Philippines Luxury Real Estate and Villas Market Overview

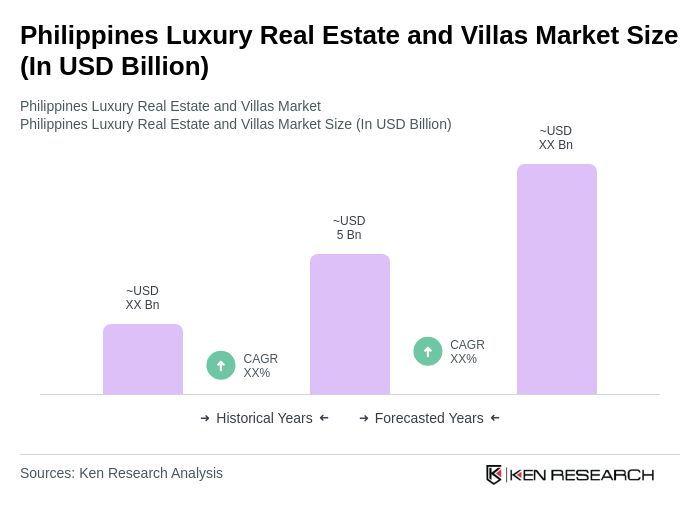

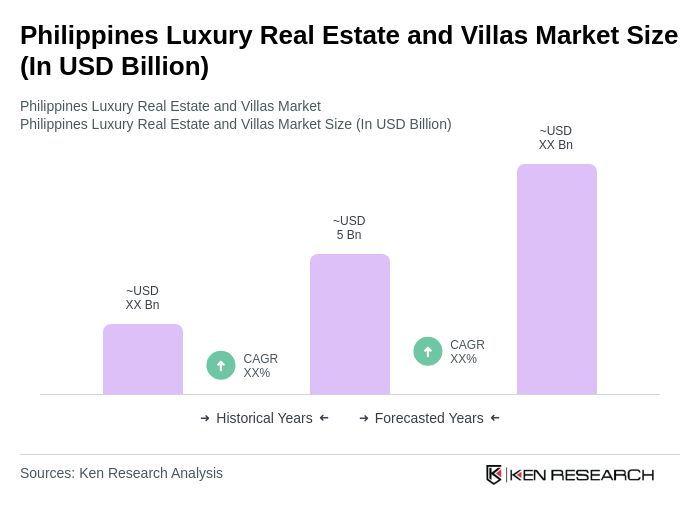

- The Philippines Luxury Real Estate and Villas Market is valued at USD 5 billion, based on a five-year historical analysis. This growth is primarily driven by increasing disposable incomes, a rising number of high-net-worth individuals, and a growing interest in luxury living among both local and foreign buyers. The market has seen a surge in demand for premium properties, particularly in urban and resort areas, reflecting a shift in consumer preferences towards luxury and exclusivity.

- Key cities dominating the market include Metro Manila, Cebu, and Boracay. Metro Manila stands out due to its status as the economic and cultural hub of the Philippines, attracting both local and international investors. Cebu is favored for its blend of urban amenities and natural beauty, while Boracay is renowned for its pristine beaches, making it a prime location for luxury villas and beachfront properties.

- In 2023, the Philippine government implemented the "Build, Build, Build" program, aimed at enhancing infrastructure development across the country. This initiative includes significant investments in transportation, utilities, and urban development, which are expected to improve accessibility and increase property values in luxury real estate markets, thereby attracting more investments in high-end properties.

Philippines Luxury Real Estate and Villas Market Segmentation

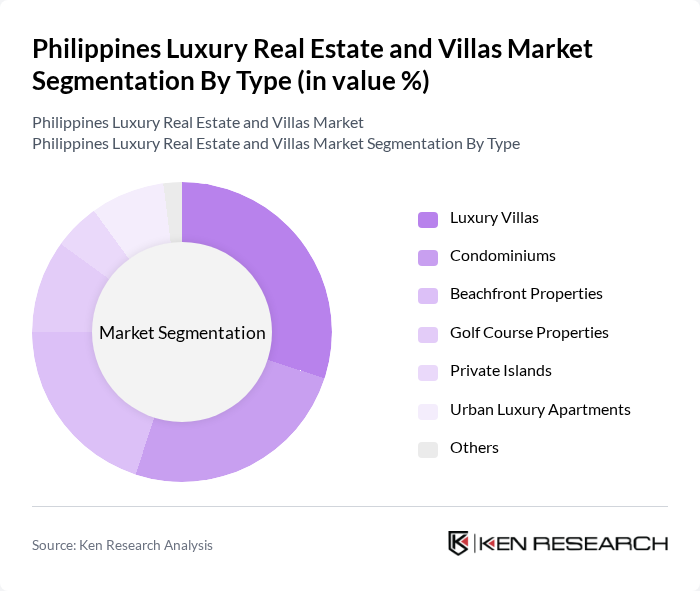

By Type:The luxury real estate market in the Philippines is segmented into various types, including luxury villas, condominiums, beachfront properties, golf course properties, private islands, urban luxury apartments, and others. Among these, luxury villas and condominiums are particularly popular due to their spacious designs and modern amenities, catering to affluent buyers seeking comfort and exclusivity.

