Region:Middle East

Author(s):Dev

Product Code:KRAD6452

Pages:93

Published On:December 2025

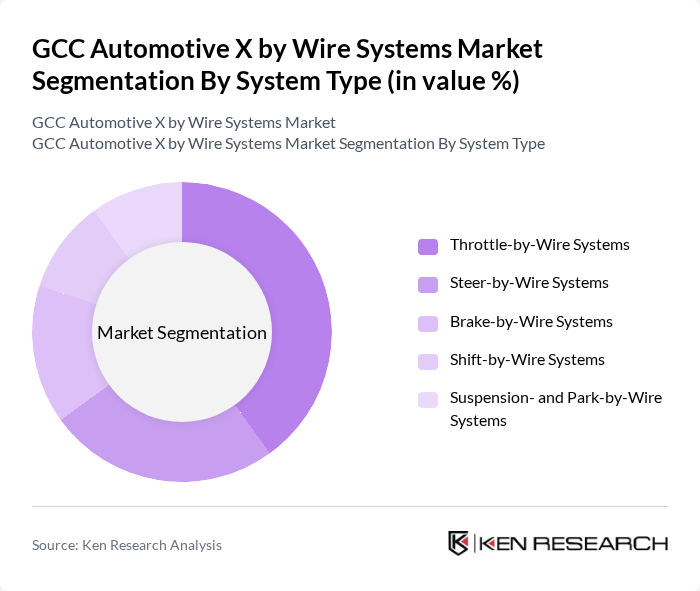

By System Type:The market is segmented into various system types, including Throttle-by-Wire Systems, Steer-by-Wire Systems, Brake-by-Wire Systems, Shift-by-Wire Systems, and Suspension- and Park-by-Wire Systems. Among these, Throttle-by-Wire Systems are leading due to their widespread use as electronic throttle control in modern internal combustion engine, hybrid, and battery electric vehicles, where they improve engine responsiveness, emissions, and efficiency. The increasing demand for responsive and precise control, particularly in premium passenger cars and high?performance SUVs that dominate GCC sales, is driving the adoption of these systems and making them a preferred choice for global and regional manufacturers serving the region.

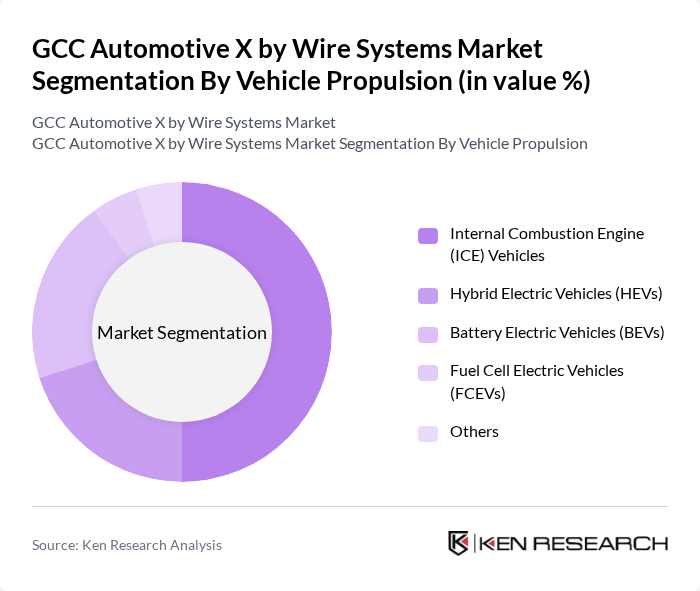

By Vehicle Propulsion:This segmentation includes Internal Combustion Engine (ICE) Vehicles, Hybrid Electric Vehicles (HEVs), Battery Electric Vehicles (BEVs), Fuel Cell Electric Vehicles (FCEVs), and Others. The market is predominantly driven by Internal Combustion Engine (ICE) Vehicles, which continue to hold a significant share due to their established presence in the GCC automotive sector and the region’s high penetration of gasoline?powered SUVs and light trucks. However, the rapid growth of Battery Electric Vehicles (BEVs) and Hybrid Electric Vehicles (HEVs) is noteworthy, supported by government incentives, charging infrastructure rollout, and OEM launches, as consumer preferences gradually shift towards more sustainable and eco?friendly options that rely heavily on X?by?wire for efficient energy and vehicle dynamics management.

The GCC Automotive X by Wire Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Robert Bosch GmbH, Continental AG, ZF Friedrichshafen AG, DENSO Corporation, Aptiv PLC, Valeo SE, Hitachi Astemo, Ltd., Mitsubishi Electric Corporation, NXP Semiconductors N.V., Infineon Technologies AG, Texas Instruments Incorporated, Hyundai Mobis Co., Ltd., Brembo S.p.A., JTEKT Corporation, Nexteer Automotive Group Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC Automotive X by Wire systems market appears promising, driven by technological advancements and increasing consumer demand for automation and safety. In the future, the market is expected to see a significant shift towards fully autonomous vehicles, with an estimated 30% of new vehicles featuring advanced driver-assistance systems. Additionally, the integration of IoT technologies is anticipated to enhance vehicle connectivity, further driving innovation and market growth in the region.

| Segment | Sub-Segments |

|---|---|

| By System Type | Throttle-by-Wire Systems Steer-by-Wire Systems Brake-by-Wire Systems Shift-by-Wire Systems Suspension- and Park-by-Wire Systems |

| By Vehicle Propulsion | Internal Combustion Engine (ICE) Vehicles Hybrid Electric Vehicles (HEVs) Battery Electric Vehicles (BEVs) Fuel Cell Electric Vehicles (FCEVs) Others |

| By Vehicle Category | Passenger Cars Light Commercial Vehicles (LCVs) Heavy Commercial Vehicles (HCVs & Buses) Off-Highway & Specialty Vehicles Robotaxis and Autonomous Shuttles |

| By Component | Sensors & Position Encoders Actuators & Motors Electronic Control Units (ECUs) Power Electronics & Semiconductors Harnesses, Connectors & Others |

| By Sales Channel | OEM-installed Systems Tier-1 Integration & Module Supply Aftermarket Retrofits Fleet & Mobility Operator Programs Others |

| By Country | Saudi Arabia United Arab Emirates Qatar Kuwait Oman & Bahrain |

| By Policy & Regulatory Driver | Safety & ADAS Regulations Emission & Fuel Economy Norms EV & Autonomous Vehicle Incentives Localisation & Industrial Policy R&D Grants and Testbed Initiatives |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| OEMs Implementing X by Wire Systems | 110 | Product Development Managers, Engineering Leads |

| Suppliers of X by Wire Components | 90 | Supply Chain Managers, Technical Sales Representatives |

| Automotive Electronics Consultants | 60 | Industry Analysts, Technology Advisors |

| Regulatory Bodies and Standards Organizations | 50 | Policy Makers, Compliance Officers |

| Automotive Research Institutions | 70 | Research Scientists, Academic Professors |

The GCC Automotive X by Wire Systems Market is valued at approximately USD 1.1 billion, reflecting a strong regional focus on premium and technologically advanced vehicles, alongside the increasing adoption of advanced automotive technologies.