Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA0227

Pages:85

Published On:August 2025

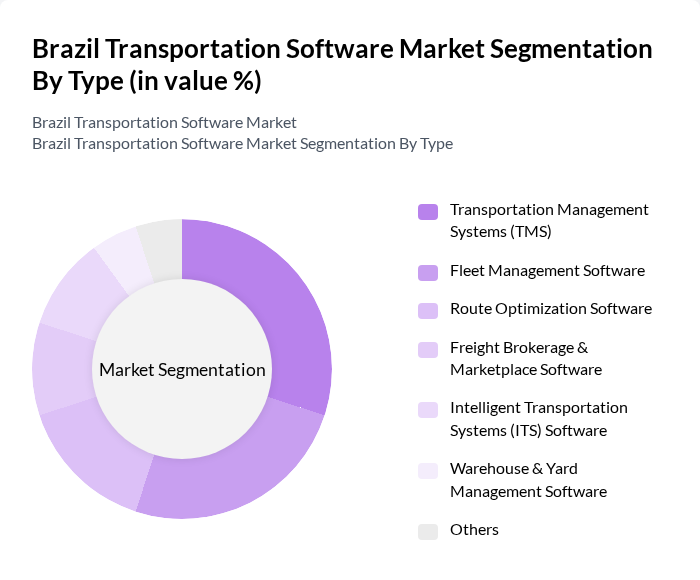

By Type:The market is segmented into various types of transportation software, including Transportation Management Systems (TMS), Fleet Management Software, Route Optimization Software, Freight Brokerage & Marketplace Software, Intelligent Transportation Systems (ITS) Software, Warehouse & Yard Management Software, and Others. Transportation Management Systems (TMS) are widely adopted for end-to-end logistics planning and execution. Fleet Management Software supports vehicle tracking, maintenance, and driver management. Route Optimization Software is used to improve delivery efficiency and reduce operational costs. Freight Brokerage & Marketplace Software connects shippers with carriers for streamlined freight matching. Intelligent Transportation Systems (ITS) Software leverages data analytics and communication technologies to optimize traffic, safety, and mobility, while Warehouse & Yard Management Software focuses on inventory and facility operations. The "Others" category includes specialized and emerging software solutions tailored for niche transportation needs .

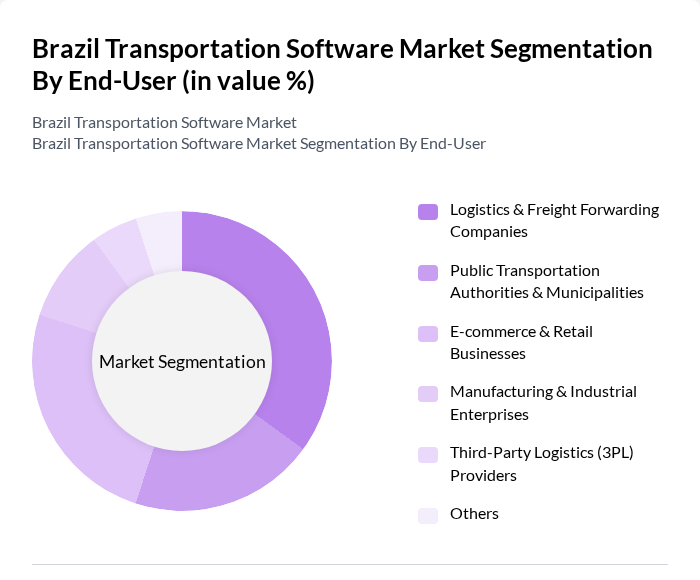

By End-User:The end-user segmentation includes Logistics & Freight Forwarding Companies, Public Transportation Authorities & Municipalities, E-commerce & Retail Businesses, Manufacturing & Industrial Enterprises, Third-Party Logistics (3PL) Providers, and Others. Logistics & Freight Forwarding Companies are the primary users, leveraging software for shipment planning, tracking, and compliance. Public Transportation Authorities & Municipalities utilize solutions for urban mobility management and public transit operations. E-commerce & Retail Businesses require transportation software for last-mile delivery optimization and inventory integration. Manufacturing & Industrial Enterprises benefit from supply chain visibility and automation, while Third-Party Logistics (3PL) Providers use these tools to manage multi-client operations. The "Others" segment includes specialized users such as cold chain logistics and hazardous materials transporters .

The Brazil Transportation Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as TOTVS, Linx, SAP Brasil, Oracle Brasil, Movile, TMS Brasil, Infor, Systech, Cargowise (WiseTech Global), CargoX, Loggi, FreteBras, TruckPad, Senior Sistemas, Omnilink contribute to innovation, geographic expansion, and service delivery in this space .

The future of Brazil's transportation software market appears promising, driven by technological advancements and increasing urbanization. As cities expand, the demand for integrated mobility solutions will rise, prompting software providers to innovate continuously. Additionally, the integration of AI and machine learning will enhance operational efficiencies, enabling real-time data analytics for better decision-making. The focus on sustainability will also shape the market, as companies seek to develop eco-friendly transportation solutions that align with government initiatives and consumer preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | Transportation Management Systems (TMS) Fleet Management Software Route Optimization Software Freight Brokerage & Marketplace Software Intelligent Transportation Systems (ITS) Software Warehouse & Yard Management Software Others |

| By End-User | Logistics & Freight Forwarding Companies Public Transportation Authorities & Municipalities E-commerce & Retail Businesses Manufacturing & Industrial Enterprises Third-Party Logistics (3PL) Providers Others |

| By Deployment Model | Cloud-Based On-Premises Hybrid Others |

| By Functionality | Route Planning & Optimization Fleet Tracking & Telematics Driver & Asset Management Compliance & Regulatory Management Freight Billing & Settlement Real-Time Analytics & Reporting Others |

| By Industry Vertical | Retail & E-commerce Healthcare & Pharmaceuticals Construction & Infrastructure Agriculture & Agribusiness Automotive Others |

| By Geographic Coverage | Urban Areas Rural Areas Intercity & Cross-Border Transportation Others |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fleet Management Software Users | 60 | Fleet Managers, Operations Directors |

| Public Transportation Software Solutions | 50 | Transit Authority Officials, IT Managers |

| Logistics and Supply Chain Software | 55 | Logistics Coordinators, Supply Chain Analysts |

| Ticketing and Fare Collection Systems | 40 | Revenue Managers, System Administrators |

| Route Optimization Software Users | 45 | Route Planners, Data Analysts |

The Brazil Transportation Software Market is valued at approximately USD 2.9 billion, driven by the increasing demand for efficient logistics solutions, advancements in technology, and the rise of e-commerce, among other factors.