Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA0198

Pages:96

Published On:August 2025

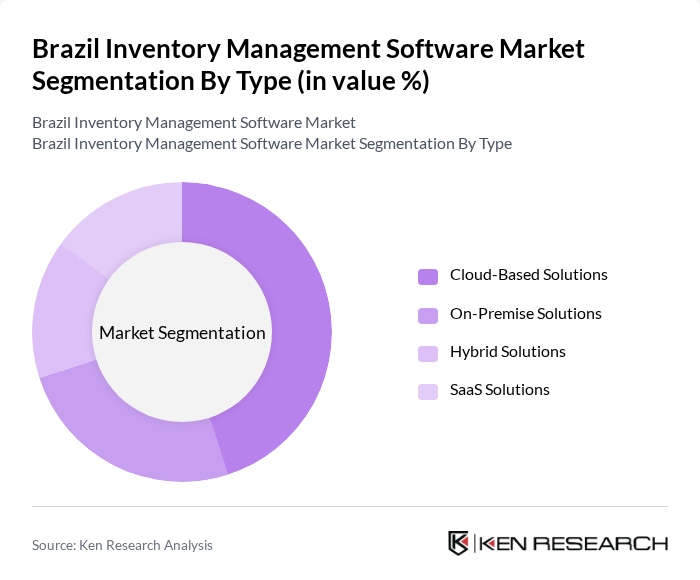

By Type:The market can be segmented into four main types: Cloud-Based Solutions, On-Premise Solutions, Hybrid Solutions, and SaaS Solutions. Each of these sub-segments addresses different business needs and preferences. Cloud-based solutions are gaining significant traction due to their scalability, cost-effectiveness, and ability to support remote operations, which is especially relevant as businesses increasingly prioritize digital transformation and operational resilience .

The Cloud-Based Solutions segment leads the market due to its flexibility, lower upfront costs, and ability to facilitate collaboration and real-time data access. Businesses are increasingly adopting cloud solutions to integrate with other digital services, scale operations efficiently, and support distributed teams. The trend toward cloud adoption is further reinforced by the need for seamless integration with e-commerce platforms and supply chain automation tools .

By End-User:The market can be segmented into various end-user categories, including Retail, Manufacturing, Wholesale & Distribution, Healthcare & Pharmaceuticals, Logistics & Transportation, Food & Beverage, E-commerce, and Others. Each sector has unique inventory management requirements, influencing the software solutions they adopt. Retail and manufacturing sectors are the primary adopters, driven by the need to optimize stock levels, reduce losses, and improve supply chain visibility .

The Retail segment is the largest end-user of inventory management software, driven by the need for efficient stock management, omnichannel integration, and customer satisfaction. Retailers are increasingly adopting advanced software to manage inventory levels, track sales, and optimize supply chains. The rapid expansion of e-commerce and the demand for real-time inventory visibility have accelerated this trend, enabling retailers to synchronize online and offline operations and respond quickly to changing consumer preferences .

The Brazil Inventory Management Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP, Oracle, Microsoft, Totvs, Linx, Senior Sistemas, Bling, Nuvemshop, ContaAzul, Sigecloud, Omie, Tiny, Vtex, Mandaê, E-Notas, Sankhya, Mega Sistemas Corporativos, TOTVS Intera, Softvar, VHSYS contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Brazil inventory management software market appears promising, driven by technological advancements and increasing digital transformation initiatives. As businesses continue to embrace automation and data-driven decision-making, the demand for sophisticated inventory solutions is expected to rise. Additionally, the growing emphasis on sustainability and efficient resource management will further propel the adoption of innovative software solutions, positioning the market for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Cloud-Based Solutions On-Premise Solutions Hybrid Solutions SaaS Solutions |

| By End-User | Retail Manufacturing Wholesale & Distribution Healthcare & Pharmaceuticals Logistics & Transportation Food & Beverage E-commerce Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud On-Premise |

| By Industry Vertical | Consumer Goods Food and Beverage Electronics & Electricals Automotive Pharmaceuticals Apparel & Fashion Others |

| By Functionality | Inventory Tracking & Visibility Order Management Reporting and Analytics Demand Forecasting Supplier & Purchase Management Barcode/RFID Integration Others |

| By Region | North Region Northeast Region Central-West Region Southeast Region South Region |

| By Pricing Model | Subscription-Based One-Time License Fee Freemium Pay-Per-Use Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Inventory Management | 120 | Inventory Managers, IT Directors |

| Manufacturing Software Solutions | 90 | Operations Managers, Supply Chain Analysts |

| Logistics and Distribution Systems | 70 | Logistics Coordinators, Warehouse Supervisors |

| Small Business Inventory Tools | 50 | Small Business Owners, Financial Managers |

| Enterprise Resource Planning (ERP) Integration | 60 | ERP Consultants, System Integrators |

The Brazil Inventory Management Software Market is valued at approximately USD 120 million, reflecting a significant growth trend driven by the increasing adoption of digital solutions across various sectors, particularly in e-commerce and automation.