Region:Middle East

Author(s):Dev

Product Code:KRAD0394

Pages:82

Published On:August 2025

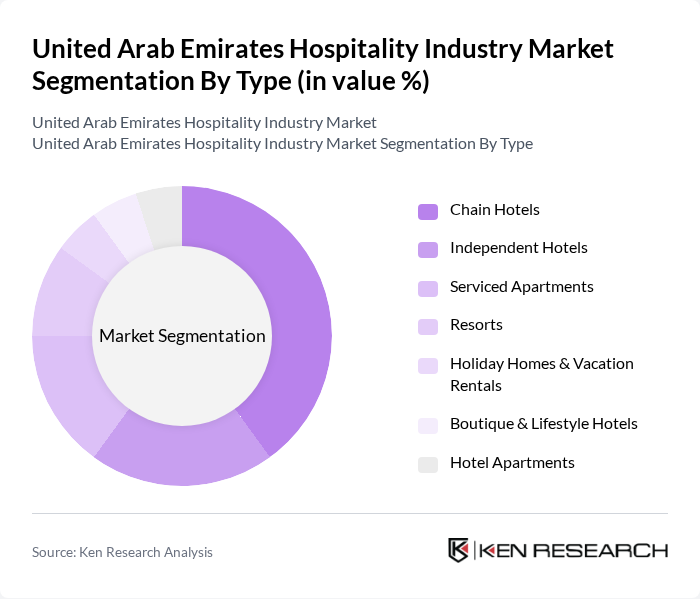

By Type:The hospitality market in the UAE can be segmented into various types, including Chain Hotels, Independent Hotels, Serviced Apartments, Resorts, Holiday Homes & Vacation Rentals, Boutique & Lifestyle Hotels, and Hotel Apartments. Each of these segments caters to different consumer preferences and needs, with chain hotels often leading in brand presence and loyalty program reach, while independent and boutique properties appeal to travelers seeking differentiated and experiential stays. Serviced apartments and hotel apartments serve long-stay and corporate demand, while holiday homes and vacation rentals have grown alongside short?term rental regulations in key emirates.

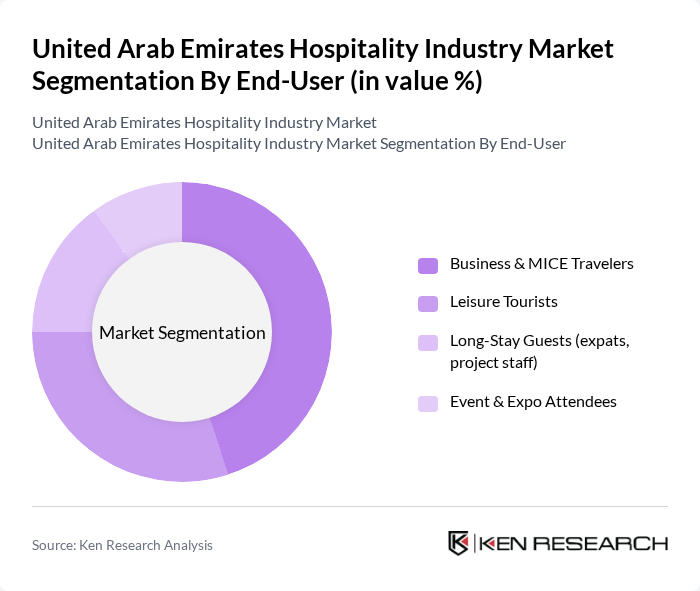

By End-User:The end-user segmentation of the hospitality market includes Business & MICE Travelers, Leisure Tourists, Long-Stay Guests (expats, project staff), and Event & Expo Attendees. Business and MICE travelers are significant contributors, supported by the UAE’s strategic air connectivity and events infrastructure, while leisure demand is propelled by destination marketing, attractions, and beach/resort offerings. Long-stay demand is supported by serviced apartments and flexible visa pathways for remote work and residency.

