Region:Asia

Author(s):Dev

Product Code:KRAB0344

Pages:80

Published On:August 2025

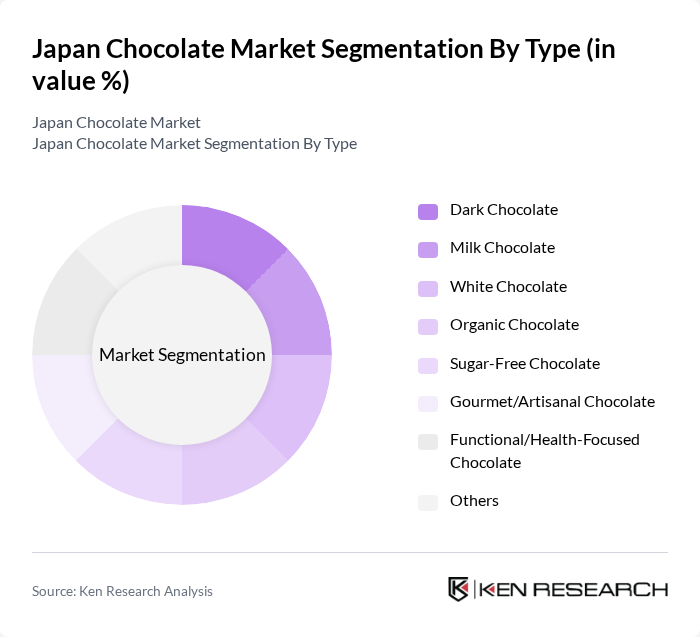

By Type:The chocolate market can be segmented into various types, including Dark Chocolate, Milk Chocolate, White Chocolate, Organic Chocolate, Sugar-Free Chocolate, Gourmet/Artisanal Chocolate, Functional/Health-Focused Chocolate, and Others. Each type caters to different consumer preferences and dietary needs. Notably, dark chocolate and functional/health-focused chocolates are gaining traction due to rising health awareness, while premiumization trends are driving demand for gourmet and artisanal varieties .

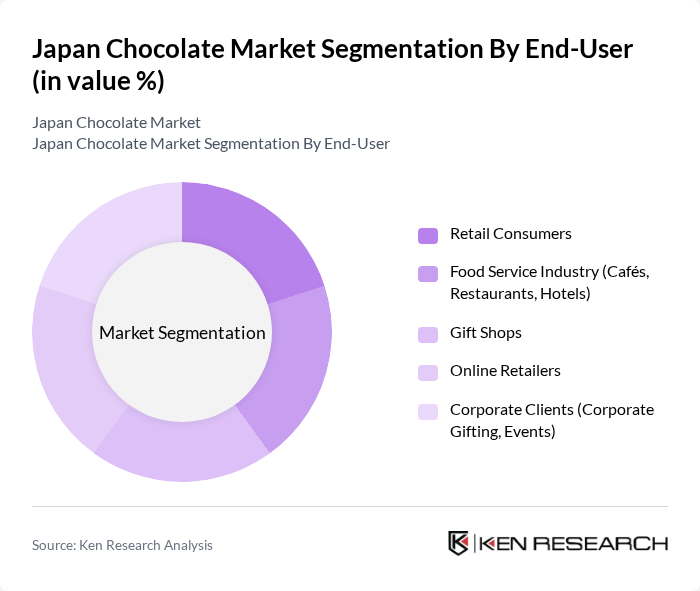

By End-User:The end-user segmentation includes Retail Consumers, Food Service Industry (Cafés, Restaurants, Hotels), Gift Shops, Online Retailers, and Corporate Clients (Corporate Gifting, Events). Retail consumers dominate the market, driven by the increasing trend of gifting and personal consumption, while the food service industry is also significant due to the growing café culture in urban areas. Online retailers are experiencing rapid growth, reflecting a broader shift toward e-commerce and convenience-driven purchasing behavior .

The Japan Chocolate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Meiji Holdings Co., Ltd., Morinaga & Co., Ltd., Lotte Co., Ltd., Ezaki Glico Co., Ltd., Nestlé Japan Ltd. (KitKat), Ferrero Japan Ltd., Bourbon Corporation, Royce' Confect Co., Ltd., Godiva Japan Inc., Lindt & Sprüngli Japan Co., Ltd., Mary Chocolate Co., Ltd., Fujiya Co., Ltd., Dandelion Chocolate Japan, Aoi Sora Chocolate, Morozoff Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan chocolate market appears promising, driven by evolving consumer preferences and innovative product offerings. As health-conscious trends continue to shape purchasing decisions, brands are likely to invest in healthier alternatives and sustainable practices. Additionally, the integration of technology in marketing and sales strategies will enhance consumer engagement. The anticipated growth in the premium and organic segments will further diversify the market, catering to a broader audience seeking quality and ethical products.

| Segment | Sub-Segments |

|---|---|

| By Type | Dark Chocolate Milk Chocolate White Chocolate Organic Chocolate Sugar-Free Chocolate Gourmet/Artisanal Chocolate Functional/Health-Focused Chocolate Others |

| By End-User | Retail Consumers Food Service Industry (Cafés, Restaurants, Hotels) Gift Shops Online Retailers Corporate Clients (Corporate Gifting, Events) |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Specialty Stores (Chocolatiers, Gourmet Shops) E-commerce Platforms Direct Sales (B2B, Corporate) |

| By Price Range | Premium Mid-Range Economy Seasonal/Limited Edition |

| By Occasion | Festivals (Valentine's Day, White Day, Christmas) Birthdays Corporate Gifting Everyday Consumption Weddings/Anniversaries |

| By Packaging Type | Boxes Bags Bars Gift Packs Others |

| By Flavor | Classic Flavors (Milk, Dark, White) Exotic Flavors (Matcha, Yuzu, Sakura, Wasabi) Seasonal Flavors (Chestnut, Strawberry, Pumpkin) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Chocolate | 120 | Chocolate Consumers, Age 18-45 |

| Retail Insights on Chocolate Sales | 60 | Store Managers, Retail Buyers |

| Manufacturing Perspectives on Chocolate Production | 50 | Production Managers, Quality Control Officers |

| Distribution Channel Analysis | 40 | Logistics Coordinators, Supply Chain Managers |

| Market Trends and Innovations | 40 | Product Development Managers, Marketing Executives |

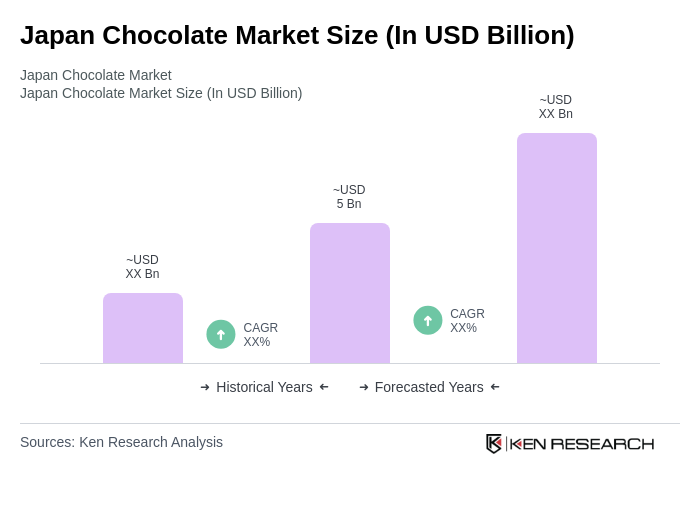

The Japan Chocolate Market is valued at approximately USD 5 billion, reflecting a significant growth trend driven by consumer demand for premium and artisanal chocolates, as well as health-conscious options like organic and sugar-free varieties.