Region:Africa

Author(s):Rebecca

Product Code:KRAB3542

Pages:100

Published On:October 2025

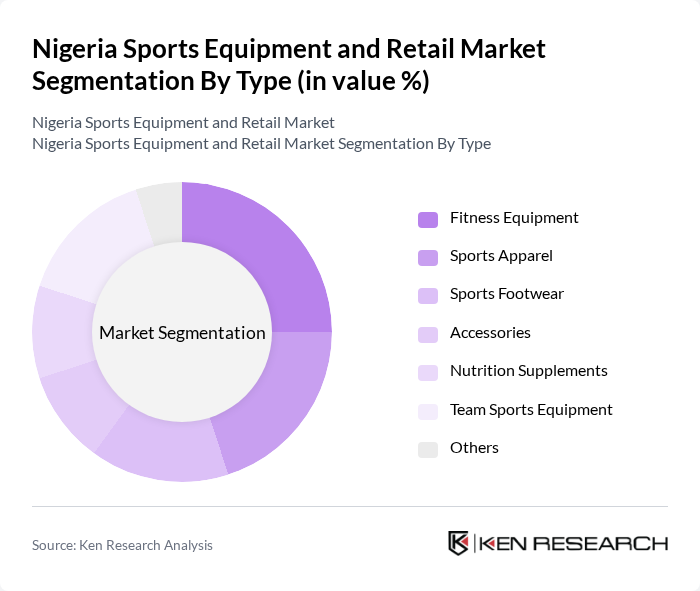

By Type:The market is segmented into fitness equipment, sports apparel, sports footwear, accessories, nutrition supplements, team sports equipment, and others. Fitness equipment includes treadmills, weights, and training machines. Sports apparel covers clothing designed for athletic activities, while sports footwear encompasses specialized shoes for various sports. Accessories include protective gear, bags, and wearable tech. Nutrition supplements consist of products supporting athletic performance and recovery. Team sports equipment covers items used in football, basketball, and other team sports. The "others" segment includes niche products and emerging categories.

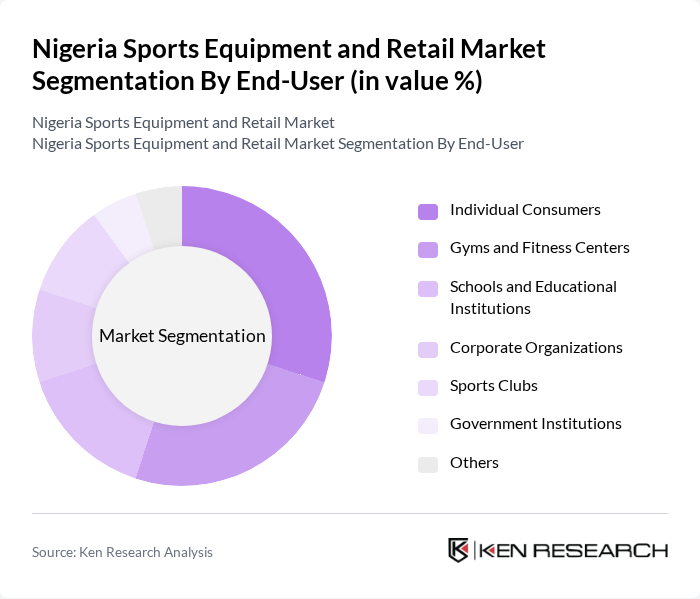

By End-User:The end-user segmentation includes individual consumers, gyms and fitness centers, schools and educational institutions, corporate organizations, sports clubs, government institutions, and others. Individual consumers drive demand for home fitness and personal sports gear. Gyms and fitness centers invest in commercial-grade equipment and accessories. Schools and educational institutions procure equipment for student sports programs. Corporate organizations increasingly support employee wellness initiatives. Sports clubs require specialized gear for training and competition. Government institutions focus on public sports infrastructure and community programs. The "others" segment includes non-profit organizations and informal groups.

The Nigeria Sports Equipment and Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nike Inc., Adidas AG, Puma SE, Decathlon S.A., Under Armour Inc., Kappa S.p.A., Wilson Sporting Goods Co., Spalding, Mizuno Corporation, Asics Corporation, New Balance Athletics, Inc., Reebok International Ltd., Skechers USA, Inc., Li-Ning Company Limited, Yonex Co., Ltd., Sports World Nigeria Ltd., Jumia Nigeria (Sports & Fitness Category), SLOT Systems Limited (Sports Equipment Division), Game Stores Nigeria, Just Fitted Nigeria contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Nigeria sports equipment market appears promising, driven by increasing youth engagement and a growing health consciousness among the population. As the government continues to invest in sports infrastructure and initiatives, the market is likely to see enhanced participation rates. Additionally, the rise of e-commerce platforms will facilitate easier access to sports equipment, further stimulating growth. The combination of these factors suggests a dynamic and evolving market landscape in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Fitness Equipment Sports Apparel Sports Footwear Accessories Nutrition Supplements Team Sports Equipment (e.g., balls, protective gear, court equipment) Others |

| By End-User | Individual Consumers Gyms and Fitness Centers Schools and Educational Institutions Corporate Organizations Sports Clubs Government Institutions Others |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Wholesale Distributors Direct Sales Sports Events and Expos Others |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| By Brand Type | International Brands Local Brands Private Labels Others |

| By Distribution Mode | Direct Distribution Indirect Distribution Franchise Models Others |

| By Application | Recreational Use Professional Sports Fitness Training Rehabilitation Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sports Equipment Sales | 120 | Store Owners, Retail Managers |

| Consumer Purchasing Behavior | 140 | Sports Enthusiasts, General Consumers |

| Market Trends in Sports Apparel | 100 | Fashion Retailers, Brand Managers |

| Fitness Equipment Usage | 80 | Gym Owners, Personal Trainers |

| Impact of E-commerce on Sports Retail | 110 | E-commerce Managers, Digital Marketing Specialists |

The Nigeria Sports Equipment and Retail Market is valued at approximately USD 1.6 billion, representing over 40% of the Africa Sports Equipment and Accessories market, which is valued at USD 3.71 billion.