Region:Middle East

Author(s):Rebecca

Product Code:KRAC1146

Pages:83

Published On:October 2025

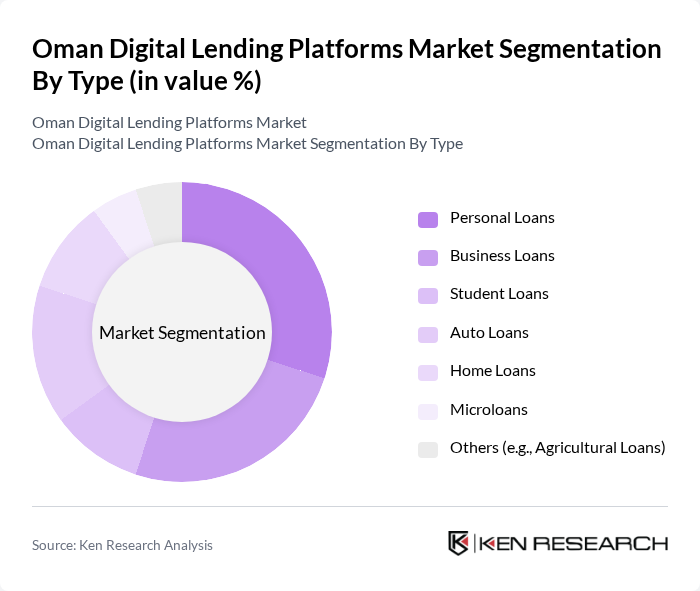

By Type:The digital lending market can be segmented into various types of loans, including personal loans, business loans, student loans, auto loans, home loans, microloans, and others such as agricultural loans. Personal loans are particularly popular due to their flexibility and ease of access, while business loans cater to the growing number of SMEs in Oman. Each type serves distinct consumer needs and preferences.

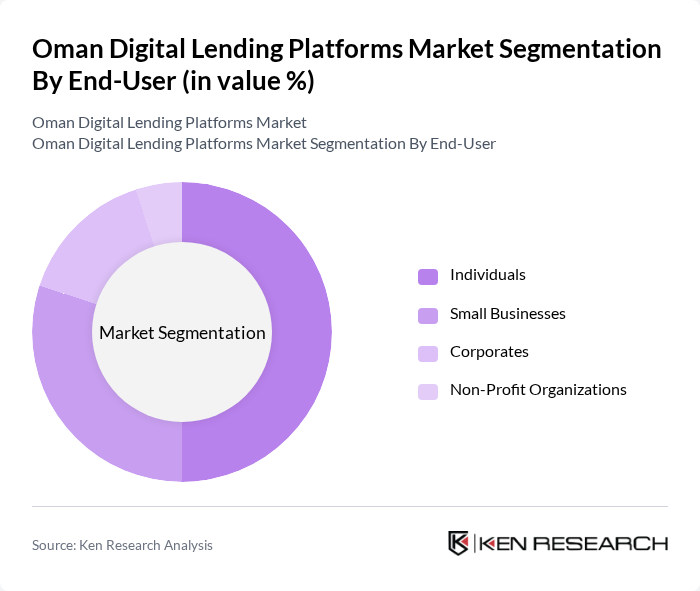

By End-User:The end-user segmentation includes individuals, small businesses, corporates, and non-profit organizations. Individuals represent a significant portion of the market, driven by the need for personal financing solutions. Small businesses are also a key segment, as they often seek loans for expansion and operational needs, reflecting the entrepreneurial spirit in Oman.

The Oman Digital Lending Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bank Muscat, Oman Arab Bank, Alizz Islamic Bank, Oman Development Bank, National Bank of Oman, Bank Dhofar, Muscat Finance, Al Yusr Islamic Finance, Ameen Finance, Fincap contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman digital lending market appears promising, driven by technological advancements and evolving consumer preferences. As artificial intelligence and machine learning become more integrated into lending processes, platforms will enhance risk assessment and customer service. Additionally, the increasing focus on personalized lending solutions will cater to diverse consumer needs, fostering greater market engagement. The ongoing collaboration between fintech companies and traditional banks will further strengthen the ecosystem, ensuring sustainable growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans Business Loans Student Loans Auto Loans Home Loans Microloans Others (e.g., Agricultural Loans) |

| By End-User | Individuals Small Businesses Corporates Non-Profit Organizations |

| By Application | Emergency Funding Business Expansion Education Financing Home Improvement |

| By Distribution Channel | Online Platforms Mobile Applications Direct Sales |

| By Customer Segment | Retail Customers Corporate Clients Government Entities |

| By Loan Size | Small Loans (up to OMR 1,000) Medium Loans (OMR 1,001 - OMR 5,000) Large Loans (above OMR 5,000) |

| By Repayment Period | Short-term (up to 1 year) Medium-term (1 to 3 years) Long-term (above 3 years) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Digital Lending Usage | 120 | Individuals aged 18-45 who have used digital lending services |

| Small Business Lending Insights | 80 | Owners and managers of SMEs utilizing digital loans |

| Regulatory Impact Assessment | 50 | Policy makers and financial regulators in Oman |

| Fintech Expert Opinions | 40 | Industry analysts and fintech consultants |

| Market Trends and Consumer Behavior | 100 | Financial advisors and market researchers |

The Oman Digital Lending Platforms Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by the increasing adoption of digital financial services and the rising demand for accessible loan options, particularly among small and medium enterprises (SMEs).