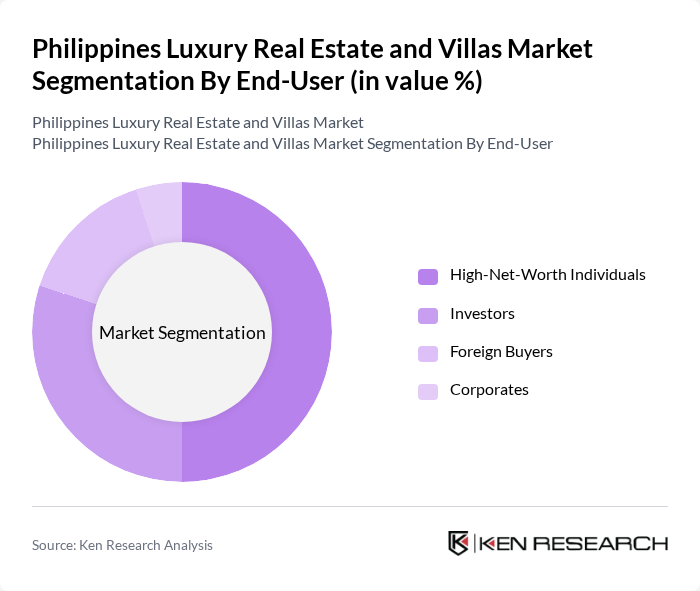

By End-User:The end-user segmentation of the luxury real estate market includes high-net-worth individuals, investors, foreign buyers, and corporates. High-net-worth individuals dominate the market, driven by their desire for exclusive properties that offer luxury living and investment opportunities. Investors are also significant players, seeking profitable ventures in the growing luxury sector.

Philippines Luxury Real Estate and Villas Market Competitive Landscape

The Philippines Luxury Real Estate and Villas Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ayala Land, Inc., SM Development Corporation, Megaworld Corporation, Robinsons Land Corporation, Vista Land & Lifescapes, Inc., DMCI Homes, Century Properties Group, Inc., Rockwell Land Corporation, Federal Land, Inc., Shang Properties, Inc., Ortigas & Company, Filinvest Development Corporation, AboitizLand, Inc., The Ascott Limited, The Residences at Greenbelt contribute to innovation, geographic expansion, and service delivery in this space.

Philippines Luxury Real Estate and Villas Market Industry Analysis

Growth Drivers

- Increasing Affluence of the Middle Class:The Philippines has seen a significant rise in the middle class, with approximately 8 million households classified as middle-income in the future. This demographic shift is driving demand for luxury real estate, as these households are increasingly seeking upscale living options. The World Bank projects that the country's GDP per capita will reach around $4,500, further enhancing purchasing power and enabling more families to invest in luxury properties.

- Rise in Foreign Investments:Foreign direct investment (FDI) in the Philippines reached $12 billion in the future, with a notable portion directed towards the real estate sector. This influx of capital is bolstering the luxury market, as international investors seek high-end properties in prime locations. The government’s efforts to streamline investment processes and provide incentives are expected to attract even more foreign capital, enhancing the overall market landscape for luxury villas.

- Growth of Tourism and Hospitality Sector:The tourism sector in the Philippines is projected to contribute approximately $12 billion to the economy in the future, driven by a surge in international arrivals. This growth is stimulating demand for luxury accommodations and villas, as tourists increasingly prefer high-end lodging options. The government’s initiatives to promote tourism, including improved infrastructure, are expected to further enhance the attractiveness of luxury real estate investments in popular destinations.

Market Challenges

- Regulatory Hurdles:The luxury real estate market faces significant regulatory challenges, particularly concerning foreign ownership laws. Currently, foreign nationals can only own up to 40% of a condominium project, which limits investment opportunities. This regulatory framework can deter potential investors, as navigating the legal landscape often requires extensive time and resources, impacting the overall growth of the luxury market in the Philippines.

- Economic Volatility:The Philippines' economy is susceptible to fluctuations, with GDP growth projected at 6% in the future, down from 6.5% in previous years. This economic volatility can affect consumer confidence and spending power, particularly in the luxury segment. Investors may become cautious, leading to a slowdown in luxury real estate transactions, as potential buyers reassess their financial commitments amid uncertain economic conditions.

Philippines Luxury Real Estate and Villas Market Future Outlook

The future of the luxury real estate market in the Philippines appears promising, driven by increasing affluence and a growing interest in sustainable living. As urbanization continues, demand for luxury properties in metropolitan areas is expected to rise. Additionally, the integration of smart home technologies will likely enhance property appeal, attracting tech-savvy buyers. The market is also anticipated to benefit from ongoing government support for tourism and infrastructure development, creating a conducive environment for luxury real estate investments.

Market Opportunities

- Eco-Friendly Luxury Developments:There is a growing trend towards eco-friendly luxury properties, with an estimated 35% of buyers prioritizing sustainability in their purchasing decisions. Developers who focus on green building practices and sustainable materials can tap into this lucrative market segment, appealing to environmentally conscious consumers and enhancing property value.

- Smart Home Technologies:The integration of smart home technologies is becoming increasingly popular, with a projected market value of $2 billion in the Philippines in the future. Luxury villas equipped with advanced automation systems and energy-efficient solutions are likely to attract tech-savvy buyers, providing a competitive edge in the market and enhancing overall living experiences.