Region:Europe

Author(s):Dev

Product Code:KRAA0395

Pages:92

Published On:August 2025

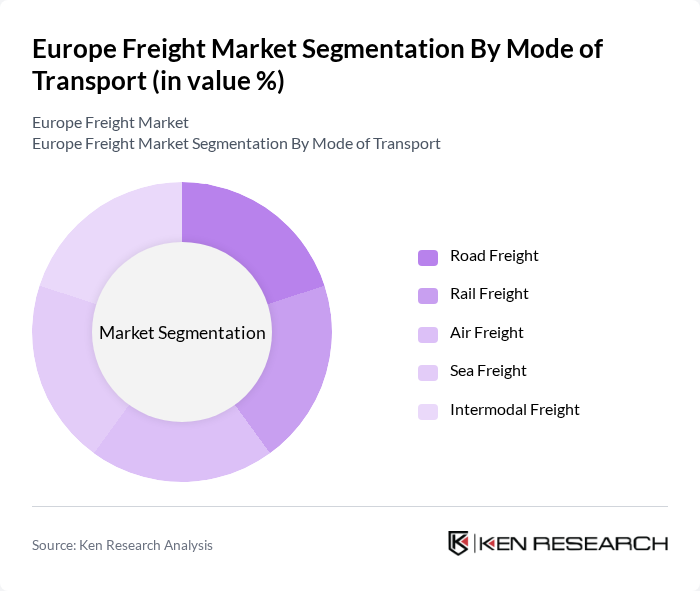

By Mode of Transport:The freight market is segmented by mode into road, rail, air, sea, and intermodal transport. Road freight dominates due to its flexibility and extensive network, supporting both short-haul and long-haul deliveries. Rail freight is preferred for bulk commodities and long-distance transport, offering cost and environmental advantages. Air freight is utilized for high-value, time-sensitive shipments, while sea freight remains the most cost-effective for large-volume, international cargo. Intermodal freight combines multiple transport modes, optimizing efficiency and reducing environmental impact through seamless cargo transfers .

By Service Type:The freight market is also segmented by service type, including freight forwarding, third-party logistics (3PL), fourth-party logistics (4PL), and freight brokerage. Freight forwarding remains essential for managing international shipments and customs processes. 3PL providers offer integrated logistics services, including warehousing, transportation, and distribution. 4PL providers oversee the entire supply chain, coordinating multiple 3PLs and optimizing logistics strategies. Freight brokerage connects shippers with carriers, facilitating efficient and flexible transport solutions .

The Europe Freight Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain & Global Forwarding, Kuehne + Nagel International AG, DB Schenker, DSV A/S, XPO Logistics Europe, UPS Supply Chain Solutions, FedEx Logistics, CEVA Logistics, Geodis (SNCF Group), Bolloré Logistics, Yusen Logistics, Maersk Logistics & Services, H. Essers, Girteka Logistics, Ewals Cargo Care contribute to innovation, geographic expansion, and service delivery in this space.

The Europe freight market is poised for significant transformation driven by technological advancements and sustainability initiatives. As logistics companies increasingly adopt automation and AI, operational efficiencies are expected to improve, reducing costs and enhancing service delivery. Additionally, the focus on green logistics will lead to the development of eco-friendly transport solutions. These trends will not only address current challenges but also create a more resilient and adaptive freight ecosystem, positioning the market for sustainable growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Mode of Transport | Road Freight Rail Freight Air Freight Sea Freight Intermodal Freight |

| By Service Type | Freight Forwarding Third-Party Logistics (3PL) Fourth-Party Logistics (4PL) Freight Brokerage |

| By Cargo Type | Dry Cargo Liquid Cargo Perishable Goods Hazardous Materials |

| By End-User Industry | Retail & E-commerce Manufacturing Automotive Pharmaceuticals & Healthcare Food and Beverage Construction |

| By Geography | Western Europe Eastern Europe Northern Europe Southern Europe |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Freight Operations | 100 | Fleet Managers, Operations Directors |

| Rail Freight Services | 60 | Logistics Coordinators, Rail Network Planners |

| Air Cargo Management | 40 | Airline Cargo Managers, Freight Forwarding Specialists |

| Maritime Freight Logistics | 50 | Port Authority Officials, Shipping Line Executives |

| Cold Chain Logistics | 40 | Supply Chain Managers, Temperature-Controlled Logistics Experts |

The Europe Freight Market is valued at approximately USD 950 billion, reflecting a comprehensive analysis of various transport modes, including road, rail, sea, and air freight. This valuation highlights the market's significant role in facilitating logistics and trade across Europe.