Region:Middle East

Author(s):Rebecca

Product Code:KRAC1094

Pages:82

Published On:October 2025

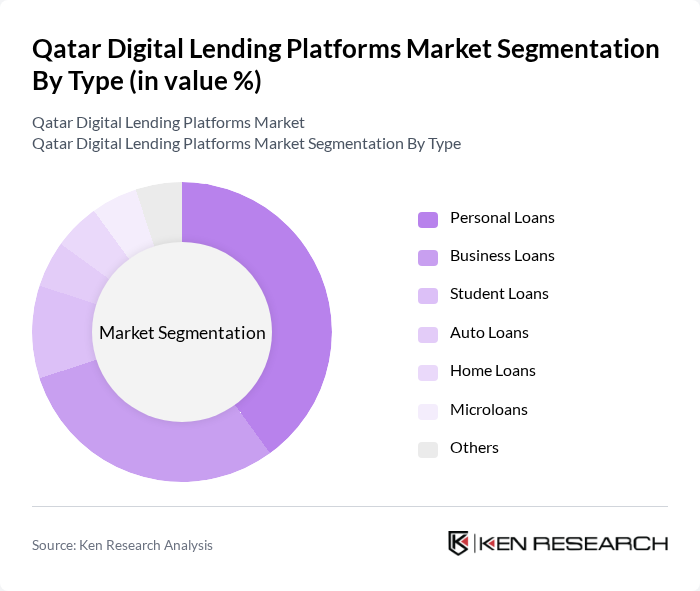

By Type:The digital lending market is segmented into personal loans, business loans, student loans, auto loans, home loans, microloans, and others. Personal loans lead the market due to their flexibility and ease of access, addressing a broad range of consumer needs. Business loans are also significant, driven by SME demand for operational and expansion financing. The rise of fully digital application processes has further accelerated adoption across all loan types.

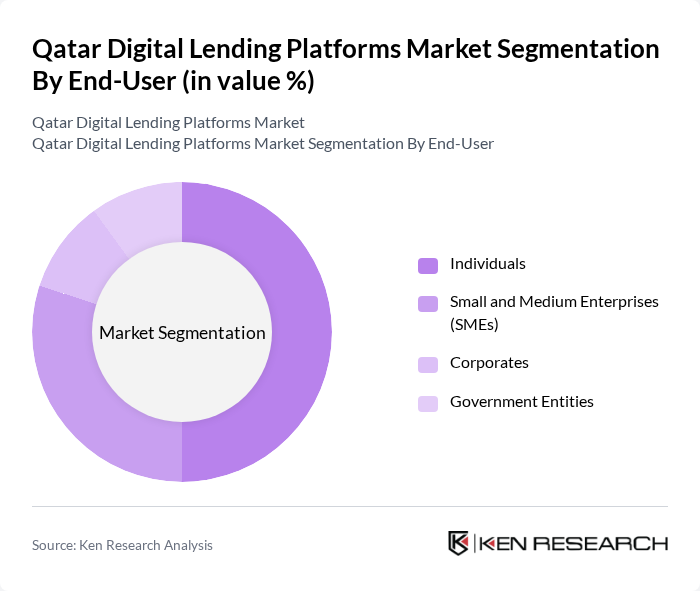

By End-User:The market serves individuals, small and medium enterprises (SMEs), corporates, and government entities. Individuals constitute the largest segment, driven by demand for personal finance solutions. SMEs are a key user group, frequently seeking loans for working capital and growth. Corporates and government entities participate in the market, typically for larger-scale financing needs.

The Qatar Digital Lending Platforms Market features a dynamic mix of regional and international players. Leading participants include Qatar Islamic Bank, Qatar National Bank, Doha Bank, Al Khaliji Commercial Bank, Masraf Al Rayan, Qatar Development Bank, QNB Finansinvest, Fawry for Banking Technology and Electronic Payments, Tamweelcom, Beehive, Lendico, Kiva, YAPILI, Fintech Galaxy, and PinPay. These institutions drive innovation, expand service delivery, and enhance the competitive environment in Qatar’s digital lending space.

The future of Qatar's digital lending platforms is poised for significant transformation, driven by technological advancements and changing consumer preferences. As mobile-first solutions gain traction, lenders will increasingly leverage artificial intelligence for personalized lending experiences. Additionally, the integration of alternative data sources for credit assessments will enhance lending accuracy. These trends indicate a shift towards more inclusive financial services, catering to diverse consumer needs while addressing regulatory challenges and security concerns in the evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans Business Loans Student Loans Auto Loans Home Loans Microloans Others |

| By End-User | Individuals Small and Medium Enterprises (SMEs) Corporates Government Entities |

| By Loan Amount | Small Loans (up to QAR 10,000) Medium Loans (QAR 10,001 - QAR 50,000) Large Loans (above QAR 50,000) |

| By Repayment Period | Short-term (up to 1 year) Medium-term (1 to 3 years) Long-term (above 3 years) |

| By Distribution Channel | Online Platforms Mobile Applications Direct Sales Partnerships with Retailers |

| By Customer Segment | First-time Borrowers Repeat Borrowers High-net-worth Individuals |

| By Credit Score Range | Low Credit Score (below 600) Medium Credit Score (600-700) High Credit Score (above 700) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Digital Lending Usage | 120 | Individual Borrowers, First-time Users |

| Small Business Lending Insights | 80 | Small Business Owners, Financial Managers |

| Regulatory Impact Assessment | 50 | Regulatory Officials, Compliance Officers |

| Market Trends and Innovations | 60 | Fintech Innovators, Industry Analysts |

| Consumer Satisfaction and Feedback | 70 | Existing Users, Customer Service Representatives |

The Qatar Digital Lending Platforms Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the increasing adoption of digital financial services and consumer preference for online lending solutions.