Region:Middle East

Author(s):Rebecca

Product Code:KRAB1733

Pages:85

Published On:October 2025

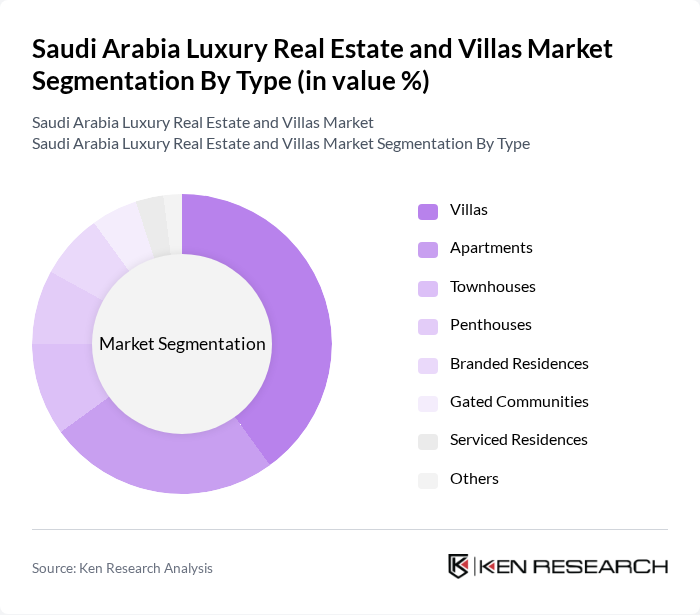

By Type:The luxury real estate market in Saudi Arabia is segmented into villas, apartments, townhouses, penthouses, branded residences, gated communities, serviced residences, and others. Villas remain the most sought-after segment due to their spacious layouts, privacy, and premium amenities, appealing to affluent families and high-net-worth individuals. Apartments and penthouses attract buyers seeking luxury living in urban centers, while branded residences and serviced residences are increasingly popular among international investors and expatriates seeking prestigious and professionally managed properties .

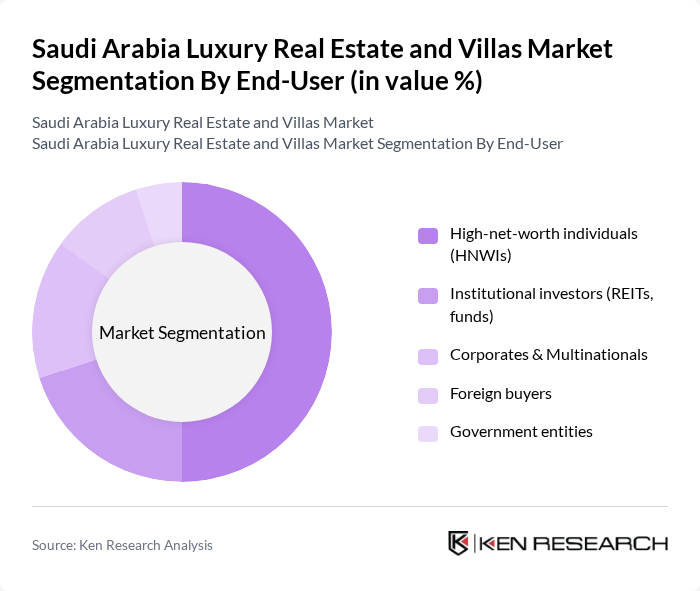

By End-User:The end-user segmentation of the luxury real estate market includes high-net-worth individuals (HNWIs), institutional investors, corporates and multinationals, foreign buyers, and government entities. High-net-worth individuals continue to dominate the market, driven by their preference for exclusive properties and luxury amenities. Institutional investors, including REITs and private funds, are increasingly active, attracted by stable returns and portfolio diversification. Foreign buyers, especially those benefiting from the Premium Residency program, are significant in coastal and urban luxury segments, seeking both vacation homes and investment opportunities .

The Saudi Arabia Luxury Real Estate and Villas Market is characterized by a dynamic mix of regional and international players. Leading participants such as ROSHN, Dar Al Arkan, Emaar, The Economic City, Kingdom Holding Company, Red Sea Global, JLL (Jones Lang LaSalle), Colliers International, Knight Frank, CBRE Group, DAMAC Properties, Al Oula Real Estate Development Company, Al-Mabani General Contractors, Misk City (Mohammed bin Salman Foundation), Al Akaria Saudi Real Estate Company (SRECO), Sumou Real Estate Company contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi luxury real estate market is poised for significant transformation, driven by urbanization and government initiatives aimed at enhancing the living experience. As the population continues to grow, demand for luxury villas and eco-friendly properties will rise. Furthermore, the integration of smart home technologies is expected to become a standard feature in new developments, appealing to tech-savvy buyers. Overall, the market is likely to experience a shift towards sustainable and innovative living solutions, aligning with global trends.

| Segment | Sub-Segments |

|---|---|

| By Type | Villas Apartments Townhouses Penthouses Branded Residences Gated Communities Serviced Residences Others |

| By End-User | High-net-worth individuals (HNWIs) Institutional investors (REITs, funds) Corporates & Multinationals Foreign buyers Government entities |

| By Price Range | Below SAR 2 million SAR 2 million - SAR 5 million SAR 5 million - SAR 10 million SAR 10 million - SAR 20 million Above SAR 20 million |

| By Location | Riyadh Jeddah Dammam/Khobar Makkah Madinah NEOM Red Sea Coast Others |

| By Development Stage | Pre-construction Under construction Completed |

| By Financing Type | Cash purchases Mortgages Investment funds/REITs |

| By Ownership Type | Freehold Leasehold Joint ownership |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Villa Purchasers | 100 | High-Net-Worth Individuals, Real Estate Investors |

| Real Estate Developers | 60 | Project Managers, Business Development Executives |

| Luxury Property Agents | 50 | Real Estate Brokers, Sales Managers |

| Financial Advisors | 40 | Wealth Managers, Investment Consultants |

| Luxury Property Buyers' Agents | 40 | Buyer Representatives, Market Analysts |

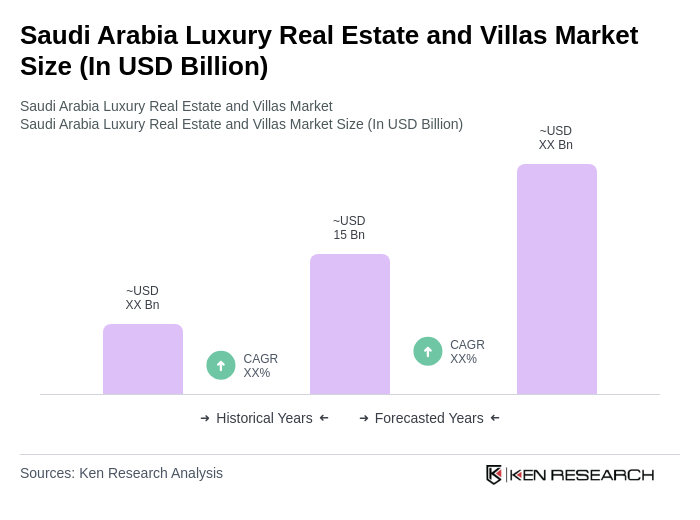

The Saudi Arabia luxury real estate and villas market is valued at approximately USD 15 billion, driven by increasing demand from high-net-worth individuals, urbanization, and government initiatives under Vision 2030 aimed at diversifying the economy.