Region:Middle East

Author(s):Rebecca

Product Code:KRAC1119

Pages:94

Published On:October 2025

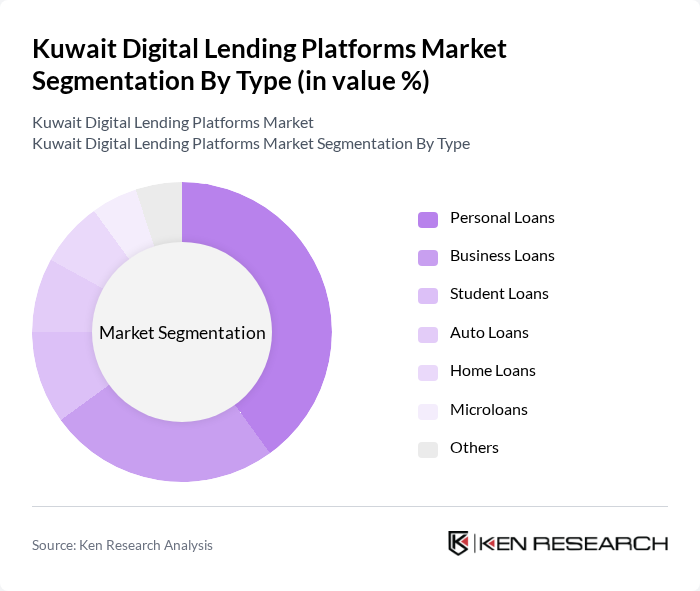

By Type:The digital lending platforms in Kuwait can be categorized into several types, including Personal Loans, Business Loans, Student Loans, Auto Loans, Home Loans, Microloans, and Others. Among these, Personal Loans are currently the most dominant segment, driven by the increasing consumer demand for quick access to funds for personal expenses, emergencies, and lifestyle needs. The convenience of online applications and faster approval processes has made personal loans particularly appealing to a wide range of borrowers.

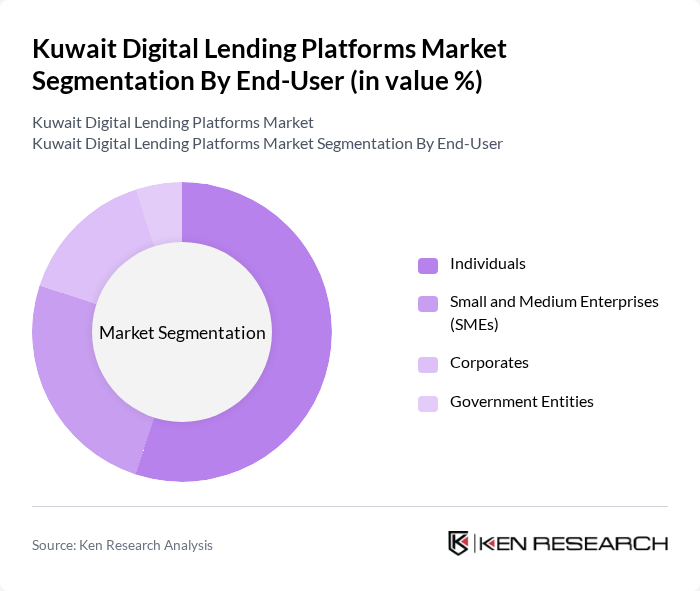

By End-User:The end-users of digital lending platforms in Kuwait include Individuals, Small and Medium Enterprises (SMEs), Corporates, and Government Entities. The segment of Individuals is leading the market, as personal borrowing needs for various purposes such as education, healthcare, and consumer goods are on the rise. The ease of access to loans through digital platforms has made it a preferred choice for many individuals seeking financial assistance.

The Kuwait Digital Lending Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kiva, Tamweelcom, Beehive, Funding Circle, Lendico, YAPILI, ZestFinance, Tala, Cashalo, Creditea, Finastra, Prospa, Upstart, Lendio, Clearbanc, Al Rajhi Bank, Boubyan Bank, Gulf Bank, National Bank of Kuwait, Warba Bank, Kuwait Finance House contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait digital lending market appears promising, driven by technological advancements and changing consumer behaviors. As platforms increasingly adopt mobile-first strategies and integrate AI for credit assessments, the efficiency of loan processing is expected to improve significantly. Additionally, the rise of blockchain technology for secure transactions will likely enhance transparency and consumer confidence, fostering a more robust lending ecosystem. These trends indicate a shift towards more personalized and accessible financial solutions for consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans Business Loans Student Loans Auto Loans Home Loans Microloans Others |

| By End-User | Individuals Small and Medium Enterprises (SMEs) Corporates Government Entities |

| By Loan Amount | Under 1,000 KWD ,000 - 5,000 KWD ,000 - 10,000 KWD Above 10,000 KWD |

| By Loan Duration | Short-term Loans Medium-term Loans Long-term Loans |

| By Application | Consumer Financing Business Financing Educational Financing Vehicle Financing |

| By Distribution Channel | Online Platforms Mobile Applications Direct Sales Partnerships with Financial Institutions |

| By Customer Segment | Retail Customers Corporate Clients Non-Profit Organizations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Personal Loan Borrowers | 100 | Individuals aged 25-45, employed professionals |

| Small Business Owners | 80 | Entrepreneurs, business managers in SMEs |

| Fintech Industry Experts | 50 | Consultants, analysts, and academics in fintech |

| Regulatory Authorities | 30 | Officials from the Central Bank and financial regulatory bodies |

| Potential Borrowers (General Public) | 120 | Individuals across various demographics, including students and homemakers |

The Kuwait Digital Lending Platforms Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the increasing adoption of digital financial services and the demand for accessible lending solutions among consumers and businesses.