Region:Asia

Author(s):Shubham

Product Code:KRAD0602

Pages:81

Published On:August 2025

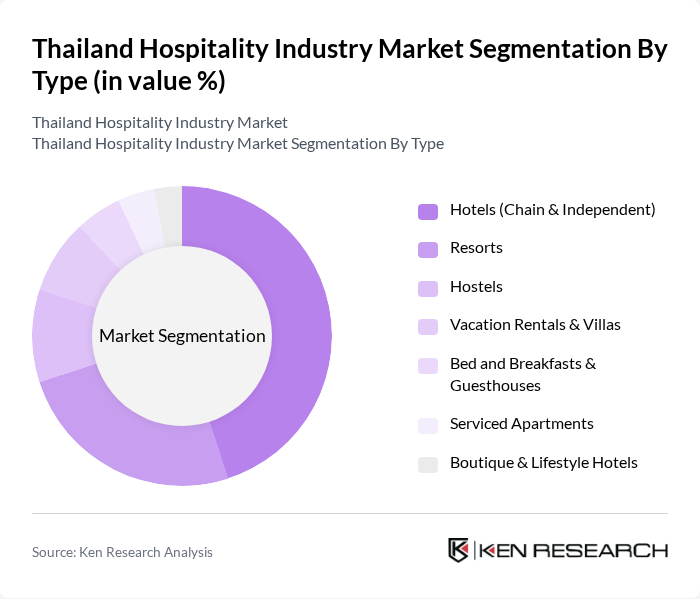

By Type:The hospitality market in Thailand is segmented into various types, including hotels, resorts, hostels, vacation rentals, bed and breakfasts, serviced apartments, and boutique hotels. Among these, hotels (both chain and independent) are the most dominant segment, driven by rising demand from business and leisure travelers, the expansion of international brands, and improving average daily rates in key destinations as demand normalizes .

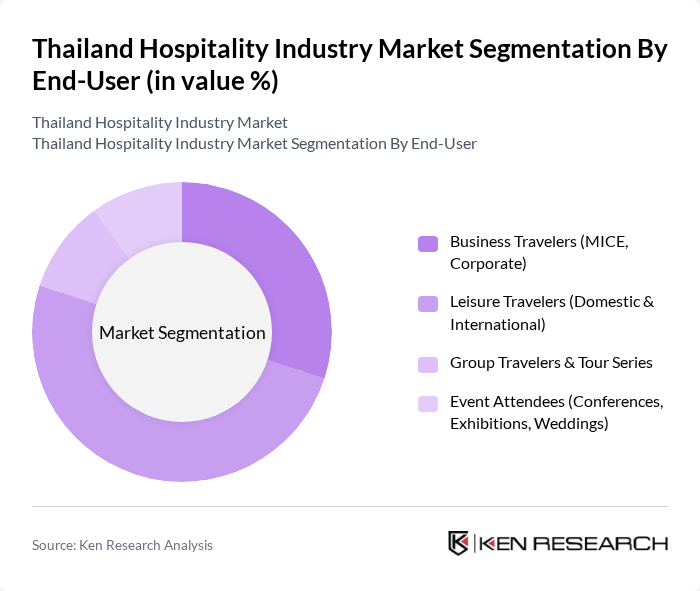

By End-User:The end-user segmentation of the hospitality market includes business travelers, leisure travelers, group travelers, and event attendees. Leisure travelers, both domestic and international, represent the largest segment, supported by Thailand’s strong destination appeal and the government’s ongoing push to expand quality leisure markets; rising occupancy and room rates indicate strengthening leisure demand alongside business and MICE recovery .

The Thailand Hospitality Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Minor International PCL (Minor Hotels: Anantara, Avani, NH Collection, Tivoli), Centara Hotels & Resorts (Central Plaza Hotel PCL), Dusit International (Dusit Thani Public Company Limited), Accor, Marriott International, Hilton, InterContinental Hotels Group (IHG Hotels & Resorts), Banyan Tree Group, Mandarin Oriental Hotel Group (Mandarin Oriental, Bangkok), Anantara Hotels, Resorts & Spas, The Peninsula Hotels (The Peninsula Bangkok), Shangri-La Group (Shangri-La Bangkok), The Ritz-Carlton Hotel Company, Four Seasons Hotels and Resorts, The Standard, Bangkok Mahanakhon contribute to innovation, geographic expansion, and service delivery in this space.

The future of Thailand's hospitality industry appears promising, driven by a robust recovery in international tourism and increasing domestic travel. As the middle class expands, demand for diverse accommodation options will rise, particularly in eco-tourism and wellness sectors. Technological advancements will further enhance guest experiences, with smart solutions becoming standard. However, the industry must navigate challenges such as regulatory compliance and environmental sustainability to ensure long-term growth and competitiveness in the global market.

| Segment | Sub-Segments |

|---|---|

| By Type | Hotels (Chain & Independent) Resorts Hostels Vacation Rentals & Villas Bed and Breakfasts & Guesthouses Serviced Apartments Boutique & Lifestyle Hotels |

| By End-User | Business Travelers (MICE, Corporate) Leisure Travelers (Domestic & International) Group Travelers & Tour Series Event Attendees (Conferences, Exhibitions, Weddings) |

| By Service Type | Accommodation (Rooms & Suites) Food and Beverage (Restaurants, Bars, Banqueting) Concierge & Experiences (Tours, Transport) Spa, Wellness & Medical Wellness |

| By Booking Channel | Direct Booking (Brand.com, Phone, Walk-in) Online Travel Agencies (OTAs) Travel Agents & Tour Operators (GDS/Offline) Corporate & TMC Bookings |

| By Location | Urban & Business Hubs (Bangkok, Chiang Mai) Beach & Island Destinations (Phuket, Krabi, Samui, Pattaya) Cultural & Nature Destinations (Ayutthaya, Chiang Rai, Isan) |

| By Price Range | Economy/Budget Mid-Scale Upscale Luxury |

| By Customer Segment | Families Couples Solo Travelers Business & MICE Groups |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Hotel Sector | 90 | General Managers, Marketing Directors |

| Mid-range Accommodation | 80 | Operations Managers, Front Office Supervisors |

| Budget Hotels and Hostels | 70 | Owners, Revenue Managers |

| Travel Agencies | 60 | Travel Consultants, Sales Managers |

| Tour Operators | 50 | Product Managers, Business Development Executives |

The Thailand Hospitality Industry Market is valued at approximately USD 1.5 billion, reflecting a recovery driven by increased international arrivals and domestic tourism. This valuation is based on a five-year historical analysis and aligns with recent industry estimates.