first nine months of the latest reported year, with domestic trips nearing sixty-four million, reinforcing broad-based demand across segments . - Pilgrimage strength: Umrah pilgrims reached about thirty-five point eight million in the latest full year reported, including a substantial share of international visitors; Holy Cities showed leading occupancy performance during peak months . - Supply mix and pipeline: Existing inventory and committed pipeline are heavily weighted to luxury, upper-upscale, and upscale, supporting the statement that premium categories dominate revenue contribution and future supply .

The Saudi Arabia hospitality industry is poised for significant transformation, driven by ongoing government initiatives and a robust influx of tourists. As the nation continues to diversify its economy, the hospitality sector will likely see increased investments in technology and sustainability. Additionally, the rise of remote work and extended stays will reshape consumer preferences, prompting hotels to adapt their offerings. This evolving landscape presents opportunities for innovative service delivery and enhanced guest experiences, positioning the industry for sustained growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Luxury, Upper-Upscale and Upscale Hotels Midscale Hotels Budget and Economy Hotels Serviced Apartments (Aparthotels) Resorts and Integrated Resorts Boutique and Lifestyle Hotels Religious Pilgrimage Accommodation (Makkah & Madinah) |

| By End-User | Religious Pilgrims (Hajj and Umrah) Leisure Tourists Business and MICE Travelers Government and Public Sector Delegations |

| By Service Type | Rooms and Extended Stay Food and Beverage (On-site Restaurants, Catering) Meetings, Incentives, Conferences, and Exhibitions (MICE) Wellness, Spa, and Recreational Services |

| By Distribution Channel | Direct Booking (Brand Websites, Apps, Call Centers) Online Travel Agencies (OTAs) and Meta-search Traditional Travel Agencies and Tour Operators Corporate and Government Contracts |

| By Location | Holy Cities (Makkah, Madinah) Major Urban Hubs (Riyadh, Jeddah, Dammam/Khobar) Leisure Destinations and Giga-Projects (NEOM, Red Sea, Diriyah) Secondary Cities and Industrial Zones |

| By Price Range | Economy Midscale Upscale Luxury/Ultra-Luxury |

| By Customer Segment | Families and Groups Solo Travelers Couples Corporate and Government Accounts |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Hotel Sector | 100 | General Managers, Marketing Directors |

| Mid-Range Hotel Sector | 80 | Operations Managers, Revenue Managers |

| Budget Accommodation Providers | 60 | Owners, Front Office Managers |

| Tourism and Travel Agencies | 75 | Travel Agents, Business Development Managers |

| Event and Conference Venues | 50 | Event Managers, Sales Directors |

The Saudi Arabia hospitality industry market is valued at approximately USD 15.4 billion, reflecting strong growth driven by increasing visitor volumes and a premium mix of accommodations, particularly in upscale and luxury segments.