Region:Africa

Author(s):Shubham

Product Code:KRAB1081

Pages:92

Published On:October 2025

By Type:The market is segmented into various types, including Functional Foods, Functional Beverages, Dietary Supplements, Vitamins and Minerals, Botanicals/Herbal Supplements, Protein & Amino Acids, Omega Fatty Acids, Probiotics, Enzymes, and Other Supplements. Among these, Dietary Supplements are currently dominating the market due to the increasing consumer focus on health and wellness, particularly in the wake of heightened awareness following the COVID-19 pandemic. The demand for vitamins, minerals, and herbal supplements has surged as consumers seek to boost their immune systems and overall health. There is also a growing preference for personalized nutrition, with vitamins and probiotics emerging as significant growth segments .

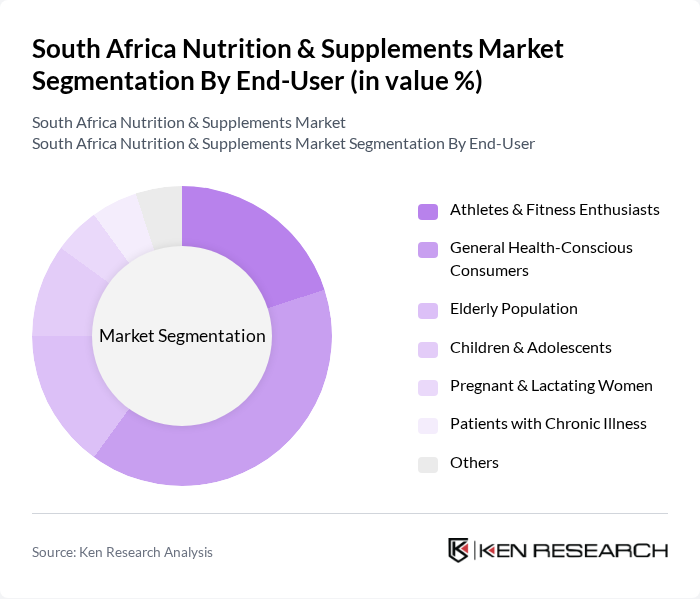

By End-User:The end-user segmentation includes Athletes & Fitness Enthusiasts, General Health-Conscious Consumers, Elderly Population, Children & Adolescents, Pregnant & Lactating Women, Patients with Chronic Illness, and Others. The General Health-Conscious Consumers segment is leading the market, driven by a growing awareness of health and wellness among the general population. This segment is characterized by a diverse demographic that includes individuals seeking to improve their overall health, manage weight, and enhance physical performance. The elderly population is also a significant segment due to the increasing focus on supplements for age-related health conditions .

The South Africa Nutrition & Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Herbalife Nutrition Ltd., Amway South Africa (Pty) Ltd., USN (Ultimate Sports Nutrition), Vital Health Foods (Pty) Ltd., NutriBullet South Africa, Nature's Way, Solgar Vitamin and Herb, GNC (General Nutrition Corporation), Biogen (Pty) Ltd., Clicks Group Limited, Dis-Chem Pharmacies Limited, Pharma Dynamics, The Real Thing, Health Connection Wholefoods, Ascendis Health Limited contribute to innovation, geographic expansion, and service delivery in this space.

The South African nutrition and supplements market is poised for significant evolution, driven by increasing consumer demand for health-oriented products and innovative solutions. As the trend towards personalized nutrition gains momentum, companies are likely to invest in tailored supplement offerings. Additionally, the rise of digital health platforms will facilitate better consumer engagement and education, enhancing market penetration. Sustainability will also play a crucial role, with brands focusing on eco-friendly practices to attract environmentally conscious consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | Functional Foods Functional Beverages Dietary Supplements Vitamins and Minerals Botanicals/Herbal Supplements Protein & Amino Acids Omega Fatty Acids Probiotics Enzymes Other Supplements |

| By End-User | Athletes & Fitness Enthusiasts General Health-Conscious Consumers Elderly Population Children & Adolescents Pregnant & Lactating Women Patients with Chronic Illness Others |

| By Distribution Channel | Supermarkets/Hypermarkets Pharmacies/Drug Stores Health Food Stores Online Retail Stores Convenience Stores Direct Sales Other Distribution Channels |

| By Price Range | Budget Mid-Range Premium |

| By Formulation | Tablets Capsules Powders Liquids Gummies Other Forms |

| By Brand Loyalty | Brand Loyal Consumers Price-Sensitive Consumers New Entrants |

| By Health Benefit | Weight Management Immune Support Digestive Health Energy & Performance Bone & Joint Health Heart Health Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Nutrition Supplements | 100 | Store Managers, Sales Representatives |

| Consumer Health Trends | 120 | Health-Conscious Consumers, Fitness Enthusiasts |

| Dietary Supplement Usage | 80 | Nutritionists, Dietitians |

| Market Distribution Channels | 60 | Wholesalers, Distributors |

| Regulatory Impact Assessment | 40 | Health Policy Experts, Regulatory Affairs Managers |

The South Africa Nutrition & Supplements Market is valued at approximately USD 1.1 billion, reflecting a significant growth trend driven by increasing health awareness and a rise in lifestyle-related diseases among the population.