Region:Europe

Author(s):Dev

Product Code:KRAA0429

Pages:85

Published On:August 2025

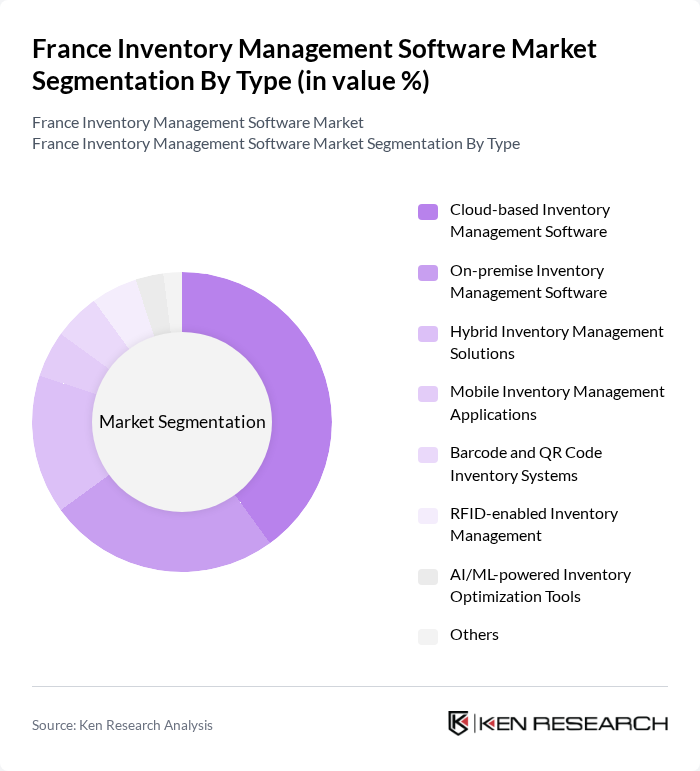

By Type:The market is segmented into various types of inventory management software, including Cloud-based Inventory Management Software, On-premise Inventory Management Software, Hybrid Inventory Management Solutions, Mobile Inventory Management Applications, Barcode and QR Code Inventory Systems, RFID-enabled Inventory Management, AI/ML-powered Inventory Optimization Tools, and Others. Among these, Cloud-based Inventory Management Software is leading due to its flexibility, scalability, cost-effectiveness, and ease of integration with other business systems, making it a preferred choice for businesses of all sizes .

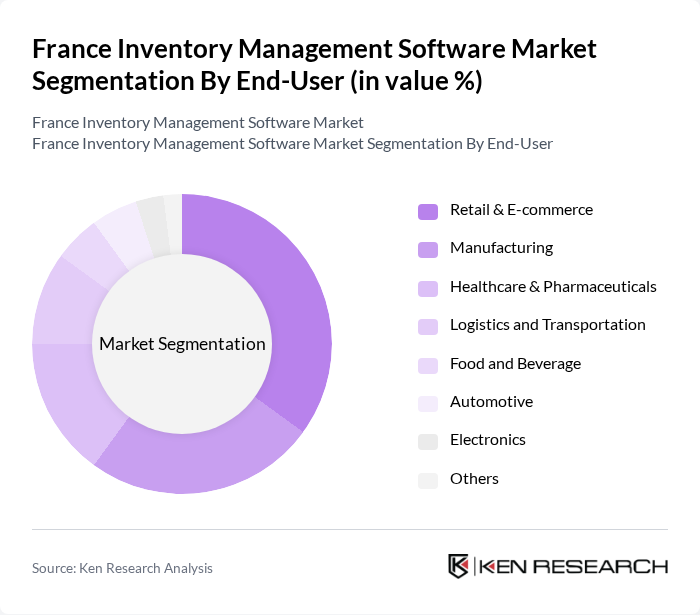

By End-User:The end-user segmentation includes Retail & E-commerce, Manufacturing, Healthcare & Pharmaceuticals, Logistics and Transportation, Food and Beverage, Automotive, Electronics, and Others. The Retail & E-commerce sector is the dominant segment, driven by the rapid growth of online shopping, omnichannel retail, and the need for efficient inventory management to meet consumer demand and manage stock levels effectively. Manufacturing and healthcare sectors are also significant adopters due to the need for real-time inventory visibility, regulatory compliance, and supply chain optimization .

