Region:Asia

Author(s):Rebecca

Product Code:KRAA6079

Pages:94

Published On:September 2025

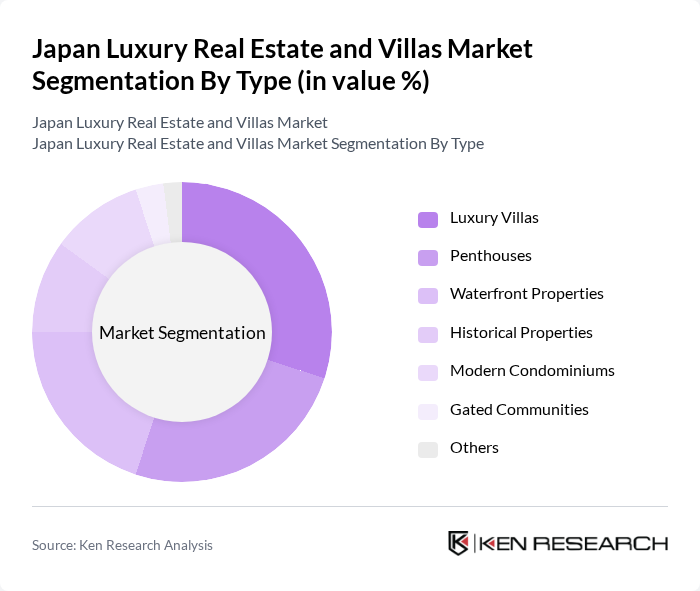

By Type:The luxury real estate market in Japan is segmented into various types, including luxury villas, penthouses, waterfront properties, historical properties, modern condominiums, gated communities, and others. Among these, luxury villas and penthouses are particularly popular due to their exclusivity and high-end amenities. The demand for waterfront properties has also surged, driven by buyers seeking scenic views and a tranquil lifestyle. Each sub-segment caters to different consumer preferences, with luxury villas often appealing to families and penthouses attracting young professionals and affluent individuals.

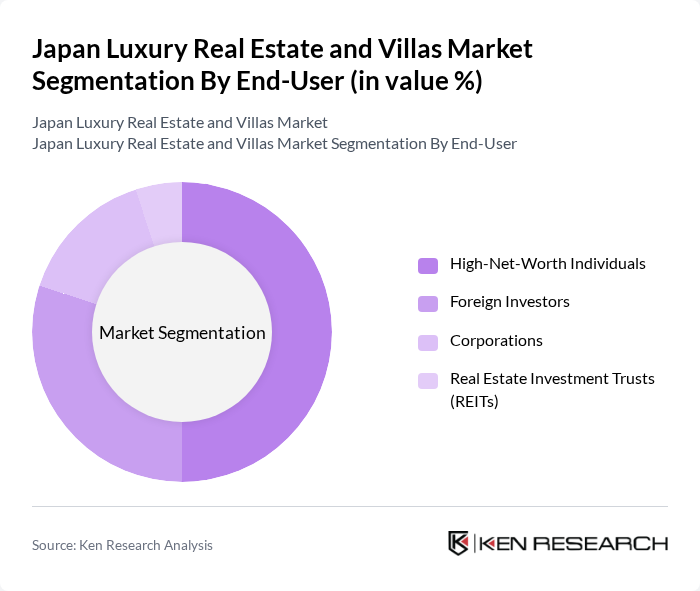

By End-User:The end-user segmentation of the luxury real estate market includes high-net-worth individuals, foreign investors, corporations, and real estate investment trusts (REITs). High-net-worth individuals dominate the market, driven by their desire for exclusive properties and investment opportunities. Foreign investors are increasingly attracted to Japan's stable economy and favorable investment climate. Corporations often seek luxury properties for executive housing or corporate retreats, while REITs are focused on acquiring high-value assets to enhance their portfolios.

The Japan Luxury Real Estate and Villas Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mitsui Fudosan Co., Ltd., Sumitomo Realty & Development Co., Ltd., Tokyu Land Corporation, Daiwa House Industry Co., Ltd., Nomura Real Estate Holdings, Inc., Sekisui House, Ltd., Japan Real Estate Investment Corporation, The Mori Trust Co., Ltd., Hulic Co., Ltd., Kenedix, Inc., Resona Holdings, Inc., Japan Property Management, Inc., Tokyu Corporation, Urban Renaissance Agency, Japan Real Estate Institute contribute to innovation, geographic expansion, and service delivery in this space.

The Japan luxury real estate market is poised for continued growth, driven by increasing disposable incomes and a rising interest in second homes. As urbanization progresses, the demand for luxury properties with modern amenities will likely increase. Additionally, the integration of sustainable practices and smart technologies in property development will attract environmentally conscious buyers. The market is expected to adapt to these trends, enhancing its appeal to both domestic and international investors, ensuring a vibrant future for luxury real estate in Japan.

| Segment | Sub-Segments |

|---|---|

| By Type | Luxury Villas Penthouses Waterfront Properties Historical Properties Modern Condominiums Gated Communities Others |

| By End-User | High-Net-Worth Individuals Foreign Investors Corporations Real Estate Investment Trusts (REITs) |

| By Price Range | Below ¥100 million ¥100 million - ¥500 million Above ¥500 million |

| By Location | Tokyo Osaka Kyoto Hokkaido Okinawa Others |

| By Property Size | Small (Less than 150 sqm) Medium (150-300 sqm) Large (Above 300 sqm) |

| By Amenities | Swimming Pools Home Theaters Smart Home Features Fitness Centers Others |

| By Sales Channel | Direct Sales Real Estate Agents Online Platforms Auctions Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Villa Sales | 100 | Real Estate Agents, Property Developers |

| High-End Rental Market | 80 | Property Managers, Luxury Renters |

| Foreign Investment in Real Estate | 60 | Investors, Financial Advisors |

| Market Trends and Consumer Preferences | 90 | Homeowners, Real Estate Analysts |

| Luxury Property Development Insights | 70 | Architects, Urban Planners |

The Japan Luxury Real Estate and Villas Market is valued at approximately USD 30 billion, reflecting a significant increase driven by demand from high-net-worth individuals and foreign investors, alongside a growing interest in luxury living spaces in urban areas.