Region:Africa

Author(s):Dev

Product Code:KRAB4299

Pages:87

Published On:October 2025

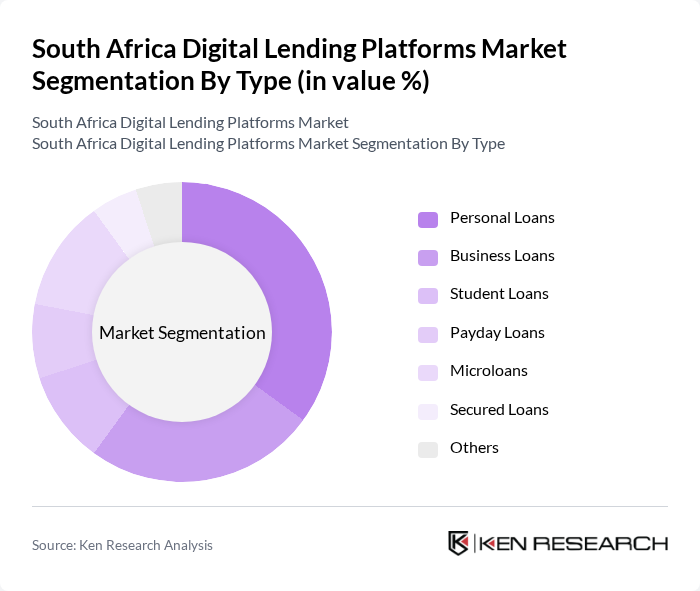

By Type:The digital lending platforms in South Africa can be categorized into several types, including personal loans, business loans, student loans, payday loans, microloans, secured loans, and others. Personal loans are particularly popular due to their flexibility and ease of access, catering to a wide range of consumer needs. Business loans are also significant, as they support the growth of small and medium enterprises (SMEs) in the region.

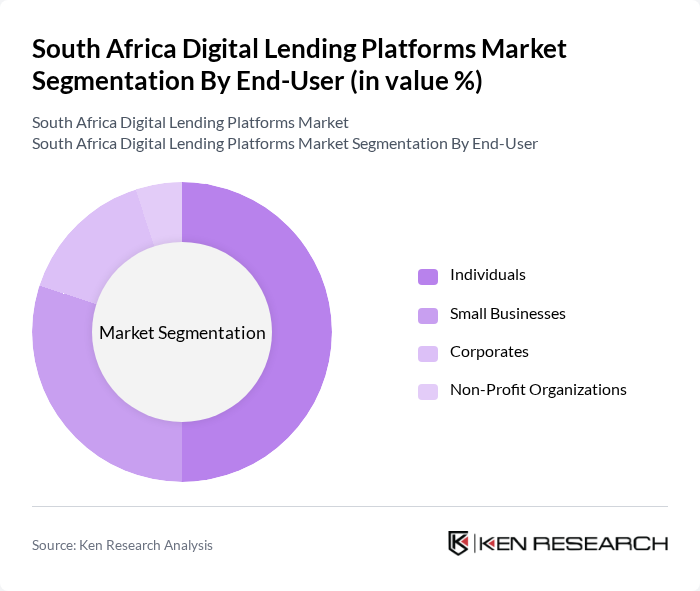

By End-User:The end-users of digital lending platforms in South Africa include individuals, small businesses, corporates, and non-profit organizations. Individuals represent the largest segment, driven by the need for personal financing solutions. Small businesses also play a crucial role, as they often seek quick access to funds for operational needs and growth opportunities.

The South Africa Digital Lending Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Capitec Bank, African Bank, Wonga, Lendico, GetBucks, Finbond, DirectAxis, Bayport Financial Services, Standard Bank, Absa Bank, Nedbank, FNB, PayJustNow, YAPILI, Lendico South Africa contribute to innovation, geographic expansion, and service delivery in this space.

The South African digital lending landscape is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As mobile-first solutions gain traction, lenders will increasingly leverage alternative data for credit assessments, enhancing approval rates. Additionally, the rise of peer-to-peer lending platforms is expected to foster competition, encouraging innovation. With a focus on customer-centric service models, digital lenders will likely prioritize user experience, ultimately reshaping the financial services sector in South Africa.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans Business Loans Student Loans Payday Loans Microloans Secured Loans Others |

| By End-User | Individuals Small Businesses Corporates Non-Profit Organizations |

| By Distribution Channel | Online Platforms Mobile Applications Direct Sales Partnerships with Retailers |

| By Loan Amount | Below ZAR 5,000 ZAR 5,000 - ZAR 20,000 ZAR 20,000 - ZAR 50,000 Above ZAR 50,000 |

| By Interest Rate Type | Fixed Interest Rates Variable Interest Rates Promotional Rates |

| By Customer Segment | Low-Income Borrowers Middle-Income Borrowers High-Income Borrowers |

| By Loan Purpose | Debt Consolidation Home Improvement Education Emergency Expenses Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Digital Lending Usage | 150 | Individual Borrowers, First-time Users |

| Small Business Lending Insights | 100 | Small Business Owners, Financial Managers |

| Regulatory Impact Assessment | 80 | Regulatory Officials, Compliance Officers |

| Fintech Expert Opinions | 60 | Industry Analysts, Fintech Entrepreneurs |

| Consumer Satisfaction and Feedback | 120 | Previous Users, Current Customers |

The South Africa Digital Lending Platforms Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by the increasing adoption of digital financial services and the demand for accessible credit solutions among consumers and businesses.