Region:Middle East

Author(s):Dev

Product Code:KRAC2675

Pages:93

Published On:October 2025

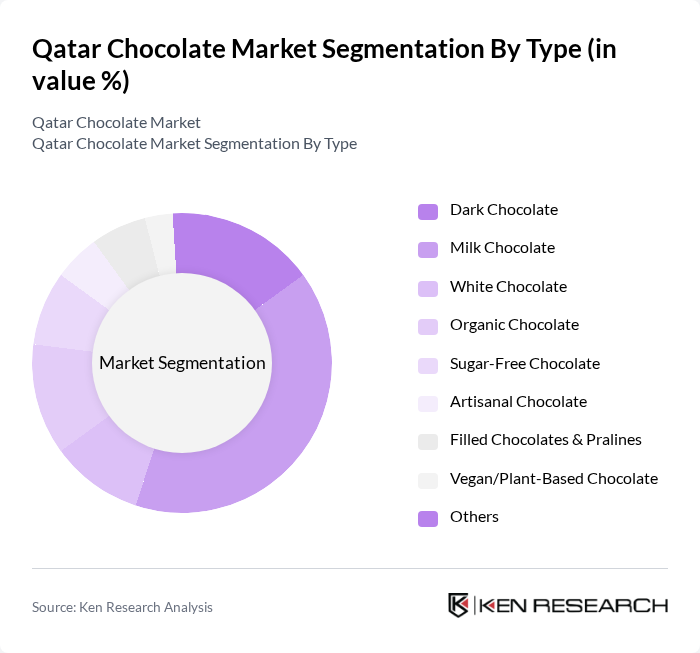

By Type:The chocolate market in Qatar is segmented into various types, including dark chocolate, milk chocolate, white chocolate, organic chocolate, sugar-free chocolate, artisanal chocolate, filled chocolates & pralines, vegan/plant-based chocolate, and others. Among these, milk chocolate remains the most popular due to its widespread appeal and versatility in culinary applications. The growing trend towards health-conscious eating has led to a rise in demand for organic, sugar-free, and vegan chocolate options, reflecting changing consumer preferences. Artisanal and premium chocolates are gaining traction, especially among younger and affluent consumers seeking unique flavors and high-quality ingredients .

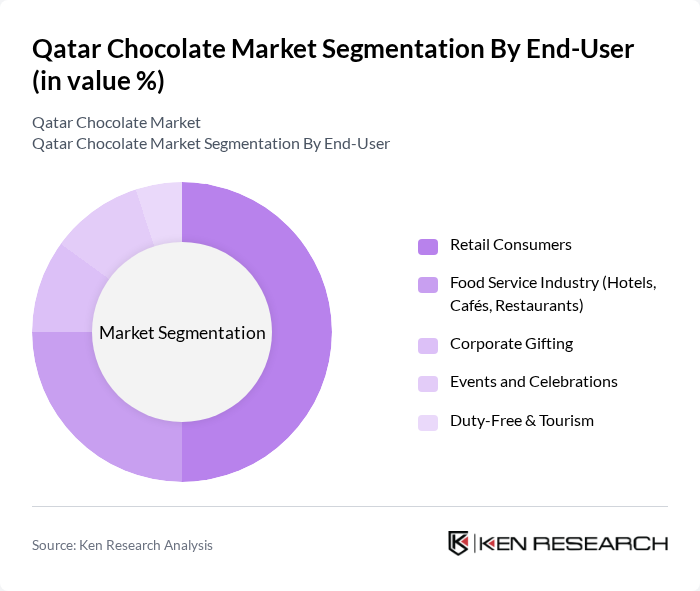

By End-User:The end-user segmentation of the chocolate market includes retail consumers, the food service industry (hotels, cafés, restaurants), corporate gifting, events and celebrations, and duty-free & tourism. Retail consumers dominate the market, driven by the increasing availability of chocolates in supermarkets, specialty stores, and online platforms. The food service industry is also a significant contributor, as hotels and restaurants incorporate chocolates into their dessert offerings and gift packages, enhancing overall market demand. Corporate gifting and events continue to support seasonal spikes in sales, while duty-free and tourism channels benefit from Qatar’s growing international visitor numbers .

The Qatar Chocolate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Chocolate Company, Al Nassma Chocolate LLC, Patchi, Godiva Chocolatier, Lindt & Sprüngli AG, Ferrero Rocher (Ferrero Group), Mars, Incorporated, Mondelez International, Nestlé S.A., Cacao Barry (Barry Callebaut Group), Barry Callebaut AG, Ghirardelli Chocolate Company, Hershey Company, Mirzam Chocolate Makers, Meiji Holdings Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The Qatar chocolate market is poised for dynamic growth, driven by evolving consumer preferences and increasing health awareness. As the demand for premium and dark chocolates continues to rise, manufacturers are likely to focus on product innovation and sustainable practices. The expansion of e-commerce will further enhance market accessibility, allowing brands to reach a broader audience. Additionally, the trend towards gifting premium chocolates is expected to create new avenues for growth, particularly during festive seasons and special occasions.

| Segment | Sub-Segments |

|---|---|

| By Type | Dark Chocolate Milk Chocolate White Chocolate Organic Chocolate Sugar-Free Chocolate Artisanal Chocolate Filled Chocolates & Pralines Vegan/Plant-Based Chocolate Others |

| By End-User | Retail Consumers Food Service Industry (Hotels, Cafés, Restaurants) Corporate Gifting Events and Celebrations Duty-Free & Tourism |

| By Sales Channel | Supermarkets and Hypermarkets Online Retail & E-commerce Specialty Chocolate Boutiques Convenience Stores Duty-Free Stores |

| By Price Range | Premium Mid-Range Economy |

| By Packaging Type | Boxed Chocolates Pouches Bulk Packaging Gift Packaging |

| By Flavor | Classic Flavors (Milk, Dark, White) Exotic Flavors (Spices, Fruits, Nuts) Seasonal & Limited-Edition Flavors |

| By Occasion | Festivals (Eid, Ramadan, National Day) Birthdays Weddings Corporate Events Tourism & Duty-Free Gifting |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Chocolate Sales | 100 | Store Managers, Category Buyers |

| Consumer Preferences | 120 | Chocolate Consumers, Age 18-45 |

| Chocolate Manufacturing Insights | 80 | Production Managers, Quality Control Officers |

| Distribution Channel Analysis | 60 | Logistics Coordinators, Supply Chain Managers |

| Market Trend Analysis | 40 | Market Analysts, Industry Experts |

The Qatar chocolate market is valued at approximately USD 45 million, reflecting a five-year historical analysis of import, production, and consumption data. This growth is driven by increasing consumer demand for premium and artisanal chocolates.