Region:Central and South America

Author(s):Dev

Product Code:KRAA0417

Pages:98

Published On:August 2025

By Type:The market is segmented into various types, including Standard Delivery, Express Delivery, Same-Day Delivery, International Shipping, Fulfillment Services, Reverse Logistics (Returns Management), Cross-Border Logistics, and Others. Among these, Express Delivery is currently the leading sub-segment, driven by consumer demand for faster shipping options. The rise of e-commerce has led to an increased expectation for quick delivery times, pushing logistics providers to enhance their express services and invest in last-mile delivery innovations .

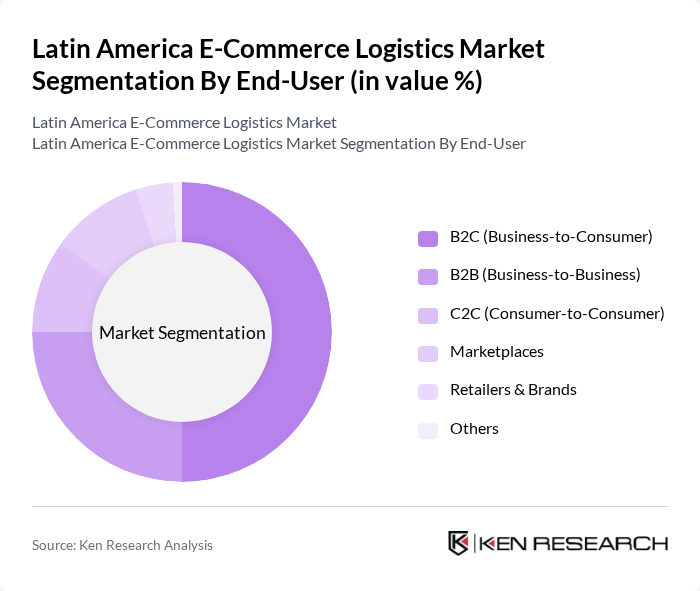

By End-User:The end-user segmentation includes B2C (Business-to-Consumer), B2B (Business-to-Business), C2C (Consumer-to-Consumer), Marketplaces, Retailers & Brands, and Others. The B2C segment is the most significant contributor to the market, as the increasing number of online shoppers drives demand for logistics services tailored to individual consumers. The convenience of online shopping, coupled with the expansion of digital payment options and improved delivery reliability, has led to a surge in B2C transactions, making it a focal point for logistics providers .

The Latin America E-Commerce Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mercado Libre (Mercado Envios), DHL Express/DHL Supply Chain, FedEx Corporation, UPS, Correios (Brazil), Grupo Logístico Andreani, DB Schenker, Kuehne + Nagel, Rappi, Amazon Logistics, Estafeta, Blue Express, Loggi, Olist, Geopost (DPDgroup) contribute to innovation, geographic expansion, and service delivery in this space.

The future of e-commerce logistics in Latin America appears promising, driven by technological advancements and evolving consumer preferences. As companies increasingly adopt automation and artificial intelligence, logistics operations will become more efficient, reducing costs and improving service quality. Additionally, the rise of omnichannel retailing will necessitate integrated logistics solutions, enhancing customer experiences. These trends indicate a dynamic market landscape, where adaptability and innovation will be crucial for success in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Standard Delivery Express Delivery Same-Day Delivery International Shipping Fulfillment Services Reverse Logistics (Returns Management) Cross-Border Logistics Others |

| By End-User | B2C (Business-to-Consumer) B2B (Business-to-Business) C2C (Consumer-to-Consumer) Marketplaces Retailers & Brands Others |

| By Delivery Method | Ground Shipping (Road) Air Freight Sea Freight Rail Transport Courier/Parcel Services Locker & Pickup Point Delivery Others |

| By Packaging Type | Standard Packaging Eco-Friendly Packaging Custom Packaging Bulk Packaging Others |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas Cross-Border Regions Others |

| By Service Type | Last-Mile Delivery Warehousing & Fulfillment Freight Forwarding Inventory Management Value-Added Services (e.g., Kitting, Labeling) Others |

| By Customer Segment | Small and Medium Enterprises (SMEs) Large Enterprises Startups Individual Consumers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| E-commerce Fulfillment Strategies | 100 | Logistics Directors, E-commerce Operations Managers |

| Last-Mile Delivery Solutions | 80 | Delivery Service Managers, Urban Logistics Coordinators |

| Warehouse Management Practices | 60 | Warehouse Managers, Inventory Control Specialists |

| Cross-Border E-commerce Logistics | 50 | International Trade Managers, Customs Compliance Officers |

| Returns Management in E-commerce | 40 | Customer Service Managers, Returns Processing Supervisors |

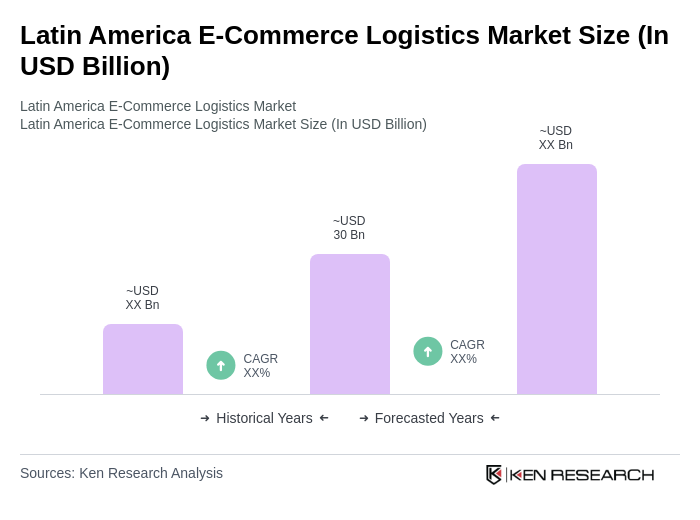

The Latin America E-Commerce Logistics Market is valued at approximately USD 30 billion, driven by the rapid increase in online shopping, smartphone proliferation, and improved logistics infrastructure across the region.