Region:Central and South America

Author(s):Shubham

Product Code:KRAB3780

Pages:91

Published On:October 2025

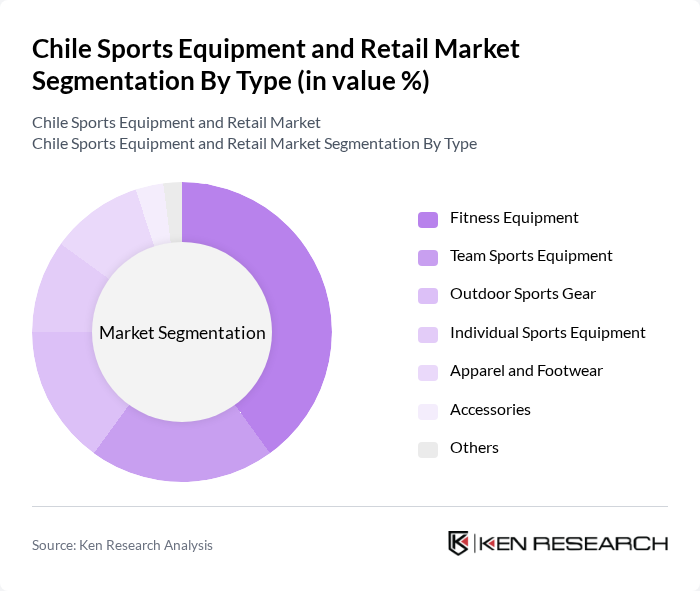

By Type:The market is segmented into various types of sports equipment, including fitness equipment, team sports equipment, outdoor sports gear, individual sports equipment, apparel and footwear, accessories, and others. Among these, fitness equipment has emerged as the leading segment, driven by the growing trend of home workouts and fitness awareness. The demand for high-quality fitness gear, such as treadmills, weights, and yoga mats, has surged as consumers invest in personal health and wellness.

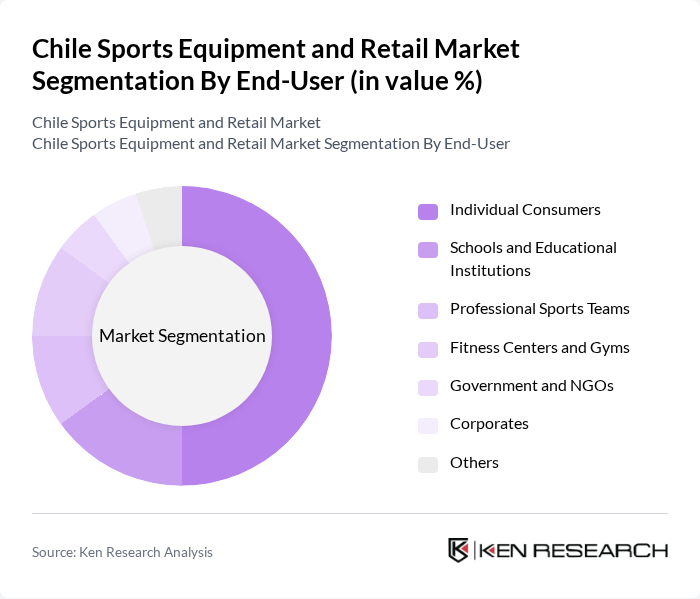

By End-User:The end-user segmentation includes individual consumers, schools and educational institutions, professional sports teams, fitness centers and gyms, government and NGOs, corporates, and others. Individual consumers represent the largest segment, as the increasing focus on personal fitness and wellness drives demand for sports equipment. Schools and educational institutions also contribute significantly, as they invest in sports facilities and equipment to promote physical education.

The Chile Sports Equipment and Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Adidas AG, Nike Inc., Under Armour Inc., Puma SE, Decathlon S.A., Columbia Sportswear Company, The North Face, Asics Corporation, Wilson Sporting Goods, New Balance Athletics, Inc., Mizuno Corporation, Salomon S.A., Head N.V., Amer Sports Corporation, K2 Sports contribute to innovation, geographic expansion, and service delivery in this space.

The Chile sports equipment and retail market is poised for transformation, driven by increasing health consciousness and a growing interest in outdoor activities. As the government continues to invest in sports infrastructure, local manufacturers are likely to gain traction. Additionally, the integration of technology in sports gear and the rise of fitness apps will further enhance consumer engagement. These trends indicate a dynamic market landscape, with opportunities for innovation and collaboration in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Fitness Equipment Team Sports Equipment Outdoor Sports Gear Individual Sports Equipment Apparel and Footwear Accessories Others |

| By End-User | Individual Consumers Schools and Educational Institutions Professional Sports Teams Fitness Centers and Gyms Government and NGOs Corporates Others |

| By Sales Channel | Online Retail Specialty Sports Stores Department Stores Discount Stores Direct Sales Others |

| By Price Range | Budget Mid-Range Premium Luxury |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers Quality-Conscious Customers Trend-Focused Customers |

| By Product Lifecycle Stage | Introduction Stage Growth Stage Maturity Stage Decline Stage |

| By Distribution Mode | Direct Distribution Indirect Distribution E-commerce Distribution Retail Distribution |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sports Equipment Sales | 150 | Store Managers, Retail Buyers |

| Consumer Purchasing Behavior | 200 | Fitness Enthusiasts, Casual Athletes |

| Market Trends in Sports Apparel | 100 | Fashion Retailers, Brand Managers |

| Impact of E-commerce on Sports Equipment | 120 | E-commerce Managers, Digital Marketing Specialists |

| Consumer Satisfaction with Sports Brands | 80 | Product Users, Brand Loyalists |

The Chile Sports Equipment and Retail Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increased health consciousness, sports participation, and the expansion of retail channels, particularly e-commerce.