Region:Asia

Author(s):Geetanshi

Product Code:KRAD0038

Pages:85

Published On:August 2025

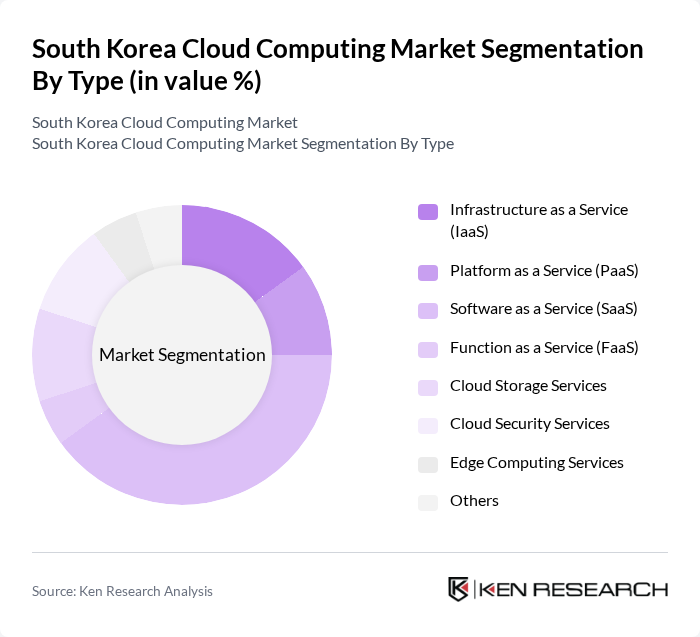

By Type:The cloud computing market in South Korea can be segmented into various types, including Infrastructure as a Service (IaaS), Platform as a Service (PaaS), Software as a Service (SaaS), Function as a Service (FaaS), Cloud Storage Services, Cloud Security Services, Edge Computing Services, and Others. Among these, SaaS is the leading sub-segment, driven by the increasing demand for software solutions that enhance productivity and collaboration. Businesses are increasingly opting for SaaS due to its cost-effectiveness, ease of deployment, and ability to support remote work and digital transformation initiatives. IaaS is also experiencing rapid growth, particularly among enterprises seeking scalable infrastructure for analytics, AI, and high-performance computing .

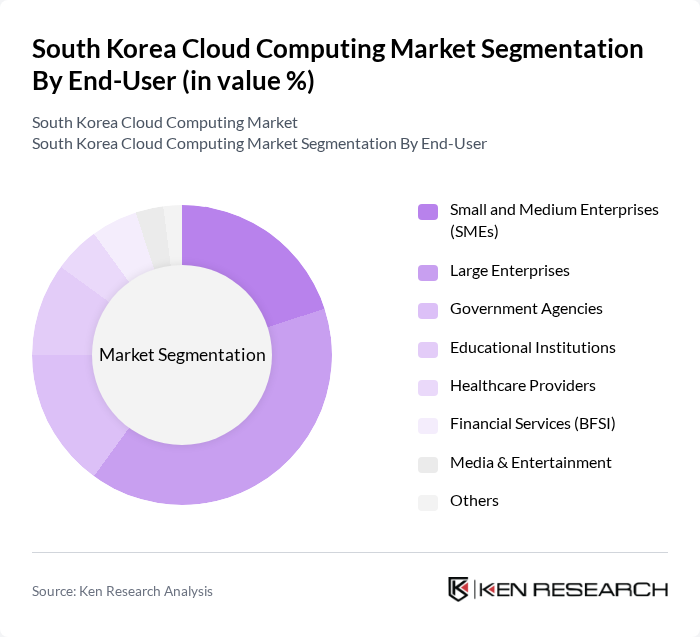

By End-User:The end-user segmentation of the cloud computing market includes Small and Medium Enterprises (SMEs), Large Enterprises, Government Agencies, Educational Institutions, Healthcare Providers, Financial Services (BFSI), Media & Entertainment, and Others. Large Enterprises dominate the market due to their substantial IT budgets and the need for advanced cloud solutions to manage vast amounts of data and enhance operational efficiency. SMEs are also increasingly adopting cloud services, driven by the need for cost-effective, scalable solutions and government subsidy programs that reduce adoption costs. The public sector, including government agencies and educational institutions, is accelerating cloud adoption in response to regulatory mandates and digital transformation goals .

The South Korea Cloud Computing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung SDS, LG CNS, SK Telecom, Naver Cloud, KT Corporation, Kakao Enterprise, Amazon Web Services (AWS), Microsoft Azure, Google Cloud, IBM Cloud, Oracle Cloud, Alibaba Cloud, Tencent Cloud, Megazone Cloud, and Bespin Global contribute to innovation, geographic expansion, and service delivery in this space.

The South Korean cloud computing market is poised for significant growth, driven by advancements in technology and increasing digitalization across industries. As businesses continue to embrace cloud solutions, the demand for innovative services such as AI integration and hybrid cloud models will rise. Additionally, the expansion of 5G infrastructure is expected to enhance connectivity and support the growth of edge computing, further solidifying cloud computing's role in the digital economy. This evolving landscape presents numerous opportunities for service providers and businesses alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Infrastructure as a Service (IaaS) Platform as a Service (PaaS) Software as a Service (SaaS) Function as a Service (FaaS) Cloud Storage Services Cloud Security Services Edge Computing Services Others |

| By End-User | Small and Medium Enterprises (SMEs) Large Enterprises Government Agencies Educational Institutions Healthcare Providers Financial Services (BFSI) Media & Entertainment Others |

| By Application | Data Backup and Recovery Application Hosting Development and Testing Big Data Analytics Internet of Things (IoT) Applications Artificial Intelligence & Machine Learning Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud Multi-Cloud Edge Cloud Others |

| By Industry Vertical | IT and Telecommunications Retail & Consumer Goods Manufacturing Transportation and Logistics Energy and Utilities Healthcare Government & Public Sector Media & Entertainment Others |

| By Service Model | Managed Services Professional Services Consulting Services Training and Support Services Migration Services Others |

| By Pricing Model | Subscription-Based Pricing Pay-As-You-Go Pricing Tiered Pricing Freemium Model Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Cloud Adoption | 100 | IT Managers, CTOs, CIOs |

| SME Cloud Utilization | 80 | Business Owners, IT Consultants |

| Public Sector Cloud Initiatives | 60 | Government IT Officials, Policy Makers |

| Cloud Security Concerns | 50 | Security Officers, Compliance Managers |

| Cloud Service Provider Insights | 40 | Sales Directors, Product Managers |

The South Korea Cloud Computing Market is valued at approximately USD 8.1 billion, reflecting significant growth driven by digital transformation initiatives across various sectors, including manufacturing, finance, and healthcare.