Region:Europe

Author(s):Geetanshi

Product Code:KRAA0226

Pages:80

Published On:August 2025

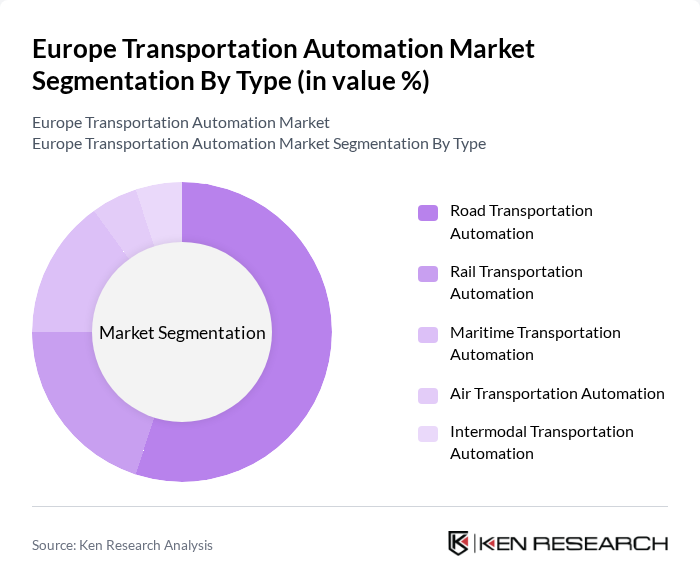

By Type:The market is segmented into Road Transportation Automation, Rail Transportation Automation, Maritime Transportation Automation, Air Transportation Automation, and Intermodal Transportation Automation. Each segment plays a crucial role in the market, driven by specific applications such as autonomous vehicles and smart traffic systems (road), automated signaling and train control (rail), automated cargo handling (maritime), advanced air traffic management (air), and seamless integration of multiple transport modes (intermodal) .

The Road Transportation Automation segment leads the market, driven by the increasing adoption of autonomous vehicles, advanced telematics, and smart traffic management systems. Demand for efficient last-mile delivery and the growth of e-commerce are accelerating investments in this segment. Technological advancements in AI, IoT, and sensor integration are further enhancing the capabilities and reliability of road automation solutions .

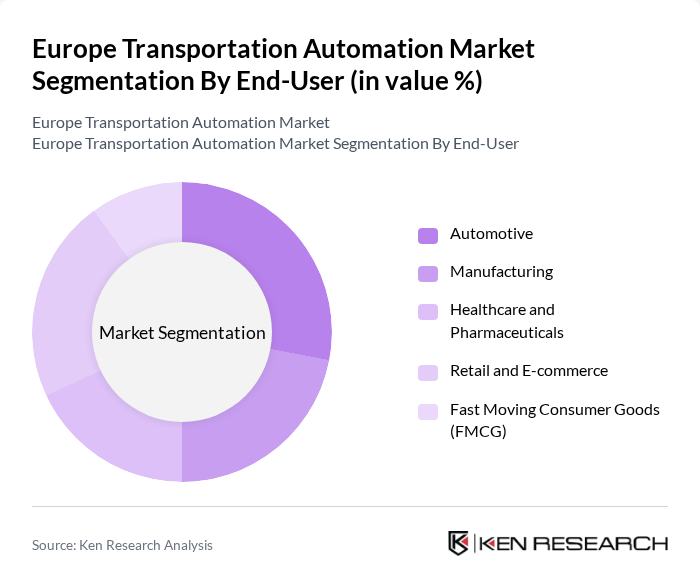

By End-User:The market is segmented by end-users, including Automotive, Manufacturing, Healthcare and Pharmaceuticals, Retail and E-commerce, Fast Moving Consumer Goods (FMCG), and Others. Each end-user segment leverages automation to address unique logistics and operational challenges, such as supply chain optimization (manufacturing), temperature-controlled logistics (healthcare), and rapid order fulfillment (retail and e-commerce) .

The Automotive segment remains a leading end-user, propelled by the rapid development of autonomous vehicles, connected car technologies, and smart logistics systems. Manufacturing and retail/e-commerce sectors are also significant contributors, leveraging automation for supply chain efficiency, inventory management, and real-time tracking. Healthcare and pharmaceuticals are increasingly adopting automation for cold chain management and regulatory compliance, while FMCG focuses on speed and accuracy in distribution .

The Europe Transportation Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, ABB Ltd., Bosch Mobility Solutions, Alstom SA, Volvo Group, Daimler Truck AG, Continental AG, Thales Group, Hitachi Rail Ltd., ZF Friedrichshafen AG, Scania AB, MAN Truck & Bus SE, Kuehne + Nagel International AG, Deutsche Post DHL Group, DSV A/S contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Europe transportation automation market is poised for transformative growth, driven by technological advancements and increasing demand for sustainable solutions. As governments continue to invest in smart transportation initiatives, the integration of AI and machine learning will enhance operational efficiencies. Furthermore, the rise of e-commerce will necessitate innovative last-mile delivery solutions, creating a fertile ground for automation technologies. Companies that adapt to these trends will likely gain a competitive edge in the evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Road Transportation Automation Rail Transportation Automation Maritime Transportation Automation Air Transportation Automation Intermodal Transportation Automation |

| By End-User | Automotive Manufacturing Healthcare and Pharmaceuticals Retail and E-commerce Fast Moving Consumer Goods (FMCG) Others |

| By Vehicle Type | Passenger Vehicles Commercial Vehicles Heavy-Duty Vehicles Autonomous Delivery Vehicles (including AMRs and AGVs) Drones and Unmanned Aerial Vehicles Others |

| By Technology | Sensor Technology AI and Machine Learning IoT Integration Cloud Computing Robotics and Automation Systems Others |

| By Application | Transportation Management Systems (TMS) Warehouse and Storage Automation Fleet Management Traffic Management Route Optimization Safety and Security Others |

| By Investment Source | Private Investments Government Funding Public-Private Partnerships Venture Capital Others |

| By Policy Support | Subsidies for Electric Vehicles Tax Incentives for Automation Grants for Research and Development Regulatory Support for Innovation Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Transportation Automation | 120 | Fleet Managers, Logistics Coordinators |

| Rail Automation Technologies | 60 | Railway Operations Directors, Technology Officers |

| Maritime Automation Solutions | 40 | Port Authorities, Shipping Line Executives |

| Air Transportation Innovations | 50 | Aviation Safety Inspectors, Airport Operations Managers |

| Logistics and Supply Chain Automation | 70 | Supply Chain Analysts, Automation Engineers |

The Europe Transportation Automation Market is valued at approximately USD 18.7 billion, driven by advancements in automation technologies, the growth of e-commerce, and sustainability initiatives across various transportation sectors.