Region:Asia

Author(s):Dev

Product Code:KRAD0522

Pages:86

Published On:August 2025

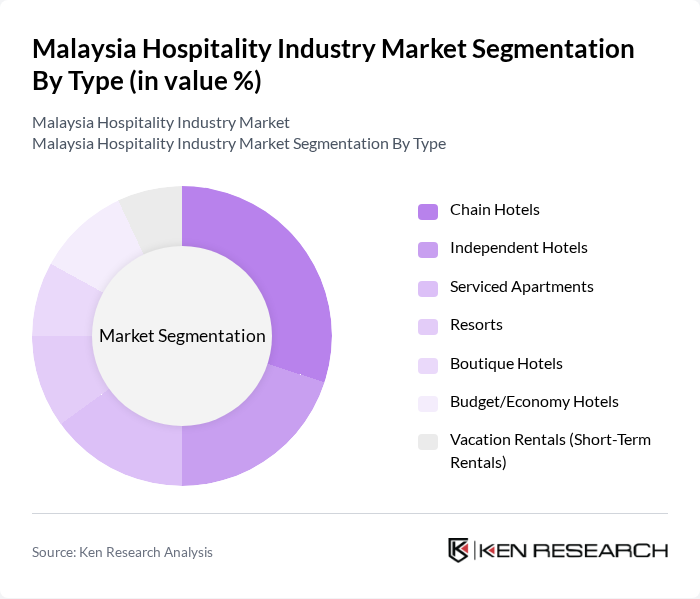

By Type:The hospitality market in Malaysia is segmented into various types, including Chain Hotels, Independent Hotels, Serviced Apartments, Resorts, Boutique Hotels, Budget/Economy Hotels, and Vacation Rentals (Short-Term Rentals). Each of these segments caters to different consumer preferences and travel needs, contributing to the overall market dynamics .

The Chain Hotels segment is currently dominating the market due to their established brand recognition, loyalty programs, and extensive distribution networks. These hotels often provide a consistent quality of service and amenities that appeal to both business and leisure travelers. The trend towards globalization and the increasing preference for branded accommodations have further solidified their position in the market. Additionally, the rise of international travel has led to a greater demand for well-known hotel chains that offer reliability and familiarity to guests .

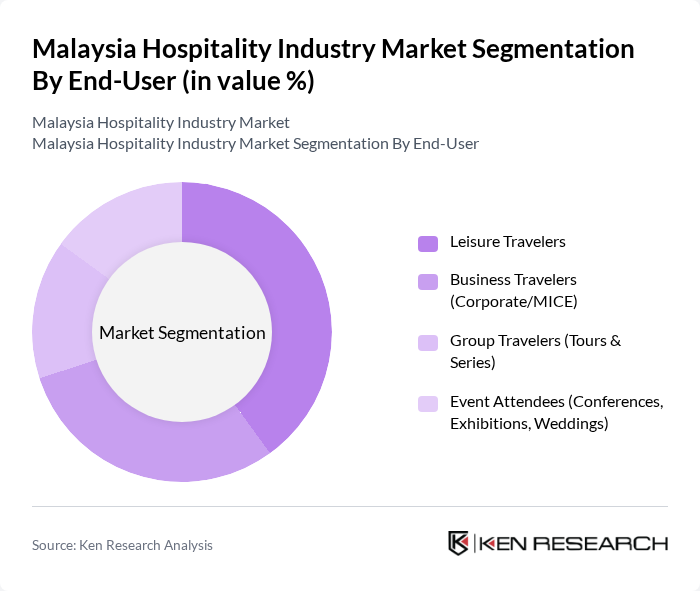

By End-User:The market is also segmented by end-user categories, which include Leisure Travelers, Business Travelers (Corporate/MICE), Group Travelers (Tours & Series), and Event Attendees (Conferences, Exhibitions, Weddings). Each segment reflects distinct travel motivations and preferences, influencing the types of accommodations and services sought .

Leisure Travelers represent the largest segment in the hospitality market, driven by the growing trend of domestic and international tourism. The increasing availability of affordable travel options and the rise of social media influence have encouraged more individuals to explore new destinations. This segment's demand for unique experiences and personalized services has prompted hotels to enhance their offerings, making leisure travel a key driver of growth in the industry .

The Malaysia Hospitality Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hilton Worldwide Holdings Inc. (Hilton Kuala Lumpur; DoubleTree by Hilton), Marriott International, Inc. (Marriott, Sheraton, Westin, Aloft, Four Points, Ritz-Carlton), Accor S.A. (Sofitel, Pullman, Novotel, Mercure, ibis), InterContinental Hotels Group PLC (IHG Hotels & Resorts: InterContinental, Holiday Inn, Holiday Inn Express), Shangri-La Hotels and Resorts (Shangri-La Kuala Lumpur; Golden Sands Resort Penang), Berjaya Hotels & Resorts (Berjaya Times Square Hotel; Berjaya Langkawi Resort), Genting Berhad (Resorts World Genting; Crockfords; First World Hotel), Tune Hotels (Tune Hotels.com), The Ascott Limited (Citadines, Somerset, lyf), Wyndham Hotels & Resorts (Ramada, Wyndham, TRYP), Sunway Hotels & Resorts (Sunway Resort, Sunway Putra Hotel), OYO Hotels & Homes (OYO Rooms), UEM Sunrise Berhad – Hyatt portfolio partner (Hyatt Regency, Alila, Andaz via owners in Malaysia), The Ritz-Carlton Hotel Company, L.L.C. (Kuala Lumpur; Langkawi), Four Seasons Hotels and Resorts (Four Seasons Hotel Kuala Lumpur; Four Seasons Resort Langkawi) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Malaysia hospitality industry appears promising, driven by a robust recovery in tourism and ongoing infrastructure improvements. As domestic and international travel continues to rebound, the sector is likely to see increased investments in technology and service enhancements. Additionally, the focus on sustainable practices and eco-tourism will shape the industry's evolution, attracting environmentally conscious travelers and fostering long-term growth in the hospitality landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Chain Hotels Independent Hotels Serviced Apartments Resorts Boutique Hotels Budget/Economy Hotels Vacation Rentals (Short-Term Rentals) |

| By End-User | Leisure Travelers Business Travelers (Corporate/MICE) Group Travelers (Tours & Series) Event Attendees (Conferences, Exhibitions, Weddings) |

| By Price Range | Budget and Economy Mid and Upper Mid-Scale Luxury and Upper Upscale |

| By Service Type | Full-Service Hotels Limited-Service/Select-Service Hotels Extended Stay/Long-Stay |

| By Location | Urban (Klang Valley, Penang, Johor Bahru) Resort Destinations (Langkawi, Sabah, Sarawak) Secondary Cities & Rural Ecotourism Hubs |

| By Distribution Channel | Online Travel Agencies (OTAs) Direct (Brand.com, App, Property) B2B Channels (GDS, Wholesalers, Corporate) |

| By Customer Segment | Families Couples Solo Travelers Business Groups & Corporate Accounts |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Hotel Sector | 90 | General Managers, Marketing Directors |

| Mid-range Hotel Sector | 80 | Operations Managers, Revenue Managers |

| Budget Accommodation Providers | 70 | Owners, Front Desk Managers |

| Travel Agency Insights | 60 | Travel Consultants, Sales Managers |

| Tourist Feedback | 90 | International Tourists, Domestic Travelers |

The Malaysia Hospitality Industry Market is valued at approximately USD 10 billion, driven by the recovery of domestic travel, an increase in international tourists, and the expansion of business travel, particularly in key cities like Kuala Lumpur, Penang, and Johor Bahru.