Region:Africa

Author(s):Rebecca

Product Code:KRAA5594

Pages:83

Published On:September 2025

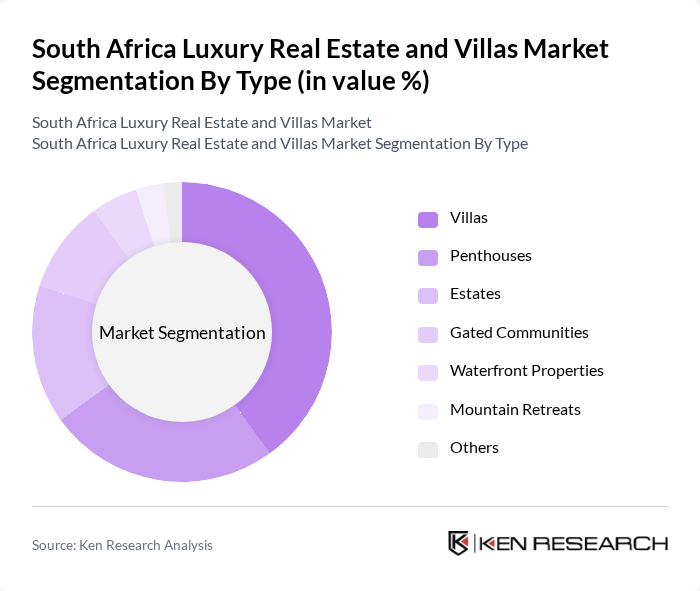

By Type:

The luxury real estate market is segmented into various types, including Villas, Penthouses, Estates, Gated Communities, Waterfront Properties, Mountain Retreats, and Others. Among these, Villas are the most dominant sub-segment, driven by their appeal to affluent buyers seeking spacious and luxurious living spaces. Penthouses also hold significant market share due to their exclusivity and panoramic views, making them highly sought after in urban areas. The trend towards gated communities is rising, as buyers prioritize security and privacy, while waterfront properties attract those looking for leisure and lifestyle benefits.

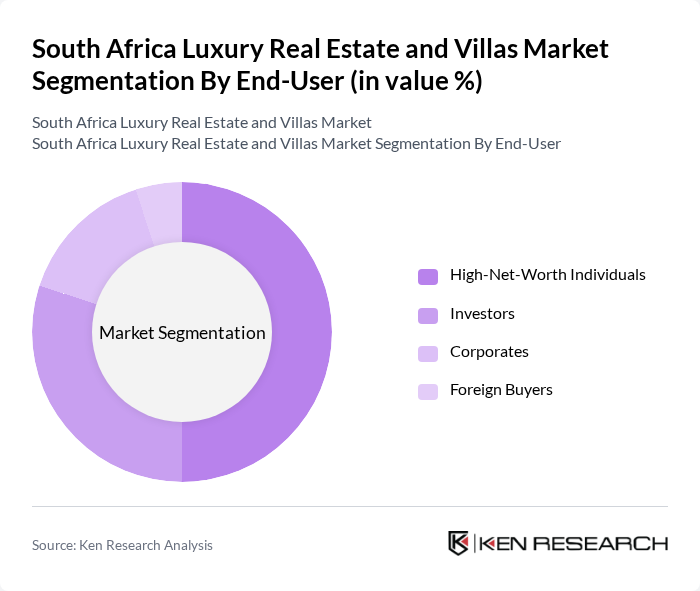

By End-User:

The end-user segmentation includes High-Net-Worth Individuals, Investors, Corporates, and Foreign Buyers. High-Net-Worth Individuals dominate the market, driven by their desire for luxury living and investment opportunities. Investors are increasingly looking for properties that promise high returns, while Corporates often seek luxury accommodations for executives. Foreign Buyers are attracted to South Africa's favorable exchange rates and lifestyle offerings, contributing to the market's growth.

The South Africa Luxury Real Estate and Villas Market is characterized by a dynamic mix of regional and international players. Leading participants such as Pam Golding Properties, Seeff Properties, Sotheby's International Realty, Engel & Völkers, RE/MAX, Chas Everitt International Property Group, Rawson Properties, Just Property, Harcourts, Knight Frank, Fine & Country, Property.CoZa, The Agency, LUXJB, Broll Property Group contribute to innovation, geographic expansion, and service delivery in this space.

The South African luxury real estate market is poised for a transformative period, driven by evolving consumer preferences and technological advancements. As urbanization continues, demand for luxury properties in metropolitan areas is expected to rise, particularly among affluent buyers seeking modern amenities. Additionally, the integration of smart home technologies will likely enhance property appeal, making them more attractive to tech-savvy consumers. This dynamic environment presents opportunities for developers to innovate and cater to changing market demands effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Villas Penthouses Estates Gated Communities Waterfront Properties Mountain Retreats Others |

| By End-User | High-Net-Worth Individuals Investors Corporates Foreign Buyers |

| By Price Range | Below ZAR 5 Million ZAR 5 Million - ZAR 10 Million ZAR 10 Million - ZAR 20 Million Above ZAR 20 Million |

| By Location | Cape Town Johannesburg Durban Pretoria Stellenbosch Others |

| By Property Features | Swimming Pools Home Automation Systems Outdoor Living Spaces Security Features |

| By Sales Channel | Direct Sales Real Estate Agents Online Platforms Auctions |

| By Investment Source | Domestic Investors Foreign Direct Investment Private Equity Government Schemes |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Villa Buyers | 100 | High-net-worth Individuals, Real Estate Investors |

| Real Estate Agents | 80 | Luxury Property Specialists, Real Estate Brokers |

| Property Developers | 60 | Developers of High-End Residential Projects, Project Managers |

| Financial Institutions | 50 | Mortgage Advisors, Wealth Management Consultants |

| Luxury Property Management Firms | 40 | Property Managers, Operations Directors |

The South Africa Luxury Real Estate and Villas Market is valued at approximately USD 3.5 billion, reflecting significant growth driven by high-net-worth individuals, foreign investments, and an expanding middle class seeking luxury living options.