Region:North America

Author(s):Dev

Product Code:KRAB2319

Pages:88

Published On:October 2025

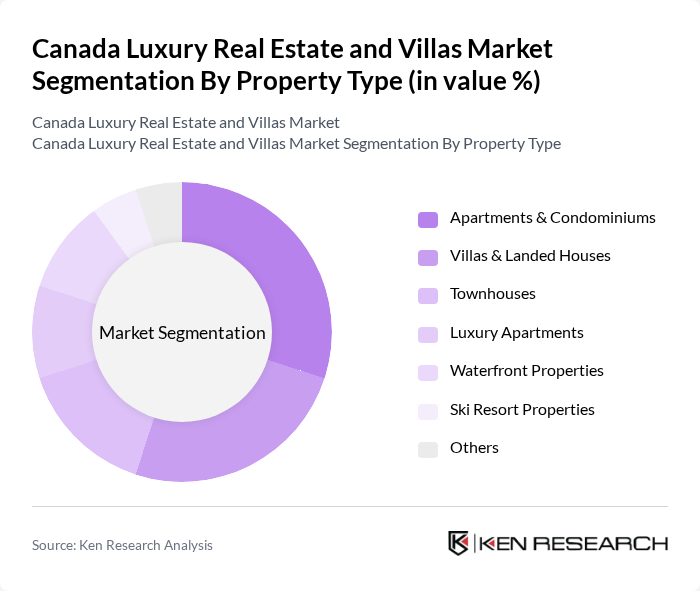

By Property Type:The luxury real estate market in Canada is segmented into Apartments & Condominiums, Villas & Landed Houses, Townhouses, Luxury Apartments, Waterfront Properties, Ski Resort Properties, and Others. Each segment addresses distinct consumer preferences and investment strategies. Demand for luxury apartments and waterfront properties remains strong, particularly in urban centers and scenic regions, driven by urbanization, lifestyle changes, and the desire for exclusive amenities. Ski resort properties continue to attract buyers seeking premium vacation homes, especially in regions like Whistler and Mont-Tremblant .

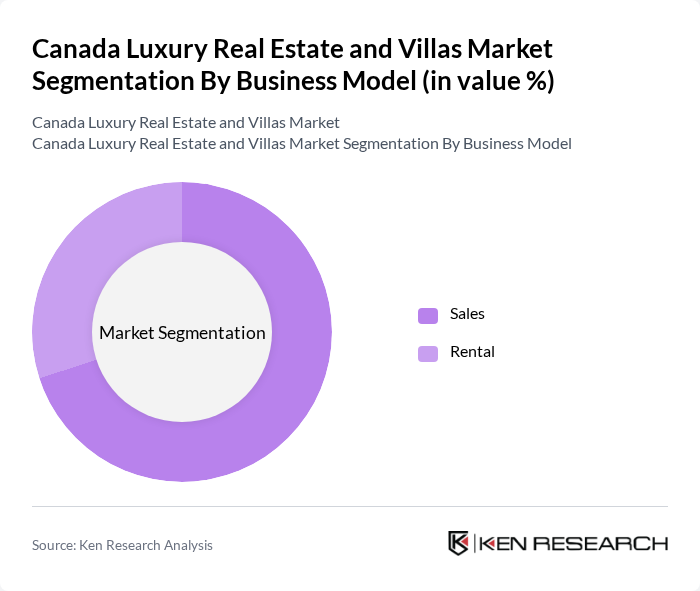

By Business Model:The luxury real estate market operates under two primary business models: Sales and Rental. The sales model remains dominant, as buyers continue to invest in luxury properties for personal use and as long-term assets. The rental segment is experiencing growth, particularly in urban markets and resort destinations, where short-term rentals cater to affluent tourists and business travelers seeking premium accommodations .

The Canada Luxury Real Estate and Villas Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sotheby's International Realty Canada, Engel & Völkers, Royal LePage, RE/MAX, Coldwell Banker, The Agency, Century 21, Bosley Real Estate Ltd., Oakwyn Realty Ltd., Harvey Kalles Real Estate Ltd., Johnston & Daniel, Chestnut Park Real Estate Limited, Phipps Realty Ltd., Urban Real Estate Group, Property.ca Realty Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Canada luxury real estate market appears promising, driven by ongoing urbanization and a sustained influx of affluent buyers. As the economy stabilizes, with GDP growth projected at 1.1% in future, demand for luxury properties is expected to remain robust. Additionally, the trend towards eco-friendly developments and smart home technologies will likely attract environmentally conscious buyers, enhancing the appeal of luxury real estate. Overall, the market is poised for continued evolution and growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Property Type | Apartments & Condominiums Villas & Landed Houses Townhouses Luxury Apartments Waterfront Properties Ski Resort Properties Others |

| By Business Model | Sales Rental |

| By Mode of Sale | Primary (New-build) Secondary (Existing-home Resale) |

| By Province | Ontario British Columbia Quebec Alberta Rest of Canada |

| By End-User | Individual Buyers Investors Corporations Vacation Home Buyers |

| By Price Range | Below CAD 1 Million CAD 1 Million - CAD 3 Million CAD 3 Million - CAD 5 Million Above CAD 5 Million |

| By Location | Urban Centers Suburban Areas Rural Retreats Resort Destinations |

| By Property Features | Smart Home Features Eco-Friendly Designs Luxury Amenities Customization Options |

| By Sales Channel | Real Estate Agents Online Platforms Auctions Direct Sales |

| By Investment Type | Primary Residence Secondary Residence Investment Properties Rental Properties |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Villa Buyers | 60 | High-Net-Worth Individuals, Real Estate Investors |

| Real Estate Agents | 50 | Luxury Property Specialists, Market Analysts |

| Developers of Luxury Properties | 40 | Project Managers, Business Development Executives |

| Luxury Property Management Firms | 45 | Property Managers, Operations Directors |

| High-End Rental Market | 55 | Property Owners, Rental Agents |

The Canada Luxury Real Estate and Villas Market is valued at approximately CAD 13 billion, reflecting recent transaction volumes and average prices in the luxury segment, particularly influenced by urban centers like Toronto, Vancouver, Montreal, and Calgary.