Region:Middle East

Author(s):Geetanshi

Product Code:KRAA0305

Pages:88

Published On:August 2025

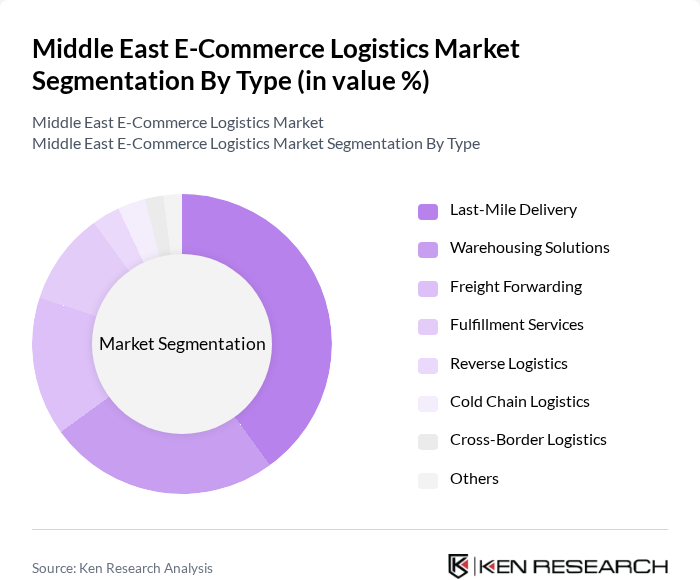

By Type:The logistics market is segmented into various types, including Last-Mile Delivery, Warehousing Solutions, Freight Forwarding, Fulfillment Services, Reverse Logistics, Cold Chain Logistics, Cross-Border Logistics, and Others. Among these, Last-Mile Delivery is the most significant segment, driven by the increasing demand for quick and efficient delivery services. The rise of e-commerce has led to a surge in consumer expectations for fast delivery, making Last-Mile Delivery a critical component of logistics operations. Investments in regional warehouses and fulfillment centers are also reshaping warehousing and fulfillment services to support rapid order processing and same-day delivery .

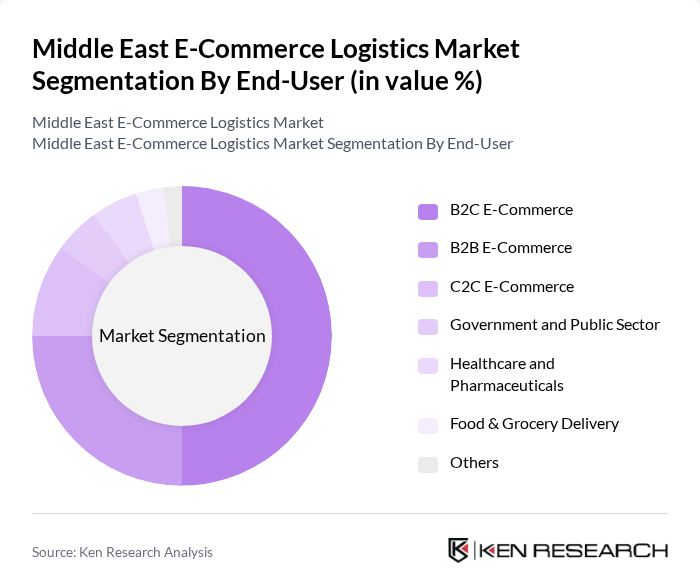

By End-User:The market is segmented by end-users, including B2C E-Commerce, B2B E-Commerce, C2C E-Commerce, Government and Public Sector, Healthcare and Pharmaceuticals, Food & Grocery Delivery, and Others. The B2C E-Commerce segment is the leading category, fueled by the growing trend of online shopping among consumers. The convenience of purchasing goods online, the increasing number of digital payment options, and the expansion of cross-border e-commerce have significantly contributed to the growth of this segment. B2B and C2C segments are also expanding, driven by digital transformation in business procurement and peer-to-peer trade .

The Middle East E-Commerce Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aramex, DHL Express Middle East, FedEx Express Middle East, UPS Middle East, Zajil Express, Naqel Express, Fetchr, Talabat Logistics, Noon Logistics, Amazon Middle East (formerly Souq.com), Emirates Post, Q-Express (Qatar Airways Cargo), MENA Logistics, Al-Futtaim Logistics, Agility Logistics, SMSA Express, Barq Express, Jeebly, iMile, Shipa Delivery contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East e-commerce logistics market appears promising, driven by technological advancements and evolving consumer preferences. As logistics providers increasingly adopt automation and AI technologies, operational efficiencies are expected to improve significantly. Additionally, the rise of omnichannel retailing will necessitate more integrated logistics solutions, enhancing customer experiences. With a focus on sustainability, companies are likely to invest in eco-friendly logistics practices, further shaping the market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Last-Mile Delivery Warehousing Solutions Freight Forwarding Fulfillment Services Reverse Logistics Cold Chain Logistics Cross-Border Logistics Others |

| By End-User | B2C E-Commerce B2B E-Commerce C2C E-Commerce Government and Public Sector Healthcare and Pharmaceuticals Food & Grocery Delivery Others |

| By Delivery Model | Standard Delivery Express Delivery Scheduled Delivery Same-Day Delivery Click-and-Collect Others |

| By Payment Method | Cash on Delivery Online Payment Mobile Wallets Bank Transfers Buy Now, Pay Later (BNPL) Others |

| By Region | GCC Countries Levant Region North Africa Others |

| By Technology Used | GPS Tracking Warehouse Management Systems Automated Sorting Systems Drones and Robotics Route Optimization Software Others |

| By Service Type | Third-Party Logistics (3PL) Fourth-Party Logistics (4PL) In-House Logistics Crowdsourced Delivery Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| E-commerce Fulfillment Strategies | 100 | Logistics Coordinators, E-commerce Operations Managers |

| Last-Mile Delivery Solutions | 80 | Delivery Service Managers, Urban Logistics Planners |

| Returns Management Practices | 60 | Customer Experience Managers, Returns Analysts |

| Warehouse Automation Trends | 50 | Warehouse Managers, Technology Integration Specialists |

| Cross-Border E-commerce Logistics | 60 | International Trade Managers, Compliance Officers |

The Middle East E-Commerce Logistics Market is valued at approximately USD 12 billion, driven by the rapid growth of online shopping, increased internet and smartphone penetration, and the demand for efficient delivery services.