Region:Central and South America

Author(s):Rebecca

Product Code:KRAB5886

Pages:83

Published On:October 2025

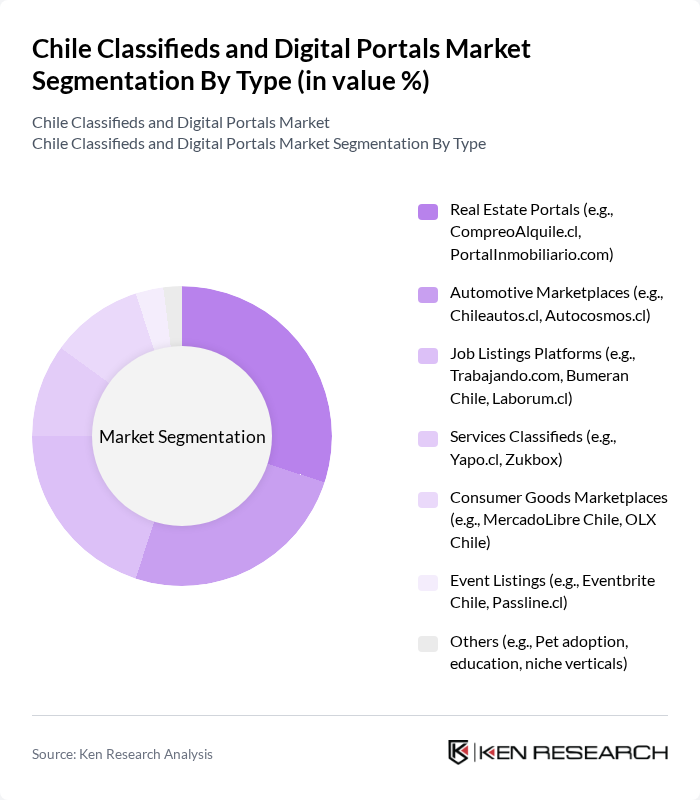

By Type:The market is segmented into Real Estate Portals, Automotive Marketplaces, Job Listings Platforms, Services Classifieds, Consumer Goods Marketplaces, Event Listings, and Others. Real Estate Portals primarily serve property buyers, sellers, and renters, offering advanced search and listing features. Automotive Marketplaces focus on vehicle sales, including new and used cars, with integrated financing and insurance options. Job Listings Platforms cater to both job seekers and employers, featuring resume databases and recruitment tools. Services Classifieds enable users to find and offer various professional and personal services. Consumer Goods Marketplaces facilitate peer-to-peer and business-to-consumer transactions for a wide range of products. Event Listings provide information and ticketing for local events, while Others cover niche verticals such as pet adoption and educational classifieds.

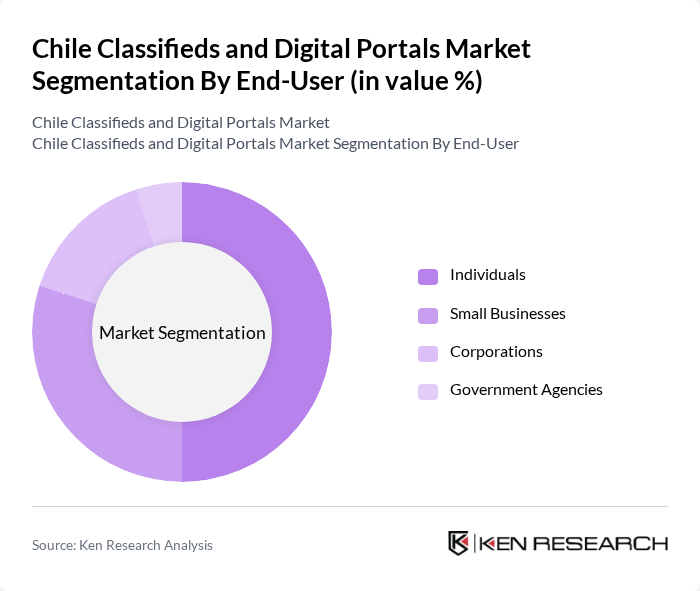

By End-User:The end-user segmentation includes Individuals, Small Businesses, Corporations, and Government Agencies. Individuals use classifieds and portals for personal transactions, job searches, and service procurement. Small Businesses leverage these platforms for local marketing, recruitment, and sales. Corporations utilize digital portals for large-scale recruitment, property management, and B2B transactions. Government Agencies increasingly adopt digital classifieds for public notices, procurement, and civic engagement, reflecting the digital transformation in public services.

The Chile Classifieds and Digital Portals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Yapo.cl, Chileautos.cl, MercadoLibre Chile, OLX Chile, CompreoAlquile.cl, Zukbox, Trovit Chile, InfoJobs Chile, Trabajando.com, Bumeran Chile, 123.cl, Anunico.cl, Clasificados.cl, Vende.cl, Laborum.cl contribute to innovation, geographic expansion, and service delivery in this space.

The Chile classifieds and digital portals market is poised for continued evolution, driven by technological advancements and changing consumer preferences. As artificial intelligence and machine learning become more integrated into platforms, user experiences will improve significantly. Additionally, the rise of social media as a marketing tool will further enhance engagement. Companies that adapt to these trends and prioritize user-centric designs will likely capture a larger share of the market, fostering sustainable growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Real Estate Portals (e.g., CompreoAlquile.cl, PortalInmobiliario.com) Automotive Marketplaces (e.g., Chileautos.cl, Autocosmos.cl) Job Listings Platforms (e.g., Trabajando.com, Bumeran Chile, Laborum.cl) Services Classifieds (e.g., Yapo.cl, Zukbox) Consumer Goods Marketplaces (e.g., MercadoLibre Chile, OLX Chile) Event Listings (e.g., Eventbrite Chile, Passline.cl) Others (e.g., Pet adoption, education, niche verticals) |

| By End-User | Individuals Small Businesses Corporations Government Agencies |

| By Sales Channel | Online Portals Mobile Applications Social Media Platforms Offline Listings |

| By Geographic Focus | Urban Areas Rural Areas Regional Markets |

| By Pricing Model | Free Listings Paid Listings Subscription-Based |

| By User Demographics | Age Groups Income Levels Education Levels |

| By Service Type | B2C Services C2C Services B2B Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Real Estate Listings | 60 | Real Estate Agents, Property Managers |

| Automotive Sales | 50 | Car Dealership Owners, Sales Managers |

| Job Listings | 70 | HR Managers, Recruitment Specialists |

| Consumer Goods Advertisements | 40 | Small Business Owners, Marketing Managers |

| Service Sector Listings | 40 | Service Providers, Business Development Managers |

The Chile Classifieds and Digital Portals Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by increased internet and mobile device penetration, as well as the rise of e-commerce in the region.