Region:Middle East

Author(s):Geetanshi

Product Code:KRAC1053

Pages:97

Published On:October 2025

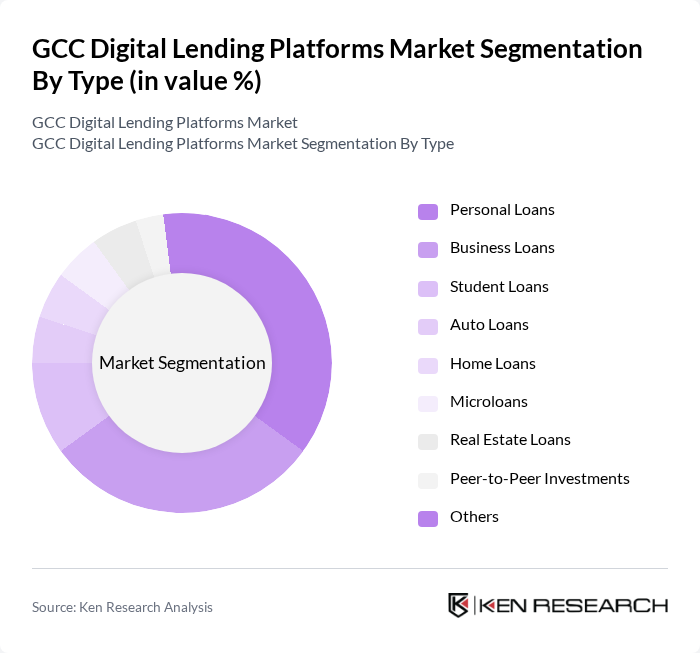

By Type:The digital lending platforms can be categorized into various types, including personal loans, business loans, student loans, auto loans, home loans, microloans, real estate loans, peer-to-peer investments, and others. Among these, personal loans and business loans are the most prominent segments, driven by consumer demand for quick access to funds and the growing need for SMEs to finance their operations. Personal loans are particularly popular due to their flexibility and ease of access.

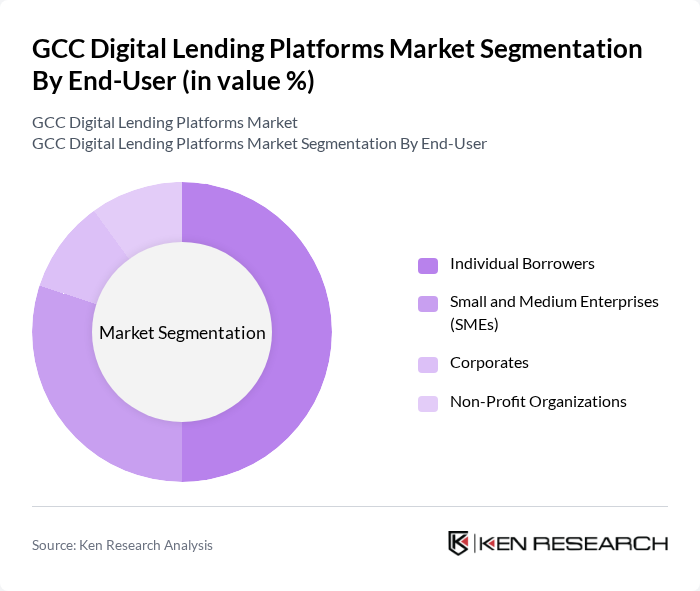

By End-User:The end-users of digital lending platforms include individual borrowers, small and medium enterprises (SMEs), corporates, and non-profit organizations. Individual borrowers dominate the market due to the increasing need for personal financing solutions, while SMEs are rapidly adopting digital lending to support their growth and operational needs. Corporates and non-profits also contribute to the market, albeit to a lesser extent.

The GCC Digital Lending Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Beehive, Raqamyah, Liwwa, Tamam, Tamweelcom, EdfaPay, NymCard, Fintech Galaxy, Funding Souq, Lendo, Aion Digital, Souqalmal, PayTabs, Raseed, Edfa3ly contribute to innovation, geographic expansion, and service delivery in this space.

The GCC digital lending market is poised for transformative growth, driven by technological advancements and evolving consumer preferences. As platforms increasingly adopt AI and machine learning, the efficiency of loan processing will improve, catering to the demand for faster services. Additionally, the integration of alternative credit scoring methods will enhance access for underserved populations, fostering financial inclusion. The collaboration between fintech companies and traditional banks will further solidify the market, creating a more robust lending ecosystem in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans Business Loans Student Loans Auto Loans Home Loans Microloans Real Estate Loans Peer-to-Peer Investments Others |

| By End-User | Individual Borrowers Small and Medium Enterprises (SMEs) Corporates Non-Profit Organizations |

| By Distribution Channel | Online Platforms Mobile Applications Direct Sales Partnerships with Financial Institutions |

| By Loan Amount | Small Loans (up to $5,000) Medium Loans ($5,001 - $50,000) Large Loans (above $50,000) |

| By Interest Rate Type | Fixed Interest Rates Variable Interest Rates |

| By Customer Segment | First-time Borrowers Repeat Borrowers High-risk Borrowers |

| By Loan Purpose | Debt Consolidation Home Improvement Education Expenses Business Expansion Working Capital Asset Purchase |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Lending Platforms | 60 | Product Managers, Marketing Directors |

| SME Lending Solutions | 50 | Business Development Managers, Financial Analysts |

| Peer-to-Peer Lending Services | 40 | Operations Managers, Risk Assessment Officers |

| Regulatory Compliance in Digital Lending | 45 | Compliance Officers, Legal Advisors |

| Consumer Behavior in Digital Lending | 55 | Market Researchers, User Experience Designers |

The GCC Digital Lending Platforms Market is valued at approximately USD 690 million, reflecting significant growth driven by the increasing adoption of digital financial services and a preference for online lending solutions among consumers and businesses.