Region:Asia

Author(s):Dev

Product Code:KRAA1522

Pages:90

Published On:August 2025

By Type:The chocolate market in China is segmented into dark chocolate, milk chocolate, white chocolate, filled & specialty chocolate, sugar-free & reduced sugar chocolate, organic & functional chocolate, and artisanal & premium chocolate. Milk chocolate remains the most popular due to its creamy texture and sweetness, appealing to a broad consumer base. Dark chocolate is gaining traction as health-conscious consumers seek products with higher cocoa content and lower sugar levels. Filled & specialty chocolate is experiencing growth, driven by innovative flavors and unique offerings that cater to evolving consumer tastes .

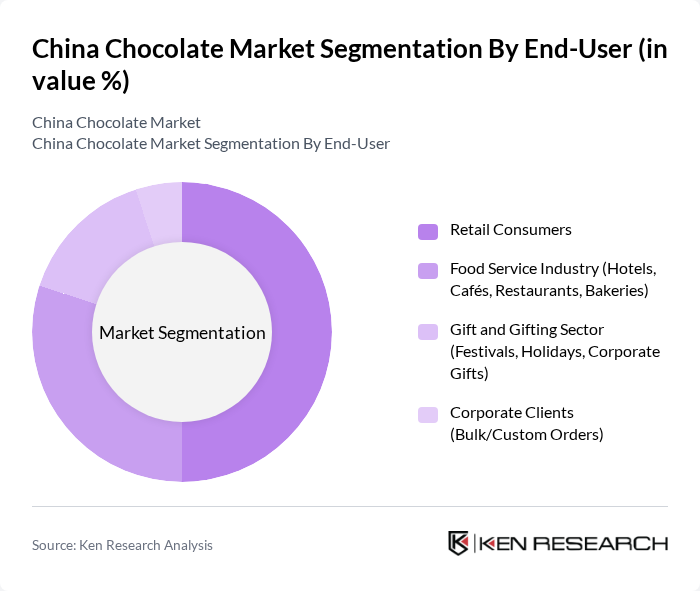

By End-User:The end-user segmentation includes retail consumers, the food service industry (hotels, cafés, restaurants, bakeries), the gift and gifting sector (festivals, holidays, corporate gifts), and corporate clients (bulk/custom orders). Retail consumers represent the largest segment, driven by the increasing trend of chocolate consumption as a snack and dessert. The food service industry is significant, with chocolate featured in menus to enhance dining experiences. The gifting sector sees heightened activity during festive seasons, with chocolates as a preferred gift option .

The China Chocolate Market features a dynamic mix of regional and international players. Leading participants such as Mars, Inc. (Dove), Mondelez International, Inc. (Cadbury), Ferrero Group, Nestlé S.A., The Hershey Company, Meiji Holdings Co., Ltd., Lindt & Sprüngli AG, Barry Callebaut AG, Cargill, Inc., Godiva Chocolatier, Inc., Ghirardelli Chocolate Company, Guylian, Daily Heiqiao (??), Leconte (?????), and Golden Monkey (???) drive innovation, geographic expansion, and service delivery in this space .

The future of the chocolate market in China appears promising, driven by evolving consumer preferences and increasing health consciousness. As disposable incomes rise, the demand for premium and dark chocolate is expected to continue its upward trajectory. Additionally, the expansion of e-commerce platforms will facilitate greater access to diverse chocolate products, enhancing consumer choice. Companies that prioritize sustainability and innovation in product offerings will likely gain a competitive edge in this dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Dark Chocolate Milk Chocolate White Chocolate Filled & Specialty Chocolate Sugar-Free & Reduced Sugar Chocolate Organic & Functional Chocolate Artisanal & Premium Chocolate |

| By End-User | Retail Consumers Food Service Industry (Hotels, Cafés, Restaurants, Bakeries) Gift and Gifting Sector (Festivals, Holidays, Corporate Gifts) Corporate Clients (Bulk/Custom Orders) |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail/E-commerce Specialty Stores & Boutiques Direct-to-Consumer (DTC) & Pop-up Stores |

| By Price Range | Premium Mid-Range Economy |

| By Packaging Type | Boxed Chocolate Pouch Packaging Bulk Packaging Gift Packaging |

| By Occasion | Festivals (Chinese New Year, Mid-Autumn Festival, etc.) Birthdays Weddings Corporate Events Valentine's Day & Other Holidays |

| By Region | North China South China East China West China Central China |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Chocolate | 120 | Chocolate Consumers, Age 18-45 |

| Retail Insights on Chocolate Sales | 80 | Store Managers, Retail Buyers |

| Manufacturing Perspectives on Chocolate Production | 60 | Production Managers, Quality Control Officers |

| Distribution Channel Effectiveness | 50 | Logistics Managers, Supply Chain Analysts |

| Market Trends and Innovations | 40 | Industry Experts, Market Analysts |

The China chocolate market is valued at approximately USD 8.9 billion, driven by rising disposable incomes, consumer preferences for premium chocolates, and a strong gifting culture during festivals and special occasions.