Region:Global

Author(s):Rebecca

Product Code:KRAA6066

Pages:82

Published On:September 2025

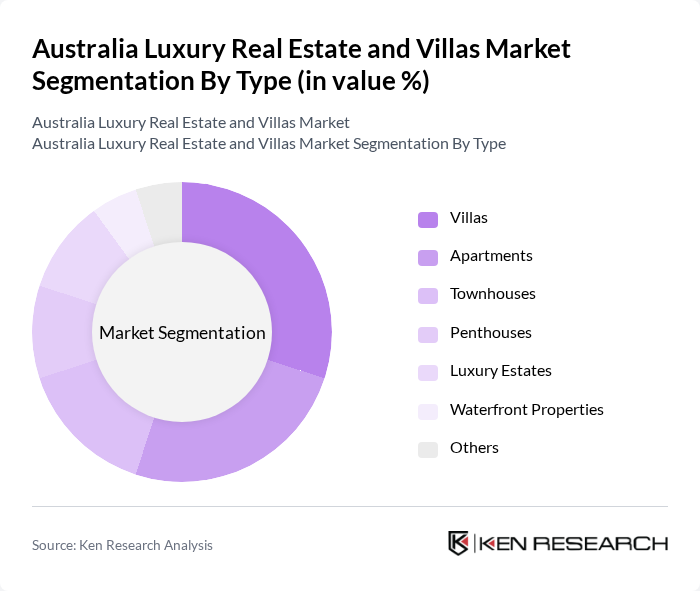

By Type:The luxury real estate market is segmented into various types, including Villas, Apartments, Townhouses, Penthouses, Luxury Estates, Waterfront Properties, and Others. Each type caters to different consumer preferences and lifestyle choices, with villas and luxury estates often being favored for their spaciousness and exclusivity. Apartments and penthouses are popular among urban dwellers seeking luxury in city centers, while waterfront properties attract buyers looking for scenic views and leisure activities.

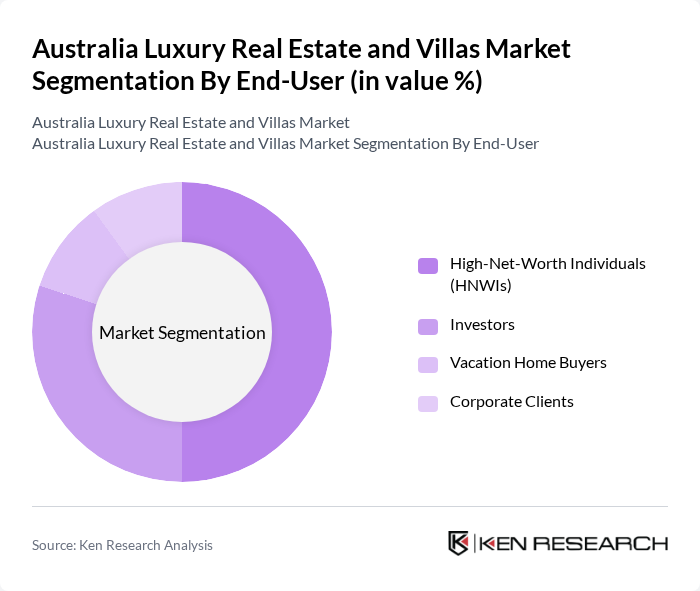

By End-User:The end-user segmentation includes High-Net-Worth Individuals (HNWIs), Investors, Vacation Home Buyers, and Corporate Clients. HNWIs are the primary consumers in this market, driven by the desire for luxury living and investment opportunities. Investors are increasingly looking for properties that promise high returns, while vacation home buyers seek second homes in desirable locations. Corporate clients often purchase luxury properties for executive housing or as part of their investment portfolios.

The Australia Luxury Real Estate and Villas Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ray White, LJ Hooker, McGrath Estate Agents, Belle Property, JLL (Jones Lang LaSalle), CBRE Group, Knight Frank, Sotheby's International Realty, Harcourts, Property Exchange, The Agency, Raine & Horne, First National Real Estate, Colliers International, UrbanX contribute to innovation, geographic expansion, and service delivery in this space.

The future of the luxury real estate market in Australia appears promising, driven by ongoing trends in urbanization and lifestyle preferences. As more affluent individuals seek properties that offer both luxury and sustainability, developers are likely to focus on eco-friendly designs and smart home technologies. Additionally, the increasing interest from international buyers, particularly from Asia, will continue to shape the market landscape. Overall, the sector is expected to adapt and thrive amid evolving consumer demands and economic conditions.

| Segment | Sub-Segments |

|---|---|

| By Type | Villas Apartments Townhouses Penthouses Luxury Estates Waterfront Properties Others |

| By End-User | High-Net-Worth Individuals (HNWIs) Investors Vacation Home Buyers Corporate Clients |

| By Price Range | Below AUD 1 Million AUD 1 Million - AUD 3 Million AUD 3 Million - AUD 5 Million Above AUD 5 Million |

| By Location | Urban Centers Coastal Areas Rural Retreats Suburban Developments |

| By Amenities | Swimming Pools Home Theaters Fitness Centers Smart Home Features |

| By Ownership Type | Freehold Leasehold Shared Ownership |

| By Sales Channel | Direct Sales Real Estate Agents Online Platforms Auctions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Villa Buyers | 100 | High-net-worth Individuals, Real Estate Investors |

| Real Estate Agents Specializing in Luxury Properties | 80 | Real Estate Agents, Brokers |

| Property Developers in the Luxury Segment | 60 | Developers, Project Managers |

| Luxury Property Management Firms | 50 | Property Managers, Operations Directors |

| Luxury Real Estate Market Analysts | 40 | Market Analysts, Economic Advisors |

The Australia Luxury Real Estate and Villas Market is valued at approximately AUD 15 billion, driven by increasing demand from high-net-worth individuals and foreign investors seeking premium properties in prime locations across the country.