Region:North America

Author(s):Geetanshi

Product Code:KRAA0177

Pages:97

Published On:August 2025

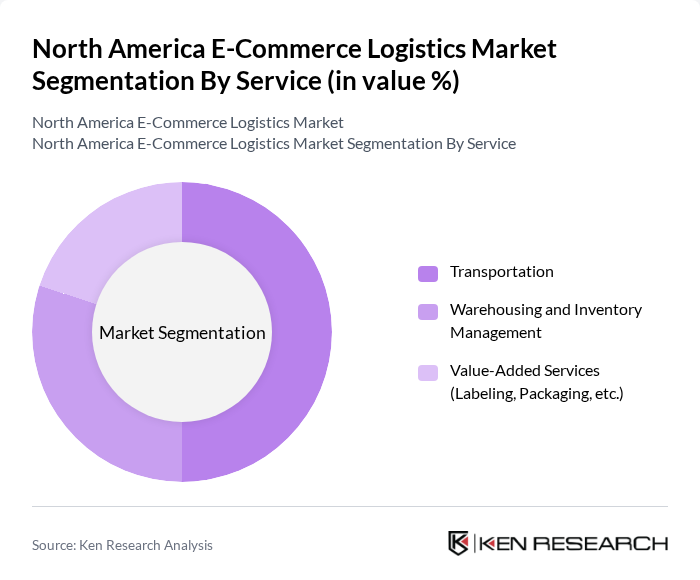

By Service:This segmentation includes various services that facilitate e-commerce logistics, such as transportation, warehousing, and value-added services. Each sub-segment plays a crucial role in ensuring the smooth operation of e-commerce logistics, with transportation being the backbone of the supply chain, warehousing providing storage solutions, and value-added services enhancing customer experience. The adoption of micro-warehousing, dark stores, and real-time tracking is further optimizing these service segments .

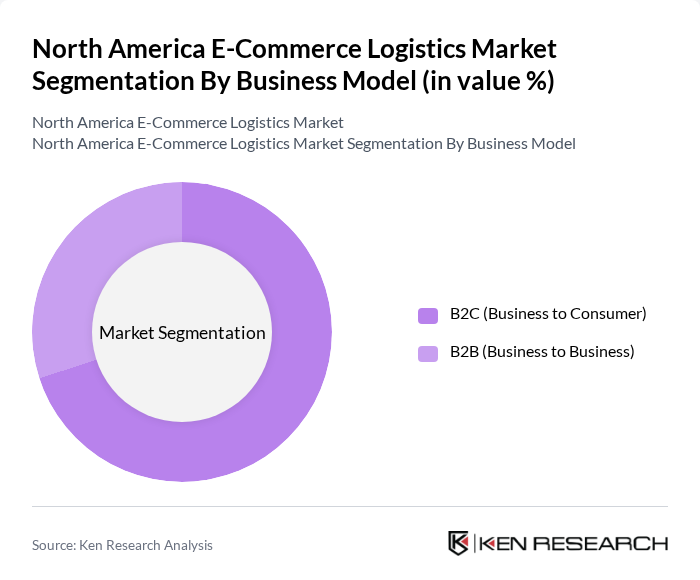

By Business Model:This segmentation focuses on the different business models utilized in e-commerce logistics, primarily B2C and B2B. The B2C model is characterized by direct sales to consumers, while the B2B model involves transactions between businesses. The growth of online shopping and omnichannel retail has significantly influenced the B2C segment, making it a dominant force in the logistics market .

The North America E-Commerce Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amazon Logistics, FedEx Corporation, UPS (United Parcel Service), DHL Supply Chain, XPO Logistics, ShipBob, Rakuten Super Logistics, GXO Logistics, Maersk (North America Logistics Division), Pitney Bowes, Walmart Fulfillment Services, Shopify Fulfillment Network, Radial, Geodis (North America), and Flexport contribute to innovation, geographic expansion, and service delivery in this space .

The North American e-commerce logistics market is poised for significant evolution, driven by technological advancements and changing consumer preferences. As companies increasingly adopt AI and automation, operational efficiencies will improve, enabling faster delivery times. Additionally, the focus on sustainability will shape logistics strategies, with more firms investing in eco-friendly practices. The integration of omnichannel retailing will further enhance customer experiences, ensuring that logistics operations align with the dynamic demands of the market.

| Segment | Sub-Segments |

|---|---|

| By Service | Transportation Warehousing and Inventory Management Value-Added Services (Labeling, Packaging, etc.) |

| By Business Model | B2C (Business to Consumer) B2B (Business to Business) |

| By Destination | Domestic International/Cross-Border |

| By Product Category | Fashion and Apparel Consumer Electronics Home Appliances Furniture Beauty and Personal Care Products Other Products (Toys, Food Products, etc.) |

| By Delivery Method | Standard Delivery Express Delivery Same-Day Delivery Scheduled Delivery |

| By Technology Used | Automated Sorting Systems Inventory Management Software Tracking and Visibility Solutions Others |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas |

| By Customer Segment | Small and Medium Enterprises (SMEs) Large Enterprises Startups |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Last-Mile Delivery Solutions | 100 | Logistics Coordinators, Delivery Operations Managers |

| Returns Management Strategies | 60 | Customer Experience Managers, Returns Analysts |

| Warehouse Automation Technologies | 50 | Warehouse Operations Managers, IT Directors |

| Cross-Border E-Commerce Logistics | 40 | International Trade Managers, Compliance Officers |

| Third-Party Logistics Partnerships | 45 | Supply Chain Executives, Procurement Managers |

The North America E-Commerce Logistics Market is valued at approximately USD 200 billion, driven by the rapid growth of online retail, consumer demand for fast delivery, and advancements in logistics technology.