Region:Europe

Author(s):Shubham

Product Code:KRAA1811

Pages:88

Published On:August 2025

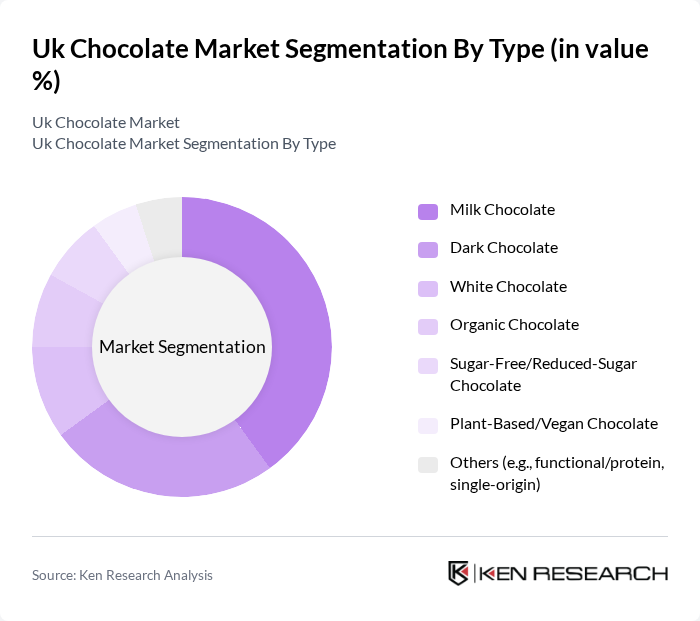

By Type:The chocolate market can be segmented into various types, including milk chocolate, dark chocolate, white chocolate, organic chocolate, sugar-free/reduced-sugar chocolate, plant-based/vegan chocolate, and others such as functional or single-origin chocolates. Among these, milk chocolate remains the most popular due to its creamy texture and widespread appeal. Dark chocolate is gaining traction as consumers become more health-conscious, while organic and vegan options are increasingly sought after by niche markets. The demand for sugar-free varieties is also on the rise, driven by health trends.

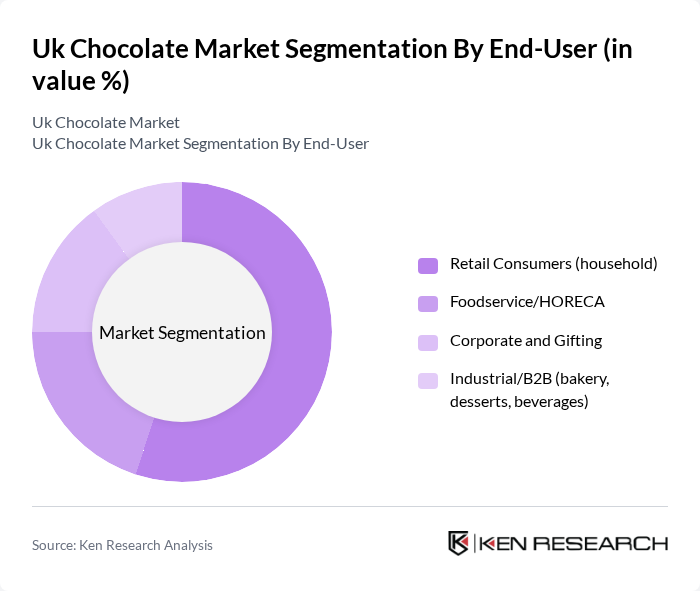

By End-User:The end-user segmentation includes retail consumers (household), foodservice/HORECA, corporate and gifting, and industrial/B2B sectors. Retail consumers dominate the market, driven by the increasing trend of chocolate consumption at home and during special occasions. The foodservice sector, including cafes and restaurants, also plays a significant role, particularly in offering chocolate-based desserts. Corporate gifting is another growing segment, especially during festive seasons, while the industrial sector utilizes chocolate in various food products.

The UK chocolate market is characterized by a dynamic mix of regional and international players. Leading participants such as Mondelez International (Cadbury, Green & Black’s), Mars, Incorporated (Galaxy, Maltesers), Nestlé S.A. (KitKat, Aero, Quality Street), Ferrero Group (Ferrero Rocher, Thorntons, Kinder), Lindt & Sprüngli AG (Lindt), Hotel Chocolat Group plc, Pladis (United Biscuits; chocolate biscuits incl. McVitie’s chocolate ranges), Divine Chocolate Ltd, Tony’s Chocolonely, Ritter Sport (Alfred Ritter GmbH & Co. KG), Mondelez International – Cadbury, Guylian (Chocolaterie Guylian NV), Fazer (Karl Fazer brand), Thorntons (Ferrero UK Ltd), Green & Black’s (Mondelez International) contribute to innovation, geographic expansion, and service delivery in this space.

The UK chocolate market is poised for continued evolution, driven by consumer preferences for healthier and ethically sourced products. As the demand for vegan and organic chocolates rises, brands are likely to innovate and diversify their offerings. Additionally, the expansion of e-commerce will facilitate greater access to premium products. With sustainability becoming a focal point, companies will increasingly adopt eco-friendly practices, ensuring that the market remains competitive and aligned with consumer values in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Milk Chocolate Dark Chocolate White Chocolate Organic Chocolate Sugar-Free/Reduced-Sugar Chocolate Plant-Based/Vegan Chocolate Others (e.g., functional/protein, single-origin) |

| By End-User | Retail Consumers (household) Foodservice/HORECA Corporate and Gifting Industrial/B2B (bakery, desserts, beverages) |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Specialty & Chocolatier Stores Online Stores/E-commerce Direct Sales (B2B/wholesale) |

| By Price Range | Premium/Luxury Everyday/Mainstream Seasonal/Occasion-led |

| By Occasion | Gifting Everyday Consumption Seasonal Events (Easter, Christmas, Valentine’s, Halloween) |

| By Packaging Type | Boxed/Assortments Pouches/Sharing Bags Bars/Countlines Sustainable/Plastic-free Packaging |

| By Flavor | Classic (milk, hazelnut, caramel) Dark & High-Cocoa Specialty/Exotic (sea salt, chili, fruit inclusions) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Chocolate | 150 | Chocolate Consumers, Age 18-65 |

| Retail Insights on Chocolate Sales | 120 | Store Managers, Retail Buyers |

| Manufacturing Perspectives on Trends | 90 | Production Managers, Quality Control Officers |

| Distribution Channel Analysis | 80 | Logistics Coordinators, Supply Chain Managers |

| Health Trends Impacting Chocolate Consumption | 100 | Nutritionists, Health-Conscious Consumers |

The UK chocolate market is valued at approximately USD 5.5 billion, reflecting a significant growth driven by consumer demand for premium and artisanal chocolate products, as well as seasonal gifting trends.