Region:North America

Author(s):Geetanshi

Product Code:KRAB6303

Pages:83

Published On:October 2025

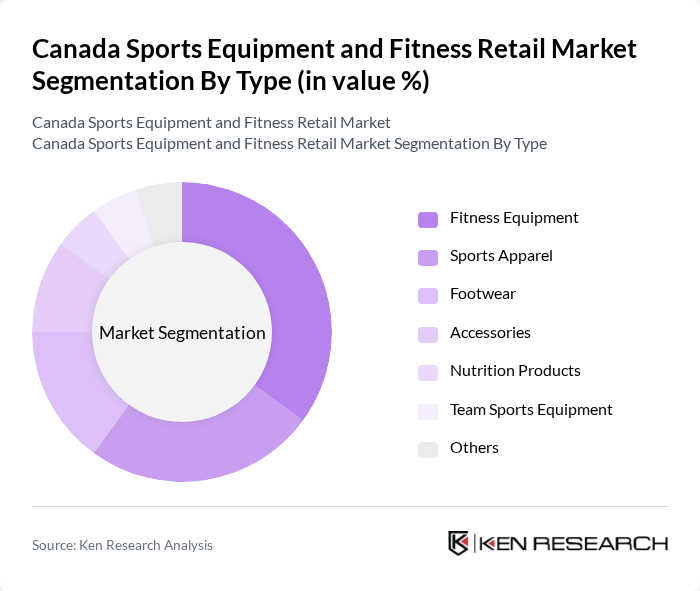

By Type:

The market is segmented into various types, including Fitness Equipment, Sports Apparel, Footwear, Accessories, Nutrition Products, Team Sports Equipment, and Others. Among these, Fitness Equipment is the leading sub-segment, driven by the growing trend of home workouts and the increasing number of fitness enthusiasts. The demand for high-quality, durable fitness equipment has surged, particularly in urban areas where space for traditional gyms is limited. Sports Apparel also shows significant growth, as consumers increasingly prioritize both functionality and style in their workout gear.

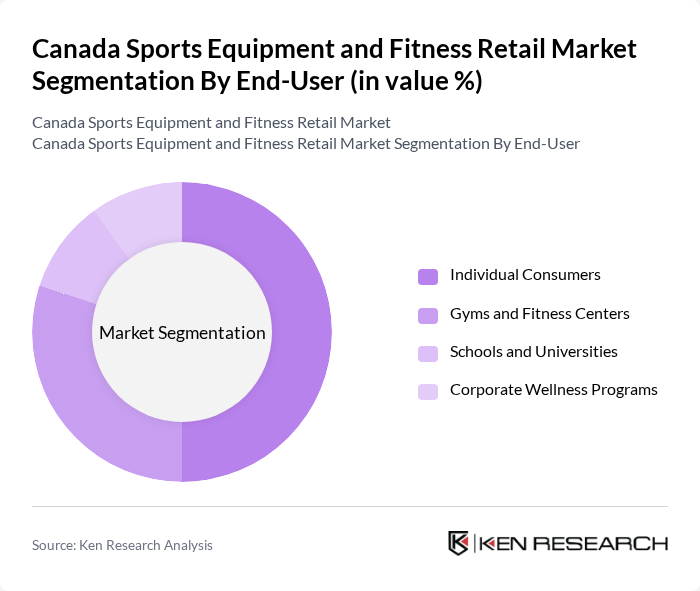

By End-User:

This market is segmented by end-users, including Individual Consumers, Gyms and Fitness Centers, Schools and Universities, and Corporate Wellness Programs. Individual Consumers dominate the market, driven by the increasing trend of personal fitness and wellness. The rise of social media influencers promoting fitness lifestyles has also contributed to this growth. Gyms and Fitness Centers are significant contributors as well, as they continuously seek to upgrade their equipment and offerings to attract more members.

The Canada Sports Equipment and Fitness Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Canadian Tire Corporation, Sport Chek, Decathlon Canada, Under Armour Canada, Lululemon Athletica, Adidas Canada, Nike Canada, The North Face Canada, Puma Canada, Reebok Canada, Wilson Sporting Goods, Callaway Golf Canada, New Balance Canada, Asics Canada, Mizuno Canada contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Canada sports equipment and fitness retail market appears promising, driven by ongoing trends in health and wellness. As consumers increasingly prioritize fitness, the demand for innovative and personalized products is expected to rise. Additionally, the integration of technology in fitness solutions will likely enhance user experiences, fostering further market growth. Retailers that adapt to these trends and invest in e-commerce capabilities will be well-positioned to capitalize on emerging opportunities in the evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Fitness Equipment Sports Apparel Footwear Accessories Nutrition Products Team Sports Equipment Others |

| By End-User | Individual Consumers Gyms and Fitness Centers Schools and Universities Corporate Wellness Programs |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Wholesale Distributors Direct Sales |

| By Price Range | Budget Mid-Range Premium |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers Trend-Focused Customers |

| By Product Lifecycle Stage | Introduction Growth Maturity |

| By Distribution Mode | Direct Distribution Indirect Distribution Franchise Models |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Sports Equipment Retailers | 150 | Store Managers, Sales Directors |

| Fitness Center Owners | 100 | Gym Owners, Operations Managers |

| Consumer Fitness Enthusiasts | 200 | Regular Gym Goers, Sports Participants |

| Online Fitness Retailers | 80 | E-commerce Managers, Marketing Directors |

| Health and Fitness Influencers | 50 | Fitness Bloggers, Social Media Influencers |

The Canada Sports Equipment and Fitness Retail Market is valued at approximately USD 4.5 billion, reflecting a significant growth trend driven by increased health consciousness and the rise of fitness trends among consumers.