The France Inventory Management Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, Microsoft Dynamics 365, Infor CloudSuite, Zoho Inventory, Odoo (France), Hardis Group (Reflex WMS), Generix Group, Cegid, Sage Group (Sage X3), NetSuite (Oracle NetSuite), Manhattan Associates, SkuVault, Akanea Développement, Acteos contribute to innovation, geographic expansion, and service delivery in this space .

The future of the France inventory management software market appears promising, driven by technological advancements and evolving consumer behaviors. As businesses increasingly prioritize automation and real-time tracking, the integration of AI and IoT technologies is expected to enhance operational efficiency. Additionally, the shift towards cloud-based solutions will facilitate easier access and scalability, allowing companies to adapt swiftly to market demands while maintaining competitive advantages in inventory management practices.

| Segment | Sub-Segments |

|---|---|

| By Type | Cloud-based Inventory Management Software On-premise Inventory Management Software Hybrid Inventory Management Solutions Mobile Inventory Management Applications Barcode and QR Code Inventory Systems RFID-enabled Inventory Management AI/ML-powered Inventory Optimization Tools Others |

| By End-User | Retail & E-commerce Manufacturing Healthcare & Pharmaceuticals Logistics and Transportation Food and Beverage Automotive Electronics Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud On-premises Others |

| By Functionality | Inventory Tracking & Visibility Order & Fulfillment Management Reporting and Analytics Demand Forecasting Supplier & Procurement Management Lifecycle & Sustainability Tracking Others |

| By Region | Île-de-France Auvergne-Rhône-Alpes Provence-Alpes-Côte d'Azur Nouvelle-Aquitaine Occitanie Hauts-de-France Grand Est Others |

| By Pricing Model | Subscription-based One-time License Fee Pay-per-Use Freemium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Inventory Management | 100 | Inventory Managers, IT Directors |

| Manufacturing Software Solutions | 80 | Operations Managers, Supply Chain Analysts |

| Logistics and Distribution Software | 70 | Logistics Coordinators, Warehouse Supervisors |

| Small Business Inventory Tools | 50 | Small Business Owners, IT Consultants |

| Enterprise Resource Planning (ERP) Systems | 90 | ERP Managers, Business Analysts |

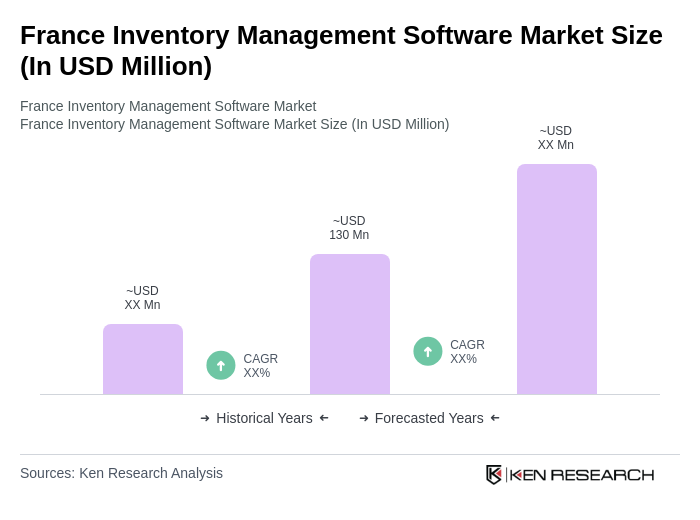

The France Inventory Management Software Market is valued at approximately USD 130 million, reflecting a five-year historical analysis. This growth is driven by the increasing need for efficient inventory control and advanced technologies like AI and IoT integration.