Region:Europe

Author(s):Geetanshi

Product Code:KRAA6057

Pages:96

Published On:September 2025

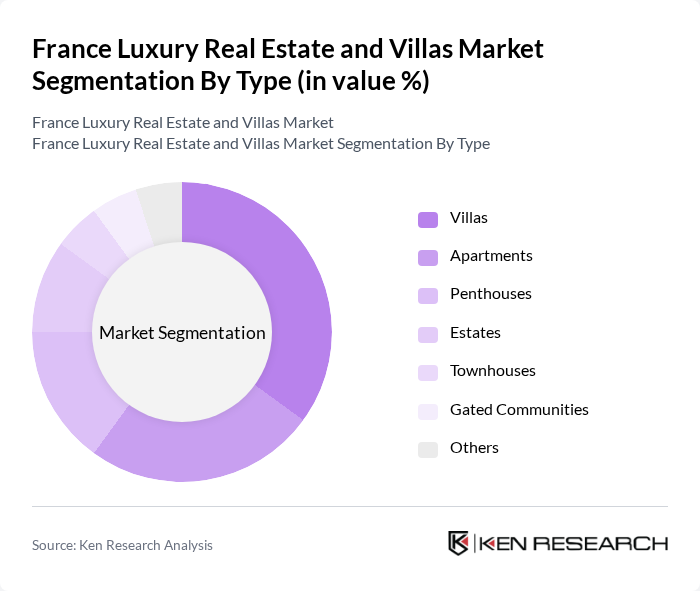

By Type:The luxury real estate market is segmented into various types, including villas, apartments, penthouses, estates, townhouses, gated communities, and others. Among these, villas are particularly popular due to their spaciousness and privacy, appealing to affluent buyers seeking exclusive living experiences. Apartments and penthouses also attract significant interest, especially in urban areas like Paris, where space is at a premium. The demand for gated communities is rising as buyers prioritize security and amenities.

By End-User:The end-user segmentation includes high-net-worth individuals, investors, vacation home buyers, and corporate clients. High-net-worth individuals dominate the market, driven by their desire for luxury living and investment opportunities in prime locations. Investors are increasingly looking for properties that offer rental income potential, particularly in tourist hotspots. Vacation home buyers are drawn to the charm of French locales, while corporate clients seek luxury accommodations for business purposes.

The France Luxury Real Estate and Villas Market is characterized by a dynamic mix of regional and international players. Leading participants such as Knight Frank, Sotheby's International Realty, Engel & Völkers, Barnes International Realty, Savills, Coldwell Banker, LuxuryEstate.com, BARNES, French Property, Agence Varenne, Daniel Féau, LUXJB, Groupe Mercure, AGENCE DU LUXE, AGENCE DES VILLAS contribute to innovation, geographic expansion, and service delivery in this space.

The future of the France luxury real estate market appears promising, driven by ongoing trends in sustainability and technological advancements. As buyers increasingly prioritize eco-friendly properties, developers are likely to focus on green building practices. Additionally, the integration of smart home technologies is expected to enhance property appeal, catering to the modern buyer's preferences. The market is also anticipated to benefit from a growing interest in remote workspaces, leading to increased demand for luxury homes that accommodate flexible living arrangements.

| Segment | Sub-Segments |

|---|---|

| By Type | Villas Apartments Penthouses Estates Townhouses Gated Communities Others |

| By End-User | High-Net-Worth Individuals Investors Vacation Home Buyers Corporate Clients |

| By Price Range | Below €1 Million €1 Million - €3 Million €3 Million - €5 Million Above €5 Million |

| By Location | Paris French Riviera Provence Loire Valley Normandy Alps Others |

| By Property Features | Swimming Pools Smart Home Features Outdoor Spaces Luxury Finishes Security Features |

| By Sales Channel | Direct Sales Real Estate Agencies Online Platforms Auctions |

| By Investment Type | Cash Purchases Mortgages Joint Ventures Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Villa Purchasers | 150 | High-Net-Worth Individuals, Real Estate Investors |

| Real Estate Agents in Luxury Segment | 100 | Luxury Property Specialists, Agency Directors |

| Property Developers Focused on Villas | 80 | Development Managers, Project Directors |

| Luxury Real Estate Market Analysts | 60 | Market Researchers, Economic Analysts |

| Investors in French Real Estate | 70 | Investment Advisors, Wealth Managers |

The France Luxury Real Estate and Villas Market is valued at approximately EUR 30 billion, driven by increasing demand from high-net-worth individuals and foreign investments, particularly in prime locations like Paris and the French Riviera.