Region:Asia

Author(s):Rebecca

Product Code:KRAB1703

Pages:91

Published On:October 2025

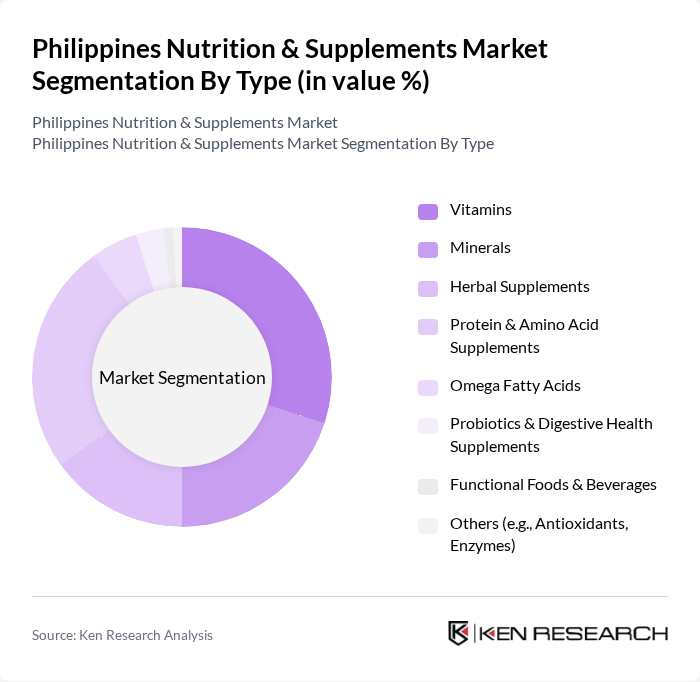

By Type:The market is segmented into various types of nutritional products, including Vitamins, Minerals, Herbal Supplements, Protein & Amino Acid Supplements, Omega Fatty Acids, Probiotics & Digestive Health Supplements, Functional Foods & Beverages, and Others (e.g., Antioxidants, Enzymes). Among these, Vitamins and Protein & Amino Acid Supplements remain particularly popular due to their perceived health benefits, effectiveness in supporting immunity, and alignment with fitness and wellness trends. The surge in fitness culture, preventive health practices, and demand for natural and specialty supplements continues to drive growth in these segments .

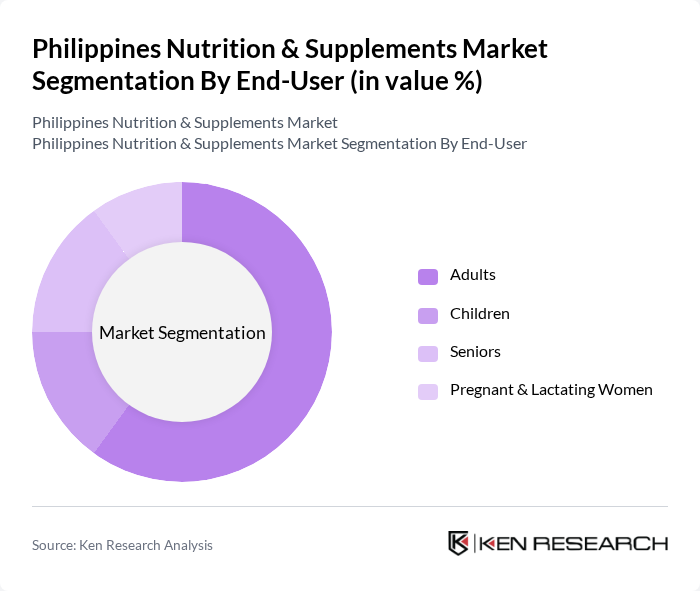

By End-User:The end-user segmentation includes Adults, Children, Seniors, and Pregnant & Lactating Women. Adults represent the largest segment, driven by a growing focus on health, fitness, and preventive care, as well as the increasing prevalence of lifestyle-related diseases. The demand for nutritional supplements among adults is further fueled by the rise of fitness trends, urban lifestyles, and the desire for proactive health management .

The Philippines Nutrition & Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as United Laboratories, Inc. (Unilab), Pascual Laboratories, Inc., GNC Holdings, Inc., Abbott Laboratories, Amway Corporation, Nestlé S.A., Unilever PLC, Glanbia PLC, Nature's Way, Blackmores Limited, USANA Health Sciences, Inc., Bayer AG, DSM Nutritional Products, Swisse Wellness Pty Ltd., Mega We Care, Nature’s Spring, ATC Healthcare International Corp., and Santé International, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines nutrition and supplements market is poised for significant growth, driven by increasing health awareness and rising disposable incomes. As consumers prioritize wellness, the demand for personalized nutrition solutions is expected to rise. Additionally, the integration of digital health technologies will enhance consumer engagement and product accessibility. Companies that adapt to these trends and invest in innovative product offerings will likely capture a larger market share, positioning themselves favorably in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Vitamins Minerals Herbal Supplements Protein & Amino Acid Supplements Omega Fatty Acids Probiotics & Digestive Health Supplements Functional Foods & Beverages Others (e.g., Antioxidants, Enzymes) |

| By End-User | Adults Children Seniors Pregnant & Lactating Women |

| By Distribution Channel | Online Retail (e.g., Lazada, Shopee) Supermarkets/Hypermarkets Pharmacies (e.g., Mercury Drug, Watsons) Health & Specialty Stores Direct Selling |

| By Price Range | Budget Mid-Range Premium |

| By Formulation | Tablets Capsules Powders Liquids Gummies & Chewables |

| By Packaging Type | Bottles Blister Packs Pouches Sachets |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers Occasional Buyers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Attitudes towards Supplements | 150 | Health-conscious Consumers, Fitness Enthusiasts |

| Retailer Insights on Nutrition Products | 100 | Store Managers, Product Buyers |

| Healthcare Professionals' Perspectives | 80 | Nutritionists, General Practitioners |

| Market Trends in Dietary Supplements | 120 | Industry Analysts, Market Researchers |

| Consumer Purchase Behavior Analysis | 140 | Online Shoppers, Supermarket Customers |

The Philippines Nutrition & Supplements Market is valued at approximately USD 4.6 billion, driven by increasing health consciousness, higher disposable incomes, and a shift towards preventive healthcare. This growth reflects a robust demand for nutritional products across various categories.