The United Arab Emirates Hospitality Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Jumeirah Group, Emaar Hospitality Group (Address Hotels + Resorts, Vida Hotels and Resorts), Accor, Hilton, Marriott International, Rotana Hotel Management Corporation PJSC, IHG Hotels & Resorts (InterContinental Hotels Group), Wyndham Hotels & Resorts, Radisson Hotel Group, Atlantis Dubai (Atlantis The Palm, Atlantis The Royal), Mövenpick Hotels & Resorts, Four Seasons Hotels and Resorts, Shangri-La Hotels and Resorts, Rove Hotels (Emaar), NH Collection (by Minor Hotels) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE hospitality industry appears promising, driven by a robust tourism recovery and ongoing government support. With the anticipated influx of international events and a focus on sustainable practices, the sector is likely to see increased investment in eco-friendly hotels and smart technologies. Additionally, the rise of experiential travel will push hospitality providers to innovate, creating unique offerings that cater to evolving consumer preferences, ensuring long-term growth and resilience in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Chain Hotels Independent Hotels Serviced Apartments Resorts Holiday Homes & Vacation Rentals Boutique & Lifestyle Hotels Hotel Apartments |

| By End-User | Business & MICE Travelers Leisure Tourists Long-Stay Guests (expats, project staff) Event & Expo Attendees |

| By Service Type | Rooms & Housekeeping Food & Beverage (On-site and Catering) Meetings, Incentives, Conferences & Exhibitions (MICE) Spa, Wellness & Recreation |

| By Distribution Channel | Direct (Brand.com, Call Center, Walk-in) Online Travel Agencies (OTAs) Global Distribution Systems (GDS) & Travel Agents Corporate & Government Contracts |

| By Location | Urban (Dubai, Abu Dhabi, Sharjah) Resort Destinations (Palm Jumeirah, Saadiyat, Ras Al Khaimah) Airport & Transit Hotels Emerging Hubs (Dubai South, JVC, Al Marjan Island) |

| By Customer Segment | Families Couples Solo Travelers Corporate & Group Bookings |

| By Price Range | Economy Mid-Scale Upscale Luxury |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Hotel Sector | 100 | General Managers, Marketing Directors |

| Mid-Scale Hotel Operations | 80 | Operations Managers, Front Office Supervisors |

| Budget Accommodation Insights | 70 | Owners, Revenue Managers |

| Tourism and Travel Agency Feedback | 90 | Travel Agents, Tour Coordinators |

| Hospitality Staff Perspectives | 60 | Frontline Staff, HR Managers |

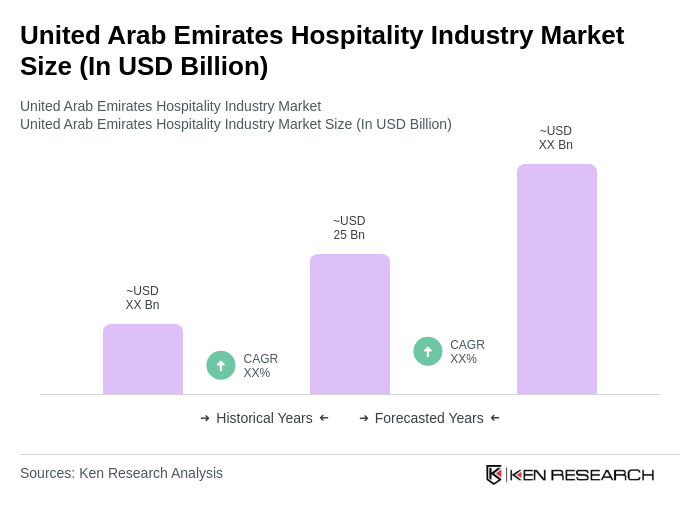

The United Arab Emirates hospitality industry market is valued at approximately USD 25 billion, reflecting its extensive scale across various lodging types, including hotels, resorts, and serviced apartments, driven by tourism growth and significant infrastructure investments.