Region:Central and South America

Author(s):Rebecca

Product Code:KRAA3354

Pages:90

Published On:September 2025

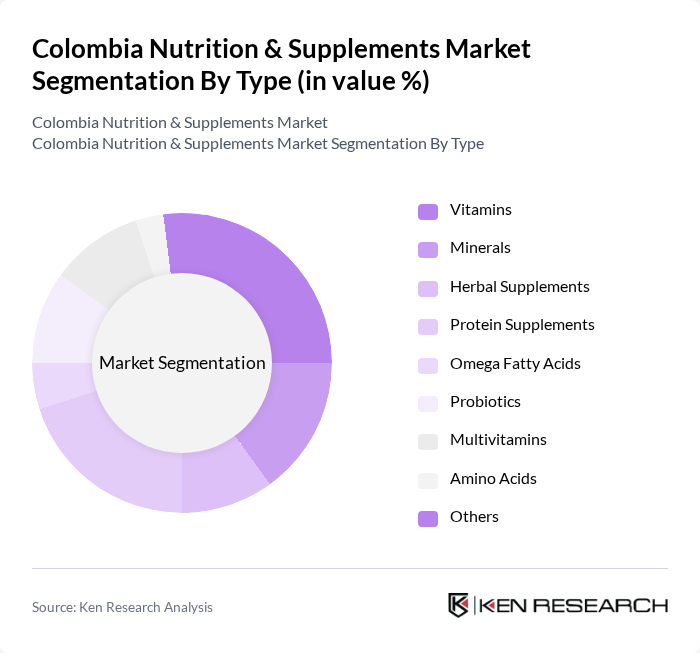

By Type:The market is segmented into various types of nutritional products, including vitamins, minerals, herbal supplements, protein supplements, omega fatty acids, probiotics, multivitamins, amino acids, and others. Among these,vitamins and mineralsare particularly popular due to their perceived health benefits and widespread consumer acceptance. The increasing focus on fitness and wellness has led to a surge in demand for protein supplements, especially among athletes and fitness enthusiasts. There is also growing interest in probiotics and herbal supplements, reflecting a broader consumer shift toward natural and functional ingredients .

By Form:The nutritional products are available in various forms, including tablets, capsules, powders, liquids, gummies, effervescent tablets, and others.Tabletsare the most preferred form due to their cost-effectiveness, extended shelf life, and convenience. Capsules are also widely used, offering rapid absorption and appeal to health-conscious consumers. Powders are gaining popularity among fitness enthusiasts for their flexibility and fast nutrient delivery. Liquids, gummies, and effervescent tablets are increasingly favored for their ease of consumption and suitability for children and the elderly. The growing trend of on-the-go nutrition has also led to an increase in the popularity of gummies and powders, especially among younger consumers .

The Colombia Nutrition & Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Grupo Nutresa S.A., Herbalife Nutrition Ltd., GNC Holdings, Inc., Amway Corporation, Nestlé S.A., Abbott Laboratories, Glanbia plc, Danone S.A., Bayer AG, Unilever PLC, DSM Nutritional Products, Nature's Way Products, LLC, Solgar Inc., USANA Health Sciences, Inc., NutraBio Labs, Inc., Laboratorios MK S.A., Laboratorios Lafrancol S.A.S., Procaps Group S.A., Medifarma S.A., Farmatodo S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Colombia nutrition and supplements market appears promising, driven by increasing health awareness and a shift towards natural products. As e-commerce continues to expand, brands will likely invest in digital marketing strategies to capture the growing online consumer base. Additionally, the trend towards personalized nutrition is expected to gain traction, with companies focusing on tailored solutions to meet individual health needs, enhancing customer engagement and loyalty in the process.

| Segment | Sub-Segments |

|---|---|

| By Type | Vitamins Minerals Herbal Supplements Protein Supplements Omega Fatty Acids Probiotics Multivitamins Amino Acids Others |

| By Form | Tablets Capsules Powders Liquids Gummies Effervescent Tablets Others |

| By Application | Weight Management Sports Nutrition General Health Immune Support Digestive Health Skin Health Bone & Joint Health Others |

| By Distribution Channel | Pharmacies/Health Stores Online Retail Supermarkets/Hypermarkets Direct Sales Others |

| By Consumer Demographics | Age Group (Children, Adults, Seniors) Gender (Male, Female) Income Level (Low, Middle, High) |

| By Packaging Type | Bottles Sachets Blister Packs Bulk Packaging |

| By Price Range | Budget Mid-Range Premium |

| By Region | Bogotá Andean Region Caribbean Region Pacific Region Amazon Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Nutrition Products | 100 | Store Managers, Category Buyers |

| Online Supplement Sales | 60 | E-commerce Managers, Digital Marketing Specialists |

| Health and Wellness Professionals | 50 | Nutritionists, Fitness Trainers |

| Consumer Behavior Insights | 80 | Health-Conscious Consumers, Supplement Users |

| Market Trends and Innovations | 40 | Product Development Managers, R&D Specialists |

The Colombia Nutrition & Supplements Market is valued at approximately USD 350 million, reflecting a significant growth trend driven by increasing health consciousness, rising disposable incomes, and a shift towards preventive healthcare among consumers.