Region:Europe

Author(s):Dev

Product Code:KRAB0403

Pages:90

Published On:August 2025

By Type:The cloud computing market can be segmented into various types, including Infrastructure as a Service (IaaS), Platform as a Service (PaaS), Software as a Service (SaaS), Function as a Service (FaaS), Cloud Storage Services, Cloud Security Services, and Edge and Content Delivery Services. Among these, SaaS is the dominant segment due to its widespread adoption across businesses of all sizes, driven by the need for cost-effective software solutions and ease of access. Independent industry analyses consistently show SaaS as the largest component of cloud spend in Europe, exceeding three-fifths share in recent measurements .

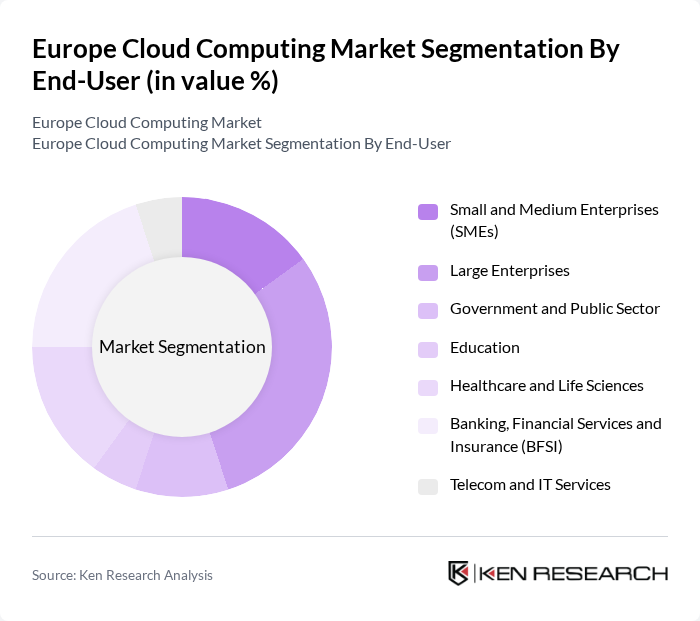

By End-User:The end-user segmentation includes Small and Medium Enterprises (SMEs), Large Enterprises, Government and Public Sector, Education, Healthcare and Life Sciences, Banking, Financial Services and Insurance (BFSI), and Telecom and IT Services. The BFSI sector is currently leading this segment due to its critical need for secure and efficient data management solutions, as well as regulatory compliance requirements. Recent spending analyses identify banking and financial services among the fastest-growing adopters of public cloud in Europe, underpinned by data sovereignty and regulatory modernization programs .

The Europe Cloud Computing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amazon Web Services (AWS), Microsoft Azure, Google Cloud, IBM Cloud, Oracle Cloud Infrastructure (OCI), Salesforce, Alibaba Cloud, SAP SE, OVHcloud, Deutsche Telekom (T-Systems), Orange Business (Orange Cloud for Business), Telefónica Tech (Telefónica Cloud), Atos (Eviden), Scaleway, Aruba S.p.A. (Aruba Cloud) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the European cloud computing market appears promising, driven by ongoing digital transformation initiatives and the increasing adoption of hybrid cloud solutions. As organizations continue to prioritize flexibility and scalability, the demand for multi-cloud strategies is expected to rise. Additionally, the emphasis on sustainability will likely shape cloud operations, with companies seeking eco-friendly solutions. This evolving landscape presents opportunities for innovation and growth, positioning cloud computing as a cornerstone of future business strategies across Europe.

| Segment | Sub-Segments |

|---|---|

| By Type | Infrastructure as a Service (IaaS) Platform as a Service (PaaS) Software as a Service (SaaS) Function as a Service (FaaS) Cloud Storage Services Cloud Security Services Edge and Content Delivery Services |

| By End-User | Small and Medium Enterprises (SMEs) Large Enterprises Government and Public Sector Education Healthcare and Life Sciences Banking, Financial Services and Insurance (BFSI) Telecom and IT Services |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud Sovereign/Trusted Cloud |

| By Industry Vertical | IT and Telecommunications Retail and E-commerce Manufacturing Energy and Utilities Media and Entertainment Transportation and Logistics Government and Defense |

| By Service Model | Managed Services Professional Services Consulting Services Support and Maintenance Services |

| By Geographic Presence | United Kingdom Germany France Italy Spain Netherlands Rest of Europe |

| By Pricing Model | Subscription-Based Pricing Pay-As-You-Go (Consumption-Based) Reserved/Committed Use and Savings Plans Spot/Preemptible and Marketplace-Based |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Cloud Adoption | 120 | IT Managers, CTOs, CIOs |

| SME Cloud Utilization | 100 | Business Owners, IT Consultants |

| Public Sector Cloud Services | 80 | Government IT Officials, Policy Makers |

| Cloud Security Solutions | 70 | Security Officers, Compliance Managers |

| Cloud Migration Strategies | 90 | Project Managers, Systems Architects |

The Europe Cloud Computing Market is valued at approximately USD 180 billion, reflecting significant growth driven by the adoption of public cloud services and SaaS across various sectors, as organizations seek scalable and flexible IT solutions.