Region:Europe

Author(s):Rebecca

Product Code:KRAA2178

Pages:81

Published On:August 2025

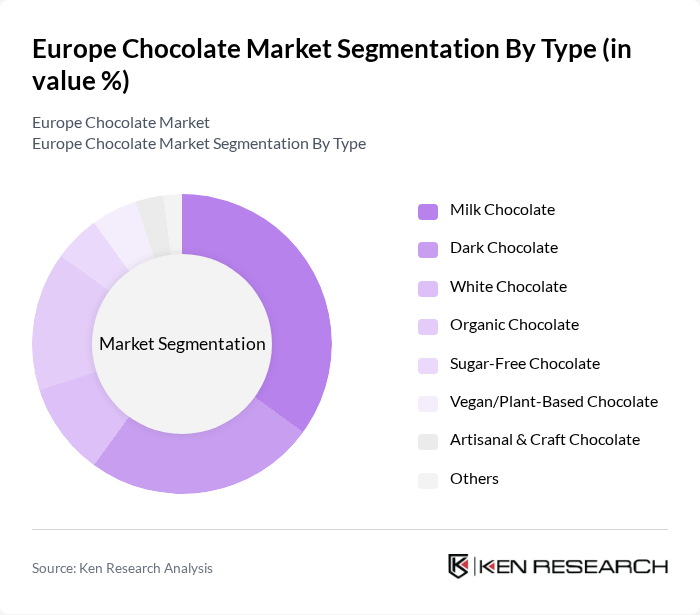

By Type:The chocolate market can be segmented into Milk Chocolate, Dark Chocolate, White Chocolate, Organic Chocolate, Sugar-Free Chocolate, Vegan/Plant-Based Chocolate, Artisanal & Craft Chocolate, and Others. Each type addresses distinct consumer preferences and dietary needs. Notably, dark chocolate and organic chocolate are gaining traction among health-conscious consumers, while artisanal and craft chocolates are increasingly popular for their unique flavors and premium positioning. The rise of vegan and plant-based chocolates reflects growing demand for ethical and sustainable options .

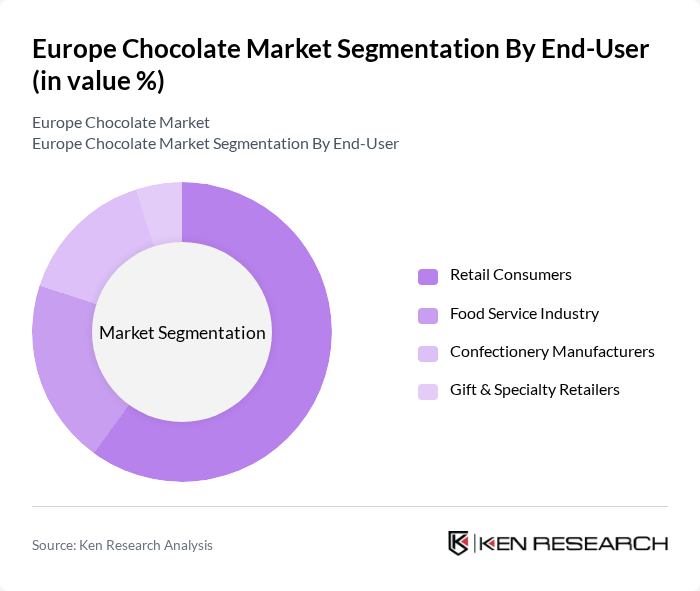

By End-User:The end-user segmentation includes Retail Consumers, Food Service Industry, Confectionery Manufacturers, and Gift & Specialty Retailers. Retail consumers represent the largest segment, driven by the popularity of chocolate as a snack and gift item. The food service industry is expanding, fueled by the increasing prevalence of chocolate desserts in restaurants and cafes. Confectionery manufacturers and specialty retailers also play significant roles, reflecting the broad application of chocolate in both direct consumption and as an ingredient in various products .

The Europe Chocolate Market features a dynamic mix of regional and international players. Leading participants such as Mondelez International (Cadbury, Milka, Toblerone), Ferrero Group (Ferrero Rocher, Kinder, Mon Chéri), Nestlé S.A. (KitKat, Smarties, Quality Street), Mars, Incorporated (Mars, Snickers, Galaxy, Dove), Lindt & Sprüngli AG (Lindt, Ghirardelli, Russell Stover), Barry Callebaut AG, Pladis Global (Godiva, Ülker, McVitie’s), Chocoladefabriken Ritter Sport GmbH & Co. KG, Cémoi Group, Toms Gruppen A/S, Storck Group (Werther’s Original, Merci, Toffifee), Cloetta AB, Fazer Group, Valor Chocolates S.A., and Leonidas S.A. drive innovation, geographic expansion, and service delivery in this space .

The future of the European chocolate market appears promising, driven by evolving consumer preferences and a focus on sustainability. As health-conscious consumers continue to seek out premium and dark chocolate options, manufacturers are likely to innovate with new flavors and healthier formulations. Additionally, the rise of e-commerce will further enhance market accessibility, allowing brands to reach a broader audience. Sustainability initiatives will also play a crucial role, as consumers increasingly demand ethically sourced and environmentally friendly products.

| Segment | Sub-Segments |

|---|---|

| By Type | Milk Chocolate Dark Chocolate White Chocolate Organic Chocolate Sugar-Free Chocolate Vegan/Plant-Based Chocolate Artisanal & Craft Chocolate Others |

| By End-User | Retail Consumers Food Service Industry Confectionery Manufacturers Gift & Specialty Retailers |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail/E-commerce Specialty Stores/Chocolate Boutiques Convenience Stores Duty-Free & Travel Retail |

| By Price Range | Premium Mid-Range Economy |

| By Packaging Type | Boxes Bags Bars/Tablets Bulk Packaging Gift Packaging |

| By Occasion | Festivals & Holidays Birthdays Weddings Corporate Gifting Everyday Consumption |

| By Region | Western Europe (Germany, France, UK, Benelux, etc.) Northern Europe (Nordics, Baltics, etc.) Southern Europe (Italy, Spain, Portugal, Greece, etc.) Eastern Europe (Poland, Czech Republic, Hungary, etc.) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Chocolate | 120 | Chocolate Consumers, Brand Loyalists |

| Retail Distribution Insights | 90 | Retail Managers, Category Buyers |

| Trends in Premium Chocolate Consumption | 60 | Gourmet Chocolate Consumers, Food Critics |

| Impact of Health Trends on Chocolate Sales | 50 | Nutritional Experts, Health-Conscious Consumers |

| Online Chocolate Purchasing Behavior | 70 | E-commerce Managers, Online Shoppers |

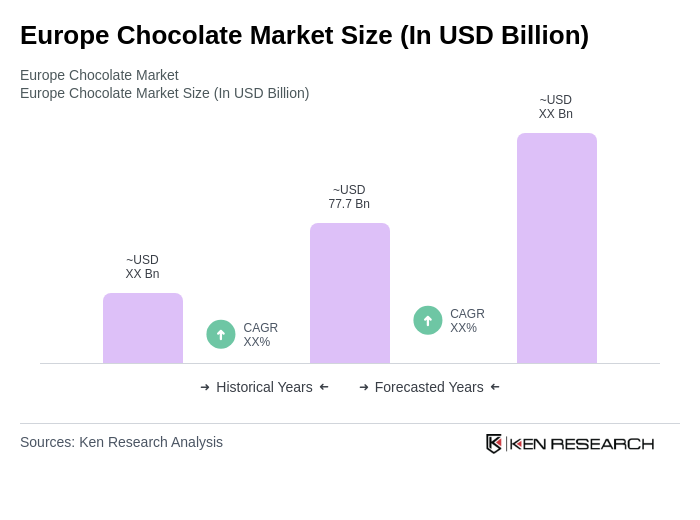

The Europe Chocolate Market is valued at approximately USD 77.7 billion, reflecting a significant growth trend driven by consumer demand for premium, dark, and organic chocolates, as well as health-conscious options like sugar-free varieties.