Region:Central and South America

Author(s):Dev

Product Code:KRAA3511

Pages:94

Published On:September 2025

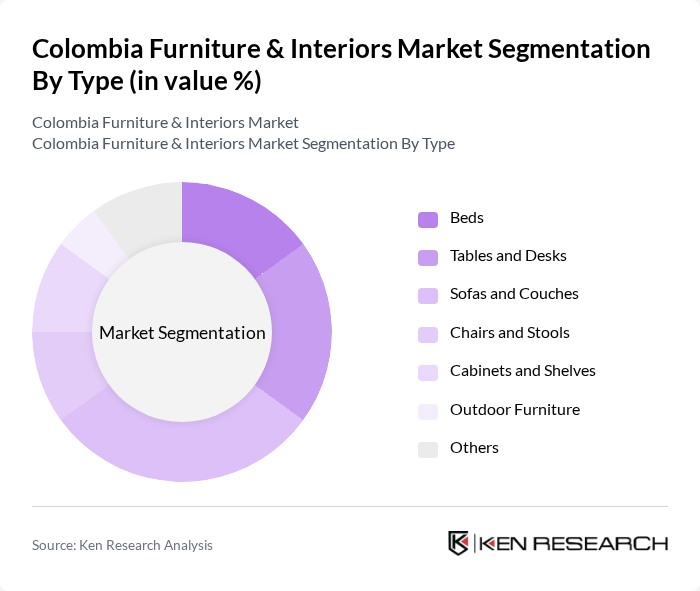

By Type:The furniture market is segmented into various types, including beds, tables and desks, sofas and couches, chairs and stools, cabinets and shelves, outdoor furniture, and others. Among these, sofas and couches are currently dominating the market due to their versatility and comfort, appealing to both residential and commercial consumers. The trend towards open-plan living spaces and multifunctional furniture has further increased the demand for stylish and functional seating options .

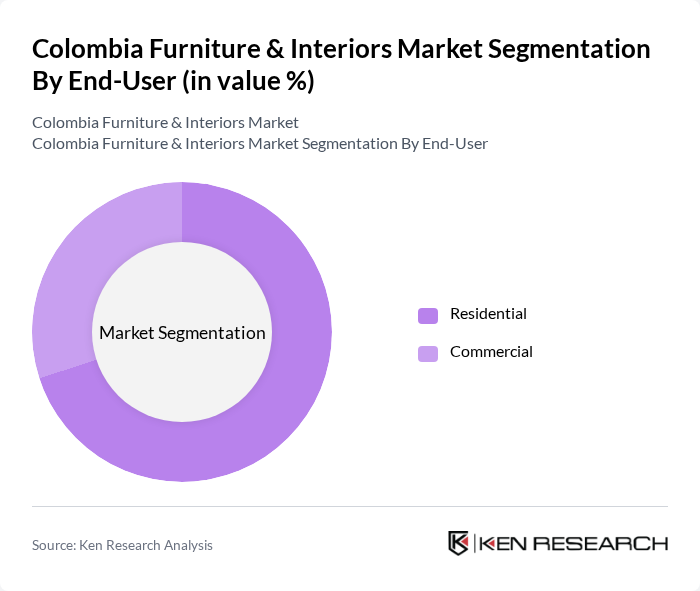

By End-User:The market is divided into residential and commercial segments. The residential segment is currently leading the market, driven by increasing home ownership, renovation activities, and a rising preference for personalized and sustainable home environments. Consumers are investing in quality furniture to enhance their living spaces. The commercial segment, while smaller, is also experiencing growth due to the expansion of businesses, hospitality, and the need for modern office furniture .

The Colombia Furniture & Interiors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Grupo Éxito, Homecenter (Sodimac Colombia), Falabella Colombia, IKEA Colombia, Muebles Jamar, MadeMuebles, Macizo, Fábrica de Muebles MV, Colchones Rosen S.A.I.C., Wood Products Manufacturing Industry IMA S.A., Grupo Plus Colombia, Mobiliario Del Portilo SAS, Loto Muebles, Muebles y Accesorios, Muebles & Decoración contribute to innovation, geographic expansion, and service delivery in this space .

The Colombia furniture and interiors market is poised for transformation as consumer preferences shift towards sustainable and innovative solutions. With urbanization and rising incomes driving demand, the market is likely to see a surge in eco-friendly furniture options and smart home integrations. Additionally, the expansion of e-commerce platforms will facilitate greater access to diverse product offerings, enhancing consumer choice. As manufacturers adapt to these trends, the market will evolve, presenting new opportunities for growth and innovation in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Beds Tables and Desks Sofas and Couches Chairs and Stools Cabinets and Shelves Outdoor Furniture Others |

| By End-User | Residential Commercial |

| By Sales Channel | Home Centres Flagship Stores Speciality Stores Online Others |

| By Material | Wood Metal Plastic Glass Others |

| By Price Range | Budget Mid-range Premium |

| By Room/Design Style | Living Room Bedroom Kitchen and Dining Room Bathroom Outdoor Home Office Modern Traditional Contemporary Rustic |

| By Functionality | Multi-functional Space-saving Ergonomic Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Furniture Purchases | 100 | Homeowners, Interior Designers |

| Commercial Furniture Solutions | 80 | Office Managers, Facility Coordinators |

| Custom Furniture Orders | 60 | Architects, Custom Furniture Designers |

| Online Furniture Shopping Trends | 90 | eCommerce Managers, Digital Marketing Specialists |

| Sustainability in Furniture Production | 50 | Sustainability Officers, Product Development Managers |

The Colombia Furniture & Interiors Market is valued at approximately USD 4.4 billion, driven by factors such as urbanization, rising disposable incomes, and a growing trend towards home improvement and interior design.