Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7266

Pages:90

Published On:December 2025

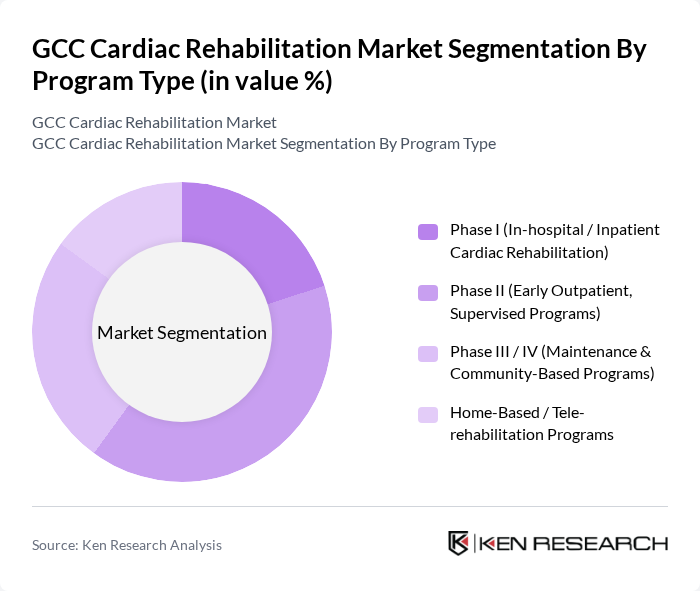

By Program Type:

The program type segmentation includes various approaches to cardiac rehabilitation, such as Phase I (In-hospital / Inpatient Cardiac Rehabilitation), Phase II (Early Outpatient, Supervised Programs), Phase III / IV (Maintenance & Community-Based Programs), and Home-Based / Tele-rehabilitation Programs. Among these, Phase II programs are currently dominating the market due to their structured approach and the increasing preference for supervised outpatient care. Patients benefit from professional guidance, which enhances adherence to rehabilitation protocols and improves overall outcomes. The trend towards outpatient care is also driven by the convenience and flexibility offered by these programs, making them more appealing to patients.

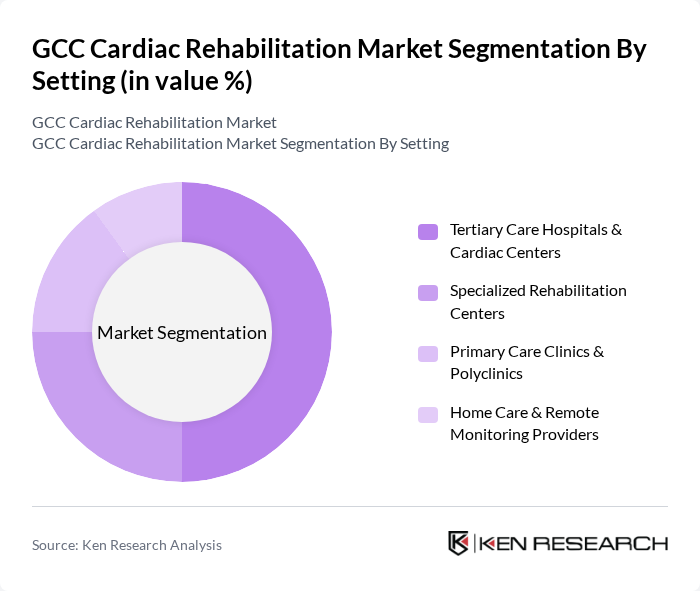

By Setting:

This segmentation includes Tertiary Care Hospitals & Cardiac Centers, Specialized Rehabilitation Centers, Primary Care Clinics & Polyclinics, and Home Care & Remote Monitoring Providers. Tertiary Care Hospitals & Cardiac Centers are leading this segment due to their comprehensive facilities and specialized staff, which provide a wide range of rehabilitation services. These institutions are equipped with advanced medical technologies and have the capacity to handle complex cases, making them the preferred choice for patients requiring intensive rehabilitation. The trend towards integrated care models further enhances their appeal, as they can offer multidisciplinary approaches to patient management.

The GCC Cardiac Rehabilitation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cleveland Clinic Abu Dhabi, Healthpoint, Abu Dhabi, King Faisal Specialist Hospital & Research Centre, Riyadh, Hamad Medical Corporation, Qatar, Dubai Health Authority (including Dubai Heart Center, Rashid Hospital), Sheikh Shakhbout Medical City (SSMC), Abu Dhabi, Saudi German Health (Saudi German Hospital Group), Mediclinic Middle East (Mediclinic City Hospital, Dubai), NMC Healthcare, UAE, Abu Dhabi Health Services Company (SEHA), Qatar Rehabilitation Institute, Doha, American Hospital Dubai, King Abdulaziz Cardiac Center, Riyadh, Bahrain Defence Force Hospital – Cardiac Rehabilitation Unit, Sultan Qaboos University Hospital, Oman contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC cardiac rehabilitation market appears promising, driven by technological advancements and a shift towards patient-centered care. As digital health solutions gain traction, tele-rehabilitation services are expected to expand, providing remote access to rehabilitation programs. Additionally, the integration of mental health support into rehabilitation services is likely to enhance patient outcomes, addressing the holistic needs of individuals recovering from cardiovascular events. This evolving landscape will foster greater participation and improved health metrics across the region.

| Segment | Sub-Segments |

|---|---|

| By Program Type | Phase I (In-hospital / Inpatient Cardiac Rehabilitation) Phase II (Early Outpatient, Supervised Programs) Phase III / IV (Maintenance & Community-Based Programs) Home-Based / Tele?rehabilitation Programs |

| By Setting | Tertiary Care Hospitals & Cardiac Centers Specialized Rehabilitation Centers Primary Care Clinics & Polyclinics Home Care & Remote Monitoring Providers |

| By Patient Profile | Post?Myocardial Infarction Patients Post?Cardiac Surgery & PCI Patients Heart Failure & Cardiomyopathy Patients High?Risk Patients with Multiple Comorbidities |

| By Service Components | Supervised Exercise Training Risk Factor Management & Medical Optimization Nutrition & Lifestyle Counseling Psychosocial & Behavioral Support |

| By Duration & Intensity | Short?Cycle Programs (<12 Weeks) Standard Programs (12–24 Weeks) Extended / Maintenance Programs (>24 Weeks) High?Intensity vs Moderate?Intensity Protocols |

| By Country | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain |

| By Technology Utilization | Wearable & Remote Monitoring Devices Mobile Health (mHealth) & Patient Engagement Apps Telehealth & Virtual Cardiac Rehabilitation Platforms AI?Enabled Decision Support & Analytics Tools |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cardiac Rehabilitation Facilities | 70 | Rehabilitation Program Directors, Healthcare Administrators |

| Cardiologists and Specialists | 60 | Cardiologists, Rehabilitation Specialists |

| Patients Post-Cardiac Events | 120 | Patients who have undergone cardiac rehabilitation |

| Health Insurance Providers | 50 | Policy Makers, Claims Managers |

| Government Health Officials | 40 | Health Policy Analysts, Program Coordinators |

The GCC Cardiac Rehabilitation Market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by the rising prevalence of cardiovascular diseases and increased awareness about cardiac health in the region.