Region:Africa

Author(s):Dev

Product Code:KRAA0404

Pages:100

Published On:August 2025

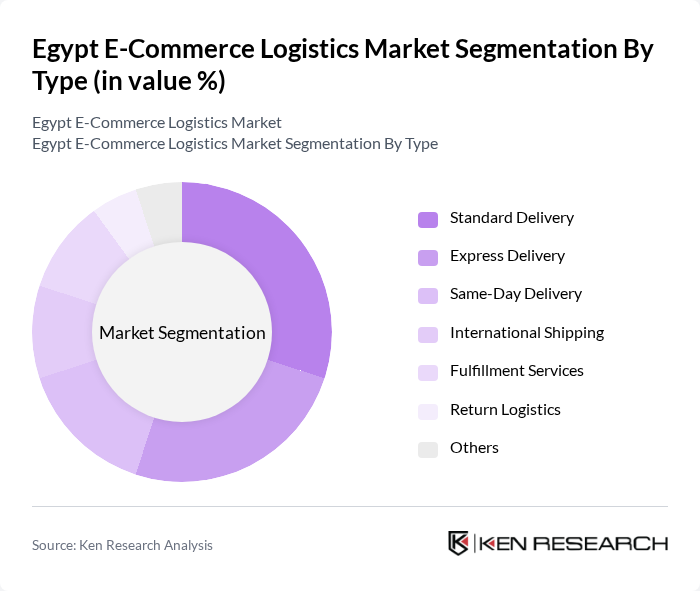

By Type:The market is segmented into various types of logistics services, including Standard Delivery, Express Delivery, Same-Day Delivery, International Shipping, Fulfillment Services, Return Logistics, and Others. Each of these segments caters to different consumer needs and preferences, with varying levels of urgency and service quality. Standard Delivery is preferred for non-urgent shipments due to its cost-effectiveness and reliability, while Express and Same-Day Delivery are gaining traction among urban consumers seeking faster fulfillment. International Shipping and Fulfillment Services are expanding as cross-border e-commerce and third-party logistics adoption increase. Return Logistics is also growing in importance as e-commerce volumes rise and customer expectations for hassle-free returns become standard .

The Standard Delivery segment is currently the leading sub-segment in the market, primarily due to its cost-effectiveness and reliability. Many consumers prefer this option for non-urgent deliveries, as it balances affordability with reasonable delivery times. The Express Delivery segment follows closely, driven by the increasing consumer demand for faster shipping options, particularly among urban dwellers who prioritize convenience. The growth of e-commerce platforms and the expansion of last-mile delivery networks have further fueled the need for efficient logistics solutions, making Standard Delivery the backbone of the logistics market .

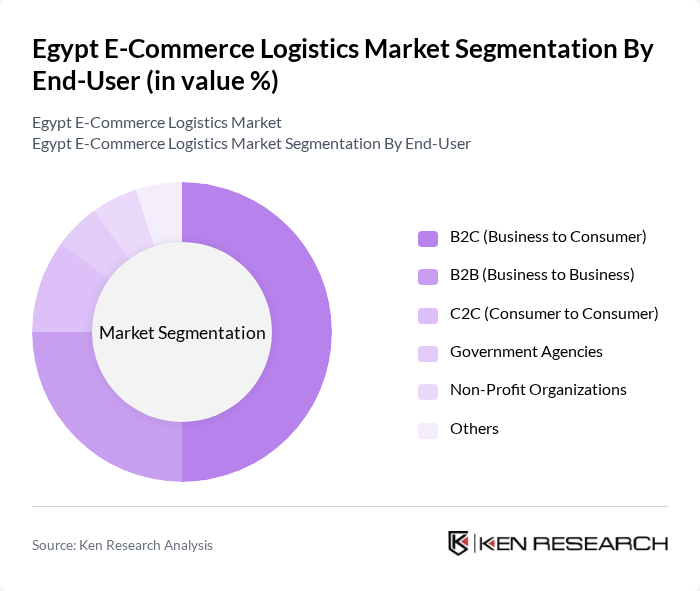

By End-User:The market is segmented into B2C (Business to Consumer), B2B (Business to Business), C2C (Consumer to Consumer), Government Agencies, Non-Profit Organizations, and Others. Each segment serves distinct logistical needs based on the nature of the transactions and the types of goods being delivered. The B2C segment is the largest, driven by the surge in online retail and consumer demand for home delivery. B2B logistics supports business supply chains, while C2C logistics is growing with the rise of peer-to-peer marketplaces. Government agencies and non-profits utilize logistics for specialized and mission-critical deliveries .

