Region:Middle East

Author(s):Rebecca

Product Code:KRAE0915

Pages:99

Published On:December 2025

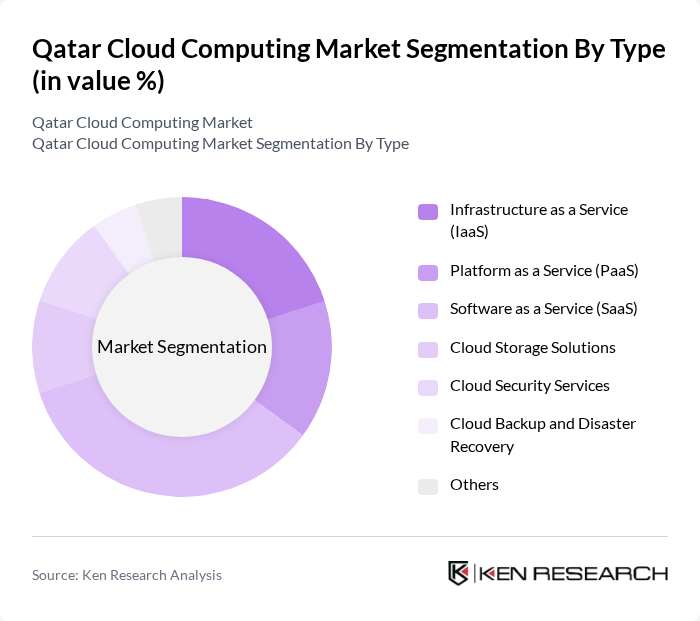

By Type:The cloud computing market in Qatar is segmented into various types, including Infrastructure as a Service (IaaS), Platform as a Service (PaaS), Software as a Service (SaaS), Cloud Storage Solutions, Cloud Security Services, Cloud Backup and Disaster Recovery, and Others. Among these, SaaS is currently the leading segment due to its flexibility and cost-effectiveness, allowing businesses to access software applications without the need for extensive hardware investments. The increasing trend of remote work and digital collaboration has further accelerated the adoption of SaaS solutions.

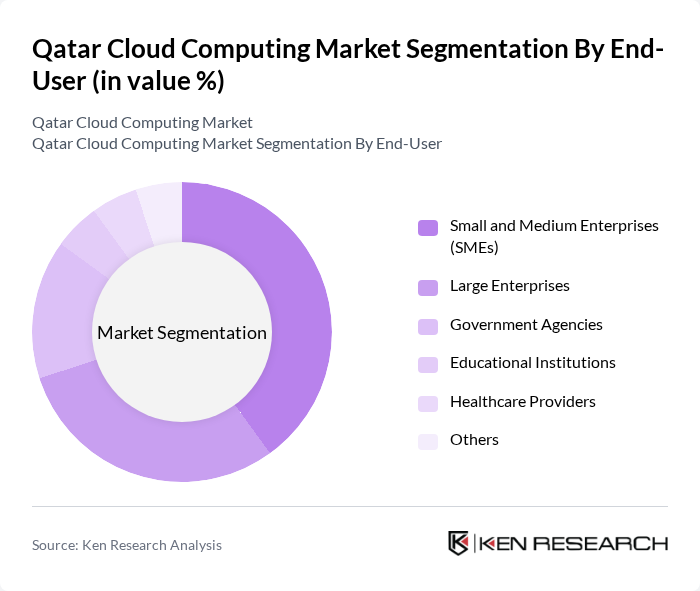

By End-User:The end-user segmentation of the cloud computing market in Qatar includes Small and Medium Enterprises (SMEs), Large Enterprises, Government Agencies, Educational Institutions, Healthcare Providers, and Others. SMEs are the dominant end-user segment, driven by their need for cost-effective solutions that enhance operational efficiency and scalability. The increasing digitalization of business processes among SMEs has led to a surge in cloud adoption, making them a key driver of market growth.

The Qatar Cloud Computing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ooredoo, Vodafone Qatar, Qatari Cloud, Microsoft Qatar, Amazon Web Services (AWS) Qatar, IBM Qatar, Oracle Qatar, Google Cloud Qatar, STC Group, Gulf Bridge International, Qatar National Bank (QNB), Qatar Petroleum, Qatar University, Doha Bank, and Qatar Science and Technology Park contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar cloud computing market appears promising, driven by ongoing digital transformation efforts and government support. As businesses increasingly recognize the importance of cloud solutions, the market is likely to witness a surge in adoption rates. Additionally, advancements in technologies such as artificial intelligence and machine learning will further enhance cloud capabilities, enabling organizations to leverage data more effectively. The focus on sustainability and compliance will also shape the development of cloud services, ensuring they meet evolving regulatory standards.

| Segment | Sub-Segments |

|---|---|

| By Type | Infrastructure as a Service (IaaS) Platform as a Service (PaaS) Software as a Service (SaaS) Cloud Storage Solutions Cloud Security Services Cloud Backup and Disaster Recovery Others |

| By End-User | Small and Medium Enterprises (SMEs) Large Enterprises Government Agencies Educational Institutions Healthcare Providers Others |

| By Industry Vertical | Financial Services Retail Telecommunications Manufacturing Energy and Utilities Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud Multi-Cloud Others |

| By Service Model | Managed Services Professional Services Consulting Services Training and Support Services Others |

| By Geographic Distribution | Doha Al Rayyan Umm Salal Al Wakrah Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Compliance Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Cloud Adoption | 150 | IT Managers, CTOs, CIOs |

| SME Cloud Utilization | 100 | Business Owners, IT Consultants |

| Public Sector Cloud Initiatives | 80 | Government IT Officials, Project Managers |

| Cloud Security Concerns | 70 | Security Officers, Compliance Managers |

| Cloud Service Provider Insights | 60 | Sales Directors, Product Managers |

The Qatar Cloud Computing Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by increasing demand for scalable cloud technologies across public and private sectors, alongside major investments from global providers like Microsoft Azure and Google Cloud.