Region:Africa

Author(s):Dev

Product Code:KRAA5883

Pages:84

Published On:September 2025

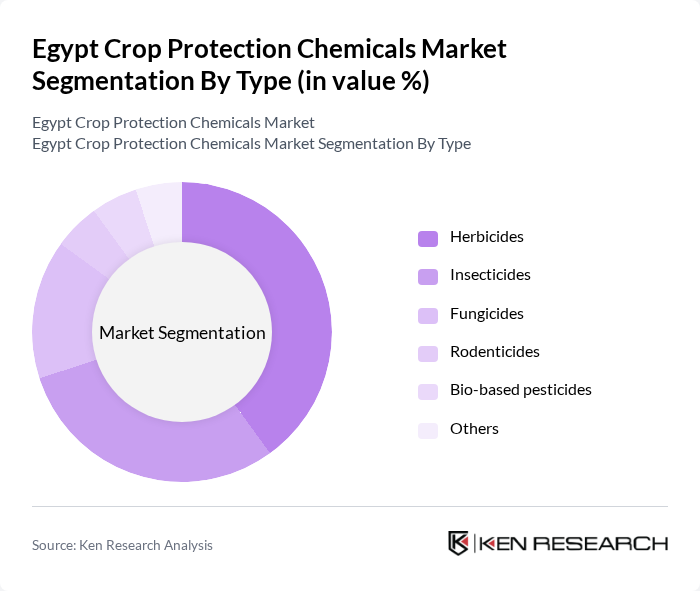

By Type:The market is segmented into various types of crop protection chemicals, including herbicides, insecticides, fungicides, rodenticides, bio-based pesticides, and others. Among these, herbicides and insecticides are the most widely used due to their effectiveness in controlling weeds and pests, which are significant threats to crop yields. The increasing adoption of herbicides is driven by the need for efficient weed management in large-scale farming operations, while insecticides are essential for protecting crops from damaging pests.

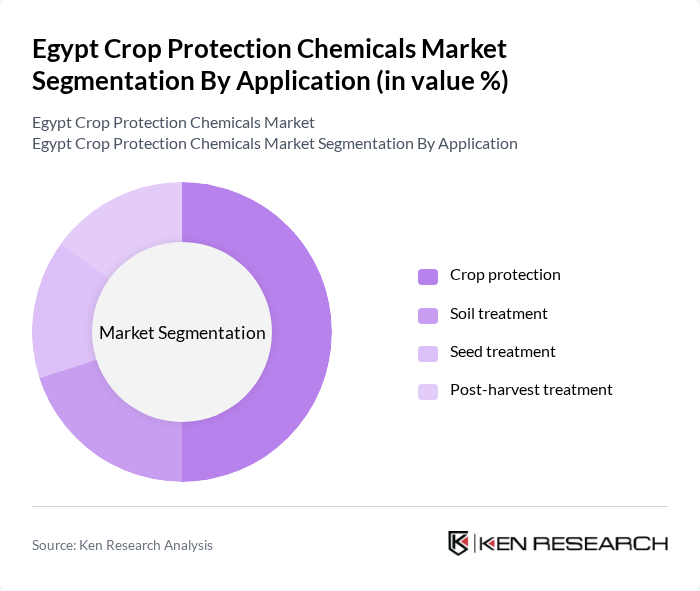

By Application:The applications of crop protection chemicals include crop protection, soil treatment, seed treatment, and post-harvest treatment. Crop protection is the leading application segment, driven by the necessity to safeguard crops from pests and diseases. Soil treatment is gaining traction as farmers recognize the importance of maintaining soil health for sustainable agriculture. Seed treatment is also becoming increasingly popular as it enhances seedling vigor and protects against soil-borne diseases.

The Egypt Crop Protection Chemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Syngenta AG, Bayer CropScience AG, BASF SE, Corteva Agriscience, FMC Corporation, ADAMA Agricultural Solutions Ltd., Nufarm Limited, UPL Limited, Arysta LifeScience Corporation, Sumitomo Chemical Co., Ltd., Cheminova A/S, Rallis India Limited, KWS SAAT SE, Isagro S.p.A., Bioworks Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Egypt crop protection chemicals market appears promising, driven by technological advancements and a growing emphasis on sustainable practices. As farmers increasingly adopt integrated pest management strategies, the demand for innovative solutions will rise. Additionally, the expansion of organic farming is expected to create new market segments. With government support and investment in agricultural research and development, the market is poised for transformation, aligning with global trends towards sustainability and efficiency in agriculture.

| Segment | Sub-Segments |

|---|---|

| By Type | Herbicides Insecticides Fungicides Rodenticides Bio-based pesticides Others |

| By Application | Crop protection Soil treatment Seed treatment Post-harvest treatment |

| By End-User | Agriculture Horticulture Forestry Others |

| By Distribution Channel | Direct sales Distributors Online sales Retail outlets |

| By Formulation | Liquid Granular Powder Others |

| By Packaging Type | Bulk packaging Retail packaging Others |

| By Price Range | Low Medium High |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cereal Crop Protection | 100 | Farmers, Agronomists |

| Vegetable Crop Protection | 80 | Crop Consultants, Retailers |

| Fruit Crop Protection | 70 | Farm Managers, Agricultural Scientists |

| Herbicide Usage Trends | 60 | Product Managers, Distribution Executives |

| Pesticide Regulatory Compliance | 90 | Regulatory Affairs Specialists, Compliance Officers |

The Egypt Crop Protection Chemicals Market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by increasing agricultural productivity, pest control needs, and modern farming techniques.