The B2C segment dominates the market, accounting for half of the total logistics services. This is largely due to the explosive growth of online shopping, where consumers increasingly prefer the convenience of home delivery. The B2B segment also plays a significant role, particularly in the supply chain for businesses that require bulk shipments. The rise of e-commerce platforms has made B2C logistics a critical area of focus for logistics providers, driving innovation and efficiency in service delivery .

The Egypt E-Commerce Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Jumia Egypt, Amazon Egypt (formerly Souq.com), Aramex, DHL Egypt, FedEx Egypt, Egypt Post, Naqel Express, Bosta, MRSOOL Egypt, MaxAB, Fetchr, Tahrir Logistics, Yalla Fel Sekka (YFS), Shipa Delivery, Sprint Logistics contribute to innovation, geographic expansion, and service delivery in this space .

The future of Egypt's e-commerce logistics market appears promising, driven by technological advancements and increasing consumer demand. The adoption of AI and automation in logistics operations is expected to enhance efficiency and reduce costs. Additionally, the government's focus on improving infrastructure and regulatory frameworks will likely create a more conducive environment for e-commerce growth. As consumer preferences evolve, logistics providers must adapt to meet the rising expectations for speed and reliability in delivery services.

| Segment | Sub-Segments |

|---|---|

| By Type | Standard Delivery Express Delivery Same-Day Delivery International Shipping Fulfillment Services Return Logistics Others |

| By End-User | B2C (Business to Consumer) – e.g., Fashion & Apparel, Consumer Electronics, Beauty & Personal Care, Food & Beverage, Furniture & Home, Others (Toys, DIY, Media) B2B (Business to Business) – e.g., Digital Procurement, Wholesale, Corporate Buyers C2C (Consumer to Consumer) Government Agencies Non-Profit Organizations Others |

| By Delivery Method | Road Transport Air Transport Rail Transport Sea Transport Drone Delivery Others |

| By Packaging Type | Standard Packaging Eco-Friendly Packaging Custom Packaging Bulk Packaging Others |

| By Payment Method | Cash on Delivery Credit/Debit Cards Mobile Wallets Bank Transfers Others |

| By Geographic Coverage | Urban Areas Rural Areas Suburban Areas Others |

| By Customer Segment | Individual Consumers Small Businesses Large Enterprises E-commerce Platforms (e.g., Jumia, Amazon, Noon, Btech, LC Waikiki) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| E-commerce Logistics Providers | 60 | Logistics Managers, Operations Directors |

| Consumer Electronics Delivery Services | 50 | Supply Chain Managers, Customer Experience Leaders |

| Fashion and Apparel E-commerce Logistics | 40 | Warehouse Supervisors, Fulfillment Managers |

| Food and Grocery Delivery Logistics | 40 | Operations Coordinators, Delivery Managers |

| Cross-border E-commerce Logistics | 40 | International Trade Managers, Compliance Officers |

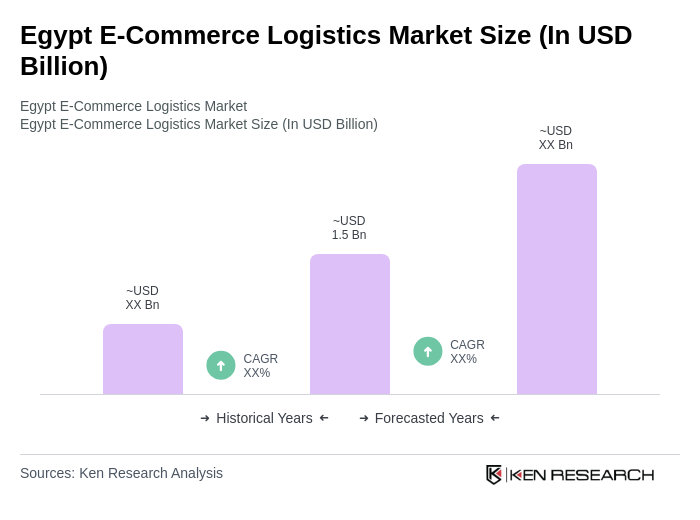

The Egypt E-Commerce Logistics Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by increased online shopping, a young population, and enhanced logistics solutions to meet consumer demands.