Region:North America

Author(s):Rebecca

Product Code:KRAA2182

Pages:96

Published On:August 2025

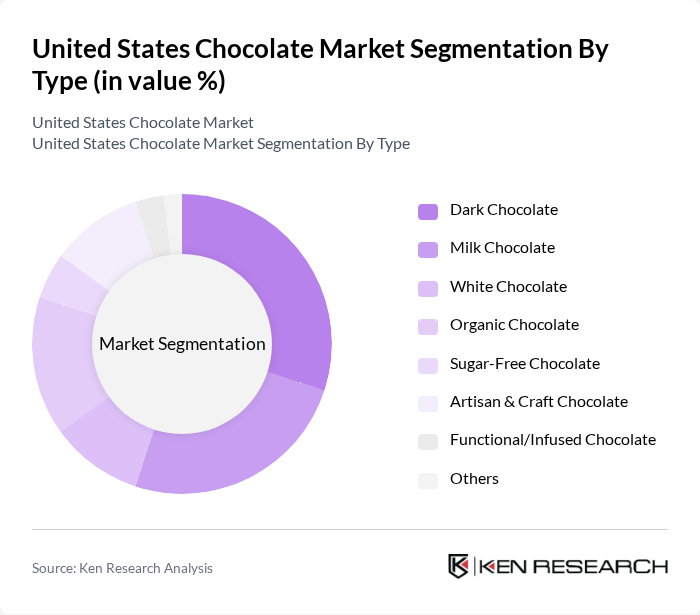

By Type:The chocolate market is segmented into dark chocolate, milk chocolate, white chocolate, organic chocolate, sugar-free chocolate, artisan & craft chocolate, functional/infused chocolate, and others. Dark chocolate has gained significant popularity due to its perceived health benefits, higher cocoa content, and antioxidant properties, making it a preferred choice among health-conscious consumers. Organic and artisan chocolates are also witnessing strong growth as consumers seek premium, ethically sourced, and sustainably produced options. Milk chocolate remains a staple, favored for its sweeter and creamier profile, while sugar-free and functional chocolates are gaining traction among consumers seeking wellness-oriented products.

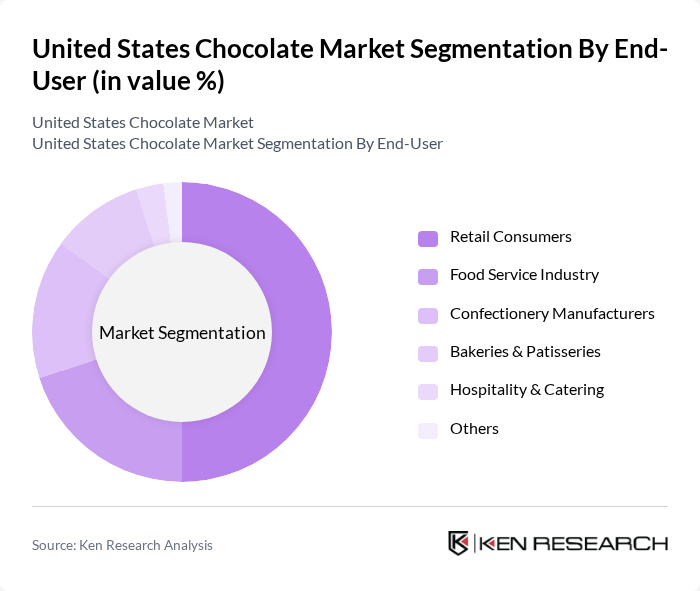

By End-User:The end-user segmentation includes retail consumers, food service industry, confectionery manufacturers, bakeries & patisseries, hospitality & catering, and others. Retail consumers represent the largest segment, driven by the increasing consumption of chocolate as a snack, treat, and gift item, especially during holidays and special occasions. The food service industry is also significant, with restaurants and cafes incorporating chocolate into desserts and beverages. Confectionery manufacturers, bakeries, and patisseries leverage chocolate for a wide range of products, while hospitality and catering sectors use chocolate for premium offerings and event-based consumption.

The United States Chocolate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mars, Incorporated, The Hershey Company, Mondelez International, Inc., Nestlé USA, Inc., Ferrero USA, Inc., Lindt & Sprüngli (USA) Inc., Ghirardelli Chocolate Company, Godiva Chocolatier, Inc., Tootsie Roll Industries, LLC, Barry Callebaut USA LLC, Chocolove, Green & Black's, Alter Eco, Endangered Species Chocolate, Scharffen Berger Chocolate Maker, Russell Stover Chocolates, See's Candies, Theo Chocolate, Lake Champlain Chocolates, Guittard Chocolate Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. chocolate market appears promising, driven by evolving consumer preferences and a focus on sustainability. As health-conscious consumers increasingly seek out organic and ethically sourced products, brands that prioritize transparency and quality are likely to thrive. Additionally, the rise of digital platforms will continue to reshape the retail landscape, enabling brands to reach wider audiences. Companies that adapt to these trends and invest in innovative product offerings will be well-positioned for growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Dark Chocolate Milk Chocolate White Chocolate Organic Chocolate Sugar-Free Chocolate Artisan & Craft Chocolate Functional/Infused Chocolate Others |

| By End-User | Retail Consumers Food Service Industry Confectionery Manufacturers Bakeries & Patisseries Hospitality & Catering Others |

| By Sales Channel | Supermarkets/Hypermarkets Online Retail/E-commerce Convenience Stores Specialty & Gourmet Stores Drugstores & Pharmacies Others |

| By Packaging Type | Bars Boxes & Gift Packs Pouches & Bags Bulk Packaging Wrappers/Single-Serve Others |

| By Price Range | Premium Mid-Range Economy Private Label/Store Brand Others |

| By Flavor | Classic Flavors (Milk, Dark, White) Nut-based Flavors Fruit-infused Flavors Exotic & Spiced Flavors Seasonal & Limited Edition Flavors Others |

| By Occasion | Everyday Consumption Gifting Seasonal Events (Valentine's, Halloween, Christmas, Easter) Corporate & Special Events Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Chocolate | 120 | Chocolate Consumers, Age 18-65 |

| Retail Insights on Chocolate Sales | 60 | Store Managers, Retail Buyers |

| Manufacturing Perspectives on Chocolate Production | 50 | Production Managers, Quality Control Officers |

| Distribution Channel Analysis | 40 | Logistics Coordinators, Supply Chain Managers |

| Health Trends Impacting Chocolate Consumption | 45 | Nutritionists, Health-Conscious Consumers |

The United States chocolate market is valued at approximately USD 35 billion, reflecting a robust demand for premium and artisanal chocolate products, as well as seasonal consumption spikes during holidays and gifting occasions.