Region:Asia

Author(s):Geetanshi

Product Code:KRAA6561

Pages:99

Published On:September 2025

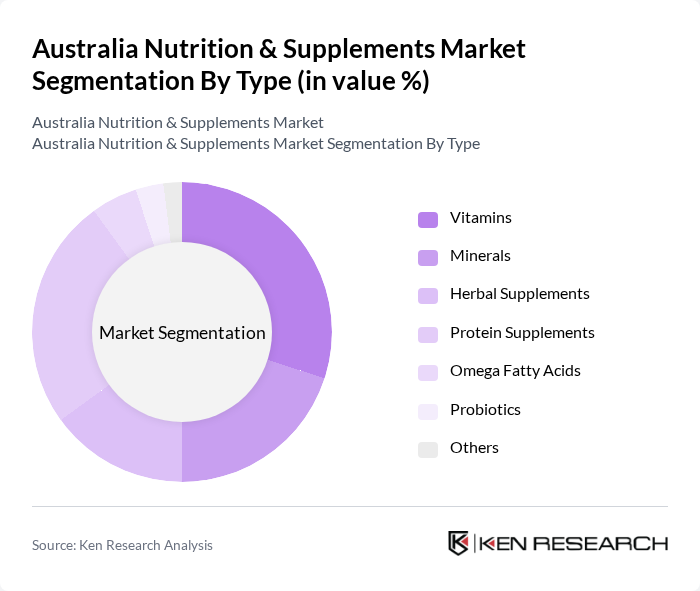

By Type:The market is segmented into various types of nutritional products, including vitamins, minerals, herbal supplements, protein supplements, omega fatty acids, probiotics, and others. Among these, vitamins and protein supplements are particularly popular due to their essential roles in health maintenance and fitness. The increasing awareness of nutritional deficiencies and the benefits of protein for muscle recovery have led to a surge in demand for these products.

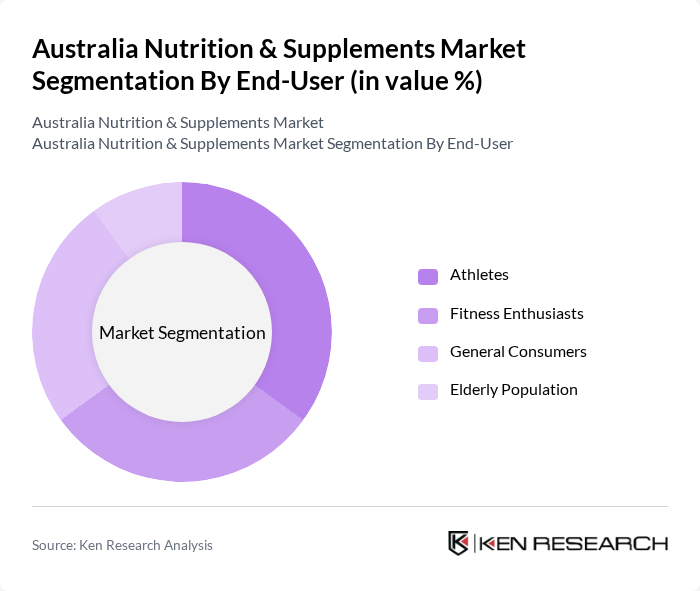

By End-User:The end-user segmentation includes athletes, fitness enthusiasts, general consumers, and the elderly population. Athletes and fitness enthusiasts are the leading consumers of nutritional supplements, driven by their need for enhanced performance and recovery. The growing trend of fitness and wellness among the general population has also contributed to increased consumption across all age groups.

The Australia Nutrition & Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Blackmores Limited, Swisse Wellness Pty Ltd, Herbalife Nutrition Ltd, GNC Holdings, Inc., Nature's Way, Nutraceutical Corporation, The Good Health Company, BioCeuticals, Australian NaturalCare, MusclePharm Corporation, Metagenics, Vital Greens, Optimum Nutrition, Bega Cheese Limited, Blackmores Institute contribute to innovation, geographic expansion, and service delivery in this space.

The Australia Nutrition & Supplements Market is poised for significant evolution, driven by the increasing demand for personalized nutrition solutions and the integration of technology in health monitoring. As consumers seek tailored products that meet their specific health needs, companies are likely to invest in innovative formulations and digital health platforms. Additionally, the trend towards natural and organic ingredients will continue to shape product development, aligning with consumer preferences for clean-label options and sustainability in the nutrition sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Vitamins Minerals Herbal Supplements Protein Supplements Omega Fatty Acids Probiotics Others |

| By End-User | Athletes Fitness Enthusiasts General Consumers Elderly Population |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Health Food Stores Pharmacies |

| By Product Form | Tablets Capsules Powders Liquids |

| By Age Group | Children Adults Seniors |

| By Price Range | Budget Mid-Range Premium |

| By Brand Loyalty | Brand Loyal Consumers Price-Sensitive Consumers New Entrants |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Supplement Sales | 150 | Store Managers, Product Buyers |

| Consumer Health Trends | 200 | Health-Conscious Consumers, Fitness Enthusiasts |

| Dietary Supplement Usage | 120 | Nutritionists, Dietitians |

| Market Distribution Channels | 100 | Distributors, Wholesalers |

| Regulatory Impact Assessment | 80 | Regulatory Affairs Specialists, Compliance Officers |

The Australia Nutrition & Supplements Market is valued at approximately USD 4.5 billion, reflecting a significant growth trend driven by increasing health consciousness, fitness trends, and the prevalence of lifestyle-related diseases among consumers.