Region:North America

Author(s):Rebecca

Product Code:KRAC9762

Pages:93

Published On:November 2025

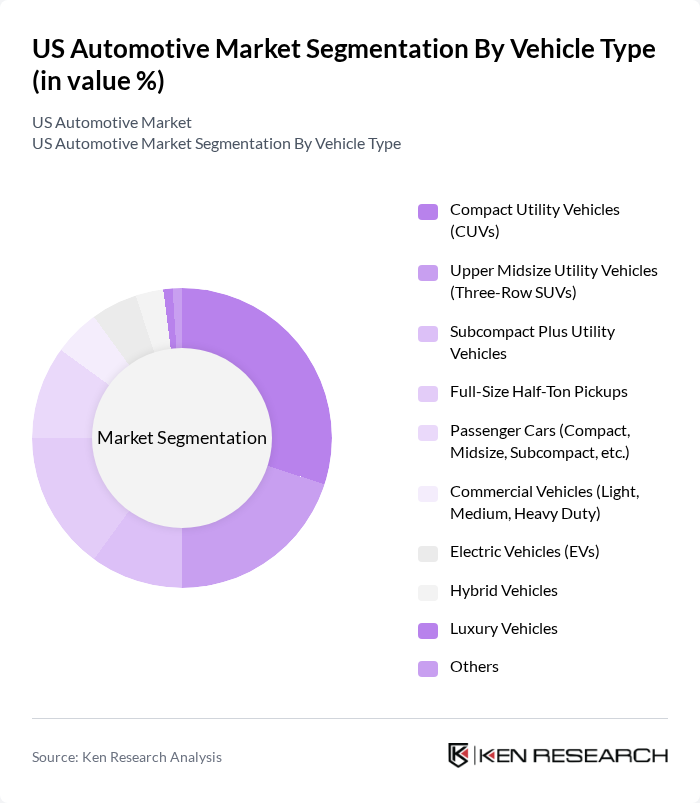

By Vehicle Type:The vehicle type segmentation includes categories such as Compact Utility Vehicles (CUVs), Upper Midsize Utility Vehicles (Three-Row SUVs), Subcompact Plus Utility Vehicles, Full-Size Half-Ton Pickups, Passenger Cars, Commercial Vehicles, Electric Vehicles (EVs), Hybrid Vehicles, Luxury Vehicles, and Others. Among these, Compact Utility Vehicles (CUVs) have emerged as the dominant segment due to their versatility, fuel efficiency, and growing consumer preference for SUVs over traditional sedans. The trend towards family-oriented vehicles and the increasing popularity of outdoor activities have further bolstered the demand for CUVs. Recent market data confirms that CUVs and SUVs together account for the majority of new vehicle sales, reflecting a sustained shift in consumer preference toward utility vehicles.

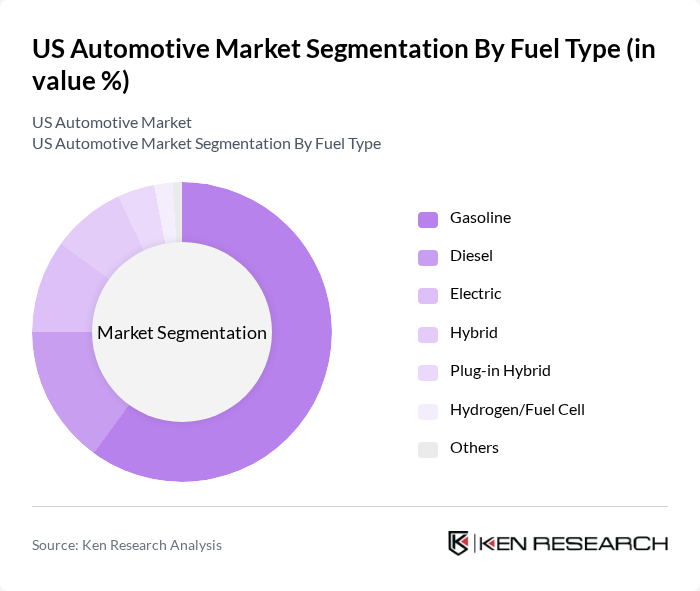

By Fuel Type:The fuel type segmentation encompasses Gasoline, Diesel, Electric, Hybrid, Plug-in Hybrid, Hydrogen/Fuel Cell, and Others. Gasoline vehicles continue to dominate the market due to their widespread availability and consumer familiarity. However, Electric Vehicles (EVs) are rapidly gaining traction, driven by advancements in battery technology, government incentives, and a growing consumer shift towards sustainable transportation options. The increasing availability of charging infrastructure is also contributing to the rise of EVs in the market. Recent market data indicates that gasoline vehicles retain the largest share, but electric and hybrid vehicles are experiencing significant growth, with EVs accounting for approximately 10–12% of new vehicle sales in recent months.

The US Automotive Market is characterized by a dynamic mix of regional and international players. Leading participants such as General Motors, Ford Motor Company, Tesla, Inc., Toyota Motor Corporation, Honda Motor Co., Ltd., Nissan Motor Co., Ltd., BMW AG, Volkswagen AG, Hyundai Motor Company, Kia Corporation, Subaru Corporation, Mercedes-Benz Group AG, Audi AG, Volvo Car Corporation, Stellantis N.V. contribute to innovation, geographic expansion, and service delivery in this space.

The US automotive market is poised for transformative growth, driven by the increasing integration of electric and autonomous vehicles. As consumer preferences shift towards sustainable and technologically advanced options, manufacturers are expected to invest heavily in R&D. Additionally, the expansion of EV infrastructure and advancements in connected vehicle technologies will enhance user experience and safety. These trends indicate a dynamic landscape where innovation and sustainability will be at the forefront of the automotive industry’s evolution.

| Segment | Sub-Segments |

|---|---|

| By Vehicle Type | Compact Utility Vehicles (CUVs) Upper Midsize Utility Vehicles (Three-Row SUVs) Subcompact Plus Utility Vehicles Full-Size Half-Ton Pickups Passenger Cars (Compact, Midsize, Subcompact, etc.) Commercial Vehicles (Light, Medium, Heavy Duty) Electric Vehicles (EVs) Hybrid Vehicles Luxury Vehicles Others |

| By Fuel Type | Gasoline Diesel Electric Hybrid Plug-in Hybrid Hydrogen/Fuel Cell Others |

| By Distribution Channel | Online Sales Dealerships Direct Sales (OEM-owned stores) Auctions Fleet Sales Others |

| By End-User | Individual Consumers Fleet Operators Government Agencies Corporate Clients Ride-Sharing/Subscription Services Others |

| By Technology | Advanced Driver Assistance Systems (ADAS) Infotainment Systems Connectivity Solutions Autonomous Driving Technology Electrification Technologies Others |

| By Market Segment | New Vehicle Sales Used Vehicle Sales Vehicle Leasing Vehicle Financing Subscription Services Others |

| By Aftermarket Services | Maintenance and Repair Parts Replacement Vehicle Customization Insurance Services Telematics and Connected Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Market | 100 | Car Owners, Dealership Managers |

| Commercial Vehicle Sector | 80 | Fleet Managers, Logistics Coordinators |

| Electric Vehicle Adoption | 60 | EV Owners, Charging Infrastructure Providers |

| Aftermarket Services | 90 | Service Center Managers, Parts Distributors |

| Consumer Preferences in Automotive | 120 | General Consumers, Automotive Enthusiasts |

The US Automotive Market is valued at approximately USD 2.3 trillion, driven by increasing consumer demand, advancements in automotive technology, and a growing focus on electric and hybrid vehicles. This market size reflects a robust supply chain and competitive landscape fostering